Nano

Nano cryptocurrency guide advises where to buy and how to buy Nano. This guide also contains the markets, value, trading, investing, buying, selling, transactions, blockchain, mining, technology, advantages, risks, history, legislation, regulation, security, payment, networks and many other interesting facts about Nano as well its status in the world of cryptocurrencies.

Nano, Thursday, 2025-06-12

Contents

What Is Nano?

2018 started at a rather low note for cryptocurrencies following the success that was 2017. Towards the end of 2017, cryptocurrencies surged and reached the highest points before taking a downward trending graph early in 2018. With more than 1800 cryptocurrencies having entered the market by the first quarter of 2018, many people are faced with the difficult choice of identifying the ideal options that can guarantee highest return on investment (ROI).

A great way to know about the best cryptocurrency to join is looking at its performance. While Bitcoin has cut a name for being the most valued crypto, it is the emerging cryptos that are stealing the show. One of these third generation cryptocurrencies is Nano that was until end of January 2018 referred as RaiBlocks (XRB). The symbol for Nano tokens is NANO, but some crypto exchanges are still using XRB.

The cryptocurrency has indeed been more profitable than most tokens in the market. Around 10th of December of 2017, the value of Nano was slightly below one US dollar. This price grew steadily by more than 3000% by January of 2018 when it crossed the $35 mark. A person who invested $1000 in Nano in December of 2017 enjoyed over 3000% return on investment (ROI). This is remarkable.

The cryptocurrency has become the new sensation in the market and experts are indicating it could become the next Bitcoin. The main reason for fast growth and success of Nano is its architecture. Though the cryptocurrency operates by providing a decentralized model of bypassing centralized institutions such as banks, it design utilizes block-lattice architecture and delegated Proof-of-Stake that eliminates the need for miners, makes the network fast, and lighter. These unique features and applications mean that Nano is indeed better than Bitcoin and most cryptos that use Proof-of-Work and standard Proof-of-Stake consensus models.

Beginner's Guide to Nano

Have you been looking forward to joining the cryptocurrency industry? The best route is picking the cryptocurrency network that promises huge returns on investment (ROI) over time. But this should not be the sole determining item. It is important to look for a network that has huge potential to add value to users. Here, it is not simply about rushing to the most expensive crypto in the industry. Rather, it is about joining the network that delivers utmost value for success.

One cryptocurrency that has defied all odds to emerge the most preferred network in the industry is Nano. Unlike other cryptocurrencies, Nano employs the advanced block-lattice architecture that requires both the value sender and receiver to participate in confirming transactions.

While every indicator points at the huge potential in Nano, it is important that you also interrogate the network comprehensively before making a decision. This means getting all the questions answered and doubts cleared completely before making a move. This is the task that this guide is created to.

The guide is designed to answer all the questions that you have about Nano. It interrogates the network’s technology, mining, advantages, risks, regulations, and transaction costs. Other things looked at in the network include where and how to buy, trade, and the crypto wallets, profitability, security and customer protection. To know about these and more about Nano, welcome to read through this comprehensive guide.

Where and How to Buy Nano?

In January of 2018, the value of Nano jumped with over 150% after corporates started showing interest. It also shifted upwards after rebranding from RaiBlocks coin. But these were not the only positive things about the crypto. Since inception, the value of Nano (previously RaiBlocks) has grown by more than 3000%. These figures, coupled with a unique architecture, and an enthusiastic team have portrayed Nano as the next generation cryptocurrency. Where and how can one buy Nano? There are two main ways of buying Nano.

- a) Buy from the cryptocurrency markets: This is a direct, easy, and reliable method of acquiring Nano. Like other cryptocurrencies, Nano is listed as a tradable asset for buyers to access and buy. Depending on the cryptocurrency of choice, it might be possible to buy Nano with fiat currency, wire transfer, credit card, or even other cryptos. Top cryptocurrency exchanges where you can buy Nano include Binance, KuCoin, and CoinSpot.

- To buy from the markets, you are required to open a trading account. This process will include verification using a personal phone number, date of birth, proof of location, and email address.

- b) Buy directly from those who already have Nano: Just like other cryptocurrencies, the people who already have Nano can sell directly to those who need them. This mainly takes place through cryptocurrency clubs. Because of the fast growth of cryptocurrencies, crypto clubs have emerged with the aim of bringing together traders and sharing info about cryptocurrencies. You can also use such clubs to get people with Nano, and that want to sell their assets. A great example of such clubs is LocalBitcoins.com.

To buy cryptocurrencies, ensure you have a cryptocurrency wallet. The wallet is the location that will hold your Nano after the buyout is completed.

Nano Wallet

Are you planning to enter the cryptocurrency world, one must have component is a digital wallet. The accepted definition of a cryptocurrency wallet is a digital location for storing crypto assets such as tokens and crypto coins. But the definition is indeed a misrepresentation.

In reality, cryptocurrency assets such as Nano only reside in the native networks. They are digital, not physical like the hard coins and notes. Therefore, what exactly do Nano wallets and other crypto wallets store?

Nano wallet and other digital wallets store two sets of codes; the private keys and public keys. The private keys are unique identifier codes that help to activate your Nano (NANO/XRB) in the network to perform a transaction. This means that you cannot make a transaction without the private keys. You should never share the private keys.

The next code stored in a cryptocurrency wallet is the public keys. This is a set of codes that help to point at the wallet. The codes are public and can be shared in the network. When a person wants to pay you in Nano, you give him the public keys. Here are the main Nano wallets.

- The NanoWallet, former RaiWallet (web-based wallet)

- This is a web-based Nano wallet designed for NANO/RXB storage only. Like other digital web-based wallets, NanoWallet allows users to store their Nano coins in addresses that can be accessed remotely. Note that though the Nano Team recommends this, the developer's details provided on the GitHub only uses a pseudonym, Jaimehgb.

- When you use the wallet, it immediately generates the private keys that you should use when making transactions. Unlike other wallets such as desktop wallets that require users to store the keys, the NanoWallet will store the codes and only generate them when you are making transactions. This means that you do not have to worry about losing the keys. You simply need to identify yourself to make a transaction. It is pretty close to how an email address operates.

- It is important to point that NanoWallet runs its own blockchain which means it is a very secure interface for storing your Nano. However, you should appreciate that no digital platform, especially the web-based types, is 100% secure. Therefore, you should try to only access the wallet from the same computer, keep the device updated, and never share the private keys.

- The Ledger Nano S (hardware wallet)

- Ledger Nano S is a hardware wallet that has earned the tag of the most secure digital wallet in the market today. The wallet takes the shape of a standard flash drive and is designed by a France based company called Ledger.

- Unlike the NanoWallet, Ledger Nano S generates the private keys and requires users to store it carefully. This code has to be used all the time when confirming transactions. Also, the hardware has a physical button that you must press when making a transaction. This implies that only the person with the hardware can send the transaction of the Nano coins stored in it.

- As a hardware wallet, it implies that your Nano coins will always be stored offline for extra security. To send transactions, you are required to plug the Nano wallet into a device such as a computer or smartphone. This means that your Nano coins will always be offline except when making transactions.

- So good is Ledger Nano S security that the manufacturer indicates you can confirm transactions even on a compromised computer without the risk of attack. Even with this assurance, it is advisable always to keep the computer and even the Nano client updated to avoid the threat of an attack.

Where to Buy Nano with Credit Card?

Every time that the subject of cashless society comes up, the thing that crops into people’s mind are payment cards such as credit cards and visas. These are cards that have gained acceptance in many stores across both conventional and online marketplaces. Now, you can also buy cryptocurrencies such as Nano using your credit card. Here are several platforms that allow people to buy Nano using credit cards.

- i) CEX.io.

- ii) Mercatox.

- iii) CoinSpot.

Where to Buy Nano with PayPal?

For years, PayPal was opposed to any transaction related to cryptocurrencies. PayPal administration considered crypto networks such as Nano to be a direct threat to its existence until recently when it started working with some of them. Indeed, accounts that were found to have made payment to crypto networks were penalized.

Though PayPal is yet to allow transactions to crypto networks, it has indicated it is reviewing its policy to allow such transactions. If you had cash in PayPal by early 2018, the best way to purchase Nano is through offloading to a bank account or credit card. These two methods are accepted in many exchanges.

How to Buy Nano with Wire Transfer?

Many people hold their banks with great regard and trust. Even after moving to the cryptocurrency networks, people still have a special connection to their banks and use them for salary processing, financial advice, and loan access. If your cash is in the bank account, it is now possible to also buy cryptocurrencies such as Nano. The first step for buying Nano with wire transfer is getting the right Nano wallet. Then, follow these steps.

- (i) Select an appropriate trading exchange such as Mercatox or CoinSpot that accepts payment for Nano in a wire transfer.

- (ii) Create a trading account at the selected trading platform and confirm it with details such as proof of address and phone number.

- (iii) Deposit ample cash into the bank account of choice. Make sure to factor the transaction charges of the selected platform.

- (iv) Navigate to the section for buying the crypto assets in your trading account at the crypto exchange and select Nano.

- (v) On the method of payment, select pay with a wire transfer. This option will require you to provide additional details that can be used by the exchange to make a claim.

- (vi) Once the transaction is completed, the Nano coins will go to the trading account.

Note that this might take a couple of days depending on your bank, country and selected market.

Where to Sell and Trade Nano?

After taking some time in the Nano network, the coins you will have bought or received as payment can be used in three ways. You can opt to hold them waiting for the value to grow or use them in the market to do shopping. However, the most profitable method of using the Nano coins is trading them in the markets. These are trading platforms that allow buyers and traders to exchange Nano and other cryptos. The platforms operate like the standard forex markets though they deal with cryptocurrencies such as Nano and Bitcoin.

When picking a Nano selling and trading platform, it is important to appreciate that they are highly vulnerable. Your coins will be at great risk of getting stolen at the exchange level than any other point in the crypto network. To trade Nano safely, consider using the following tips to pick the best trading platforms.

- Only select the crypto trading platform with a good reputation.

- Consider selecting the platform that lists many cryptocurrencies.

- The best platform should not have limitations on the amount you can handle or withdraw.

- Only select the exchange with low transaction charges.

- Pick the exchange that demonstrates extra commitment to keep clients assets as secure as possible.

- Only use the cryptocurrency exchange that allows people in your geo-location.

Remember that once you pick the right trading platform, you have to create a trading account. This will require verification using your details such as proof of location, phone number, and date of birth. These details may vary depending on the selected crypto trading platform and location. Some of the top trading platforms include Binance, Mercatox, KuCoin and OkEX.

How Much Are the Transaction Fees of Nano?

When cryptocurrencies debuted, the main promises included offering a platform to bypass centralized organizations and lowering the transaction costs. Bypassing the profit-seeking institutions such as banks means it is possible to cut cost by a huge margin. But the cost is still relatively high especially in some of the top cryptocurrencies such as Bitcoin and Ethereum.

Nano has taken the principle of cutting cost to the next level by adopting an architecture that allows it to run transactions at zero cost. The cryptocurrency uses the Directed Acyclic Graph algorithm that is based on block-lattice architecture. Because all the coins have already been released and every user has own blockchain, no incentives are needed for miners. This means that you can enjoy sending value across the globe for free.

Nano Markets

The cryptocurrency markets have been growing rapidly. They are entering into the crypto industry very fast to keep pace with the growing number of cryptocurrencies and rising demand. The markets are driven purely by demand and supply that respond to happenings in the finance, crypto space, and other related niches. Since its entry into the market, Nano has been listed in very many markets including the following.

1) Binance.

- Binance is one of the youngest crypto exchanges that entered the market in mid-2017. It was created by Changpend Zhao who wanted to make crypto trading easy and cheap. To help raise the value of the exchange, Zhao also launched a native token referred as BNB. Users who trade Nano for BNB get huge discounts and special offers on transaction fees.

- The Binance exchange lists very many cryptocurrencies for users to select the most profitable pairs. Besides, they have a very small transaction fee of 0.1%. This implies that you can keep the bulk of the profit made when trading on the platform.

- The biggest challenge of using the Binance network is that it is a crypto-to-crypto type of market. This means that only users with other types of cryptocurrencies can trade in the market. If you have cash or credit cards, you cannot trade on this exchange. You will need to start from another crypto exchange that allows users to buy with fiat and credit cards.

2) KuCoin.

- This is one of the leading cryptocurrency exchanges in the globe today. Many traders prefer it because of the unique features that help them trade profitably. One unique characteristic of KuCoin is the focus on listing emerging digital assets. This implies that traders in the network will never miss an ICO or new tokens when they hit the market. This is a great chance for new cryptocurrency enthusiasts to enter the niche because many assets start at the ICO (Initial Coin offering) before growing over time.

- To help traders make the right decisions on the selected asset pairs, KuCoin provides advanced analytics about every asset listed in its system. This implies that even new cryptocurrency traders are sure of trading like pros within a very short time. Besides, the exchange lists very many cryptocurrencies so that Nano traders will never miss a profitable option to jump to if the current one is not desirable.

- KuCoin has a very small transaction fee of 0.1%. This implies that the exchange is one of the cheapest in the industry. To enjoy even lower rates and special offers, KuCoin encourages users to trade with its native shares called KuCoin Shares.

- The main drawback of using this exchange is that it allows only crypto-to-crypto trading. People who have fiat currencies or cash on their credit cards cannot make a direct purchase. Rather, they have to start from other exchanges that accept fiat and credit cards before moving to KuCoin.

3) Mercatox.

- Mercatox is a peer-to-peer cryptocurrency that allows users to trade over 100 cryptocurrencies. Since its launch in 2016, the cryptocurrency exchange has grown progressively to reach more than 300,000 users across the globe.

- In addition to listing very many cryptos, Mercatox is preferred for allowing traders to use both fiat currencies and credit cards. This makes it a great starting point especially for new crypto enthusiasts who only have cash on their credit cards.

- The average transaction fee at the exchange is 0.25% of the traded volume. Though this is relatively low compared to other platforms, the exchange should consider revising it downwards. Besides, the exchange has indicated it is working on a lending platform to allow users to trade more.

Value of Nano

When the term cryptocurrency is mentioned, many people associate it to Bitcoin because of the huge value growth reported in the last quarter of 2017. However, the focus on cryptocurrencies has slowly shifted from the direct face value to the expected progress in the coming years. This notion has made Bitcoin and other top cryptos to be less desirable because of the high transaction cost and a face value presumed to have hit or approaching its climax. This is where Nano beats other cryptos to become the best crypto.

Before December of 2017, the value of Nano was about $1. By January in 2018, it had grown to more than $30. This is a remarkable growth in value. Everything in the crypto community appears to be working in Nano’s favor. From its design to architecture, the crypto looks perfectly designed to become the next big mover. This is the reason why many people including experts see it as the next Bitcoin.

The overall market capitalization of Nano also shot up by January 2018 to hit an all-time high of over three billion USD. Though the market capitalization and value started shifting downward after the rapid growth in January, the value is still a huge improvement from the 2017 value.

Is It Profitable to Invest in Nano?

The profitability of a cryptocurrency can be gauged by the shift in value over time. Nano is doing very well on this front. Since inception, the cryptocurrency has recorded significant growth because of its unique architecture and positive publicity.

Between inception of Nano (RaiBlocks Coin by then) and early 2018, the value of the cryptocurrency grew by a huge margin. Investors who had picked the opportunity when RaiBlocks was released enjoyed over 3000% growth in value in January of 2018. But this is not the only thing pointing to the expected high growth of Nano.

Immediately after RaiBlocks changed to Nano and top corporate such as Twitch started joining it, the crypto community got convinced that the potential of the crypto would grow progressively. Other indicators that Nano will be a profitable investment in the coming days include;

- The Nano team is very aggressive on improving the network.

- The demand is likely to keep growing as more people find top cryptos such as Bitcoin and Ethereum too expensive.

- The community is excited about a crypto network that does not charge them anything to send the value.

- The technology used in the Nano is very advanced. It is light, fast, and enviable in all angles. The community is upbeat that the cryptocurrency is the next big thing in the market.

Where to Spend or Use Nano?

One of the main methods used by the crypto community to gauge the popularity of a cryptocurrency is acceptance as a means of payment. Becoming a major payment option is a key objective held dearly by most cryptocurrency founders. Nano is no different.

The development team has been working very hard to ensure that the cryptocurrency is accepted in multiple stores. However, the cryptocurrency is still relatively new, and only a few points of sale accept it for payment. One of these places is Twitch. Twitch is a gaming streaming service that has more than 10,000 subscribers.

Even though the market reaction about Nano has been impressive, its development team has its work of making it accepted in more stores cut out. Despite this, having Nano does not mean that you cannot purchase in top stores. Simply exchange Nano for the accepted coins and complete the buyout.

Can Nano Grow to Become a Major Payment Network?

Nano stands a great chance of becoming a major payment network. However, it has to address key obstacles on the way. One of the main things that put Nano ahead of others to becoming a major payment network is eliminating transaction costs. Many people have been complaining that the charges on other networks such as Bitcoin and Ethereum are very high. But now they have a great option to go to and enjoy sending payments for free. Here are other pointers that Nano can become a great network.

- The transaction allows users to send value at zero transaction cost.

- The community is bullish about the cryptocurrency’s growth.

- The cryptocurrency technology used in Nano helps to make transactions faster and reliable.

- More corporates have expressed the desire to form partnerships with Nano.

- The Nano development team is very aggressive in crafting new features and keeping the network updated.

- The value of Nano has been growing progressively, and it is expected to continue with the trend in the coming months.

How Does Nano Work?

Nano is a cryptocurrency that operates on a peer2peer basis. Like other cryptocurrencies, this model’s main aim is to bypass the centralized organizations such as banks to make sending value faster and cheaper. The architecture of the Nano was also aimed at helping address challenges such as scalability and power inefficiency experienced in other cryptocurrencies such as Bitcoin.

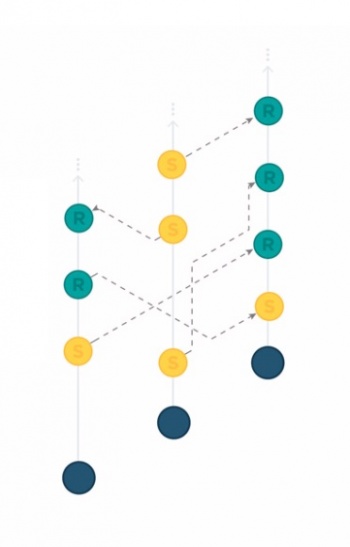

Nano addresses these challenges through the use of acyclic graph algorithm and a unique block-lattice structure. With this architecture, every user/ Nano account is its own blockchain (account-chain). Consider this to be an equivalent of the standard blockchain network’s balance history. Besides, every account can only be updated by the account owner. This implies that updating the network can happen asynchronously of the Nano network.

Because every transaction made in the network is its own block, when a user sends some NANO/XRB, two transactions will be needed for confirmation to be completed. The sender transaction that deducts the amount from his account, and the receiver transaction that confirms he has received the NANO/XRB. The effect of this is speedy transactions at zero transaction fees.

Does Nano Use Blockchain Technology?

Nano, like other cryptocurrencies, operates as a public ledger that progressively gets updated as new blocks are embedded. However, the model of Nano differs from others in that it applies the directed acyclic graph algorithm that operates with private block lattice. The block-lattice architecture helps to record account balances as opposed to tracking transactions. What this means is that you can prune data so that the space required is very small.

The Nano blockchain reflects the details relating to the individual account and only the owner can update it. Once the owner updates the info, it is embedded into the main block-lattice. By allowing traders to record transaction balances on the individual block, the Nano blockchain can be updated faster, and transactions completed promptly.

Because both sender and receiver are involved in updating transactions, it means that there is no need for miners. The nodes that join the network only help to build consensus through voting when there is a conflict. Note that not all the delegates or nodes in the network vote to address a conflict. By employing the Delegated Proof-of-Stake, Nano only allows those that have invested more (stake) in the network to vote. These are the nodes that are trusted not to harm the network because their investment is still in the system.

Mining Nano

You cannot mine Nano. Mining is used in most crypto networks such as Bitcoin to help distribute the remaining cryptocurrencies through a reward model. However, the supply of Nano coins has already hit the maximum supply. The tokens were distributed via a faucet distribution model that closed in October of 2017. This means that those sites that claim to mine Nano only use your hashing power to mine other networks such as Monero and then buying NANO/XRB to pay miners.

By using the Directed Acyclic Graph based block-lattice architecture, every user posses his own blockchain. This means that instead of tracking the transaction amount, the blockchain records the account balances. With the owner being the only authorized entity to update his block, the need for miners is eliminated. This is the reason that the network has managed to scrap the transaction fees completely.

What Are the Advantages of Nano?

- It is one of the networks that operate without transaction costs

- If you have some cash and want to send abroad using the banking system, the chances are that it will be very expensive. Even the cryptos that came earlier such as Bitcoin and Ethereum are still very expensive. For example, the cost of sending cash using Bitcoin network was more than $ 50 in January of 2018. However, Nano has ushered a new dawn in cryptocurrencies where people can make transactions for free. This is one of the benefits drawing a lot of people to the network.

- Allows users to operate without worrying about third-party seizures

- One notable thing about cash stored in the bank is that bank account details can easily leak to third parties and even public. Worse still, the bank account can easily get frozen if a court battle whirls to your doorstep. However, Nano is an open source and anonymous network that is hidden from third parties. This means that no one including the courts knows about your details. Therefore, there is nobody that can freeze the account. Even a court order cannot freeze the account.

- The main network that allows users to own the network

- When people use the standard payment services such as PayPal, MasterCard, and banking, they feel passive. Once they make the savings or send cash, they get the sense of accomplishment and move away. Like other cryptocurrencies, Nano helps people to join, use, and own the network. This means that you are part of the network and your vote will be required when consensus is needed.

- It is one of the most secure networks in the crypto market

- When people join the cryptocurrency network, they are interested in getting the most secure option for their assets. The delegated proof-of-stake model used in the Nano system helps to keep it secure from miners who might have malicious intentions.

- The commitment of the Nano development team has also managed to keep the system free from hackers since inception. These considerations have won the Nano the tag of the most secure blockchain in the crypto world.

- The best way to operate in absolute freedom

- If you want to send cash abroad on the weekend or at night, the chances are that it will be impossible. Even those that have some mobile activated applications only allow people to send a limited amount of cash. However, Nano cryptocurrency network is different. The crypto network allows users to operate with utmost freedom. Whether it is at weekend, public holiday, or at night, you are sure of being able to use the network.

- The cryptocurrency value and community have been growing steadily

- The effectiveness of a crypto network is partly gauged by its value and community. For Nano, these parameters have been experiencing positive growth in since inception. As the value took an upward trend early in 2018, the crypto community also kept growing. Many people believe that this growth will keep growing and the crypto could become the next Bitcoin.

What Are the Risks of Nano?

While the benefits associated with Nano are very many and appealing, it is important to appreciate that the network also comes with a lot of risks. Like other cryptocurrencies, users in the Nano network operate anonymously. While this is seen in many ways as an advantage, it is also a great demerit. The anonymity makes it easy for users to fall to scammers. Other risks of operating in the Nano network include.

- The danger of getting attacked by hackers

- It is not uncommon to hear people crying that their crypto networks have been hacked and thousands of crypto assets lost. The threat of getting attacked looms at the Nano network level, the wallet, and more so at the exchange level. Though the Nano network development team has been working extra hard to keep the network safe, and no successful attack has been reported since inception, you cannot be 100% secure.

- The risk of new and more appealing cryptocurrencies entering the market

- The third generation cryptocurrencies such as Nano are mainly aimed at addressing shortcomings noted in the previous networks. For example, Nano targets addressing shortcomings noted in the Bitcoin and Ethereum networks. However, newer and more advanced cryptocurrencies are also likely to emerge in the future and pull down the appeal of Nano. This could lower its value and diminish the trust people have in it.

- High volatility

- Cryptocurrencies such as Nano have demonstrated to be highly volatile. Every time that something related to the crypto industry takes place, Nano and other cryptocurrencies respond immediately. When China announced that it was going to burn ICOs (Initial Coin Offering), Nano value responded by shifting downwards. A similar downward shift was noted when a cryptocurrency exchange was hacked in South Korea towards the end of 2017.

- The looming regulations

- Every country in the globe is working on some form of regulation to help control cryptocurrencies. From China to the United States, the governments are feeling threatened by the cryptocurrencies so much that they want to limit their growth. China has already outlawed ICOs and looks committed to suppressing other crypto related activities. If most countries pass harsh regulations as anticipated, there is a risk that adoption and use of Nano could go down or diminish completely.

- The Nano model operates as a direct threat to the banking system

- While the first and second generation cryptocurrencies were aimed directly offering an alternative to banks, third generation cryptocurrencies have been working on partnerships. For example, OmiseGO and Ripple provide banks with a platform for enhancing payment as opposed to looking like a direct threat. But Nano architecture aims at replacing the banks especially with its zero transaction fee. This could deny Nano support from such financial institutions as they channel their clients to other friendly networks such as Ripple.

What Happens if Nano Gets Lost?

If you have been in the cryptocurrency network for some time, owning some high-value coins gives one a sense of success. It is even more fulfilling if you own fast growing coins like NANO. If you wake up and find that the Nano coins have been lost, it can be very distressing. However, this has become the order of the day in the cryptocurrency world as hackers perfect their skills of breaking and siphoning away native coins. The most vulnerable point is at the cryptocurrency exchanges.

Early in February of 2018, the BitGrail Cryptocurrency Exchange was hacked, and over $195 million worth of Nano coins siphoned away. One question that keeps surfacing when such losses occur is; what really happens when crypto coins such as Nano are lost? To demonstrate what happens, it is better to look at the losses based on the channels of loss.

- (a) Loss through hacking or sending to the wrong address: If you lost Nano through hacking at any level, it means that the native coins are lost forever. They are still in the network but have changed hands. The bitter thing about this is that there is no one to complain to.

- (b) Loss through forgetting the private keys or damage to the wallet: If you have lost the private keys or the wallet has been damaged, it is impossible to access your Nano coins. This implies that the Nano altcoins are still in the network but in a dormant state. You will need to get the right private keys or wallet to restore the coins.

Nano Regulation

Cryptocurrencies entry into the finance industry threw most governments into a state of confusion. Most of them felt threatened because cryptocurrencies are decentralized and directly risked the existence of centralized organizations such as banks. Despite this, it is interesting to realize that no country has passed laws to regulate cryptocurrencies. The United States Federal Bureau of Investigation was the first to note that cryptocurrencies such as NANO presented a huge threat to national and global security. FBI pointed that because transactions are anonymous, cybercriminals are likely to exploit the characteristic to operate without getting noted.

Even as more jurisdictions expressed their discontent with Nano and other cryptocurrencies, none of them had passed a legal framework by early 2018. A country such as China whose leadership has openly expressed hate of cryptocurrencies only resorted to direct gag orders.

One question that comes out when the topic of cryptocurrency regulation is discussed on various forums is; why are jurisdictions taking so long to pass laws? It has now become a reality that passing cryptocurrency related regulation is not as simple as governments would want it to be. Here are some of the common things that make passing crypto related regulations extra difficult.

- The cryptocurrency technologies are changing very fast.

- Crypto networks such as Nano are not owned by any specific individuals. Rather, users and nodes spread across the globe own and run them.

- Cryptocurrencies hold the solution for many problems such as Big Data that have become big challenges to most governments.

- Most administrations are playing catch-up when it comes to cryptocurrency technologies.

Though most countries lack cryptocurrency related regulations, the threats posed by crypto networks are a sure indication that the laws will finally dawn. As a trader or investor in the Nano crypto, it advisable to regularly check for law-related updates. It is also crucial to be ready for the aftershocks that might come with such laws.

Is Nano Legal?

Nano is legal in most countries in the globe. By the first quarter of 2018, no country had passed a legal framework to address the rising issues with cryptocurrencies. This section explores Nano legal status in individual countries.

1) Russia

- Russia is one country that has demonstrated the commitment to pass a crypto legal framework. At first, Russia had indicated that it was not willing to regulate cryptocurrencies. However, the focus shifted after it became evident that the cryptocurrencies were distorting the investment landscape. By the close of 2017, the finance ministry indicated that traders accepting cryptocurrencies such as Nano could be found to have committed an offense.

- At the onset of 2018, finance ministry and Russia central bank started working on a crypto draft law to help guide the crypto industry. By February, the released the Digital Finance Assets Draft bill. This draft law proposes to regulate mining, crypto exchange, and ICOs. It is important to point that the draft law has attracted sharp resistance from the opposition in the country.

2) The United States

- The United States was the first to note the risks that cryptocurrencies would bring. Despite this, the administration has a lot to benefit from the cryptocurrencies growth in its borders. This is why the federal administration had not passed any regulation by early 2018. The only mention or guideline given by federal authorities was from the Commodities Futures Trading Commission (CFTC) that advised all Nano and other crypto traders that revenue generated is taxable. CFTC clarified that cryptocurrencies are commodities and income from trading them should be considered taxable.

- The approach taken by US to address cryptocurrency regulation is seeking a global front. The Treasury has established that cryptocurrency networks such as Nano are decentralized and, therefore, owned by nodes spread across the globe. Early in 2018, Treasury Deputy Director visited Japan, China, and South Korea seeking to build a common approach in addressing cryptocurrencies. He was categorical that the anonymity of cryptocurrencies has to be addressed with urgency to avoid creating new lines of stashing cash and tax avoidance.

3) China

- China is one of the jurisdictions that have been extra hard on cryptocurrencies and their applications. The country’s administration took a position that rhymes with the current focus on stemming cash flow and addressing corruption. The government does not want to be associated with anything crypto. First, it banned cryptocurrency ICOs. Then, it started freezing bank accounts associated with cryptocurrency exchanges and restricted miners in the country.

- Notably, even after the direct restrictions, cryptocurrencies such as Nano and Ethereum have thrived more in China than any other country globally. Most investors in China do not want to be left behind when it comes to investing in cryptocurrencies. From miners to investors, China remains a highly attractive jurisdiction.

4) Switzerland

- While China, Russia, and the US among other states feel threatened by cryptocurrencies, one country that is sitting pretty with them is Switzerland. The country's administration has indicated that it wants to provide a reliable and trusted platform for cryptocurrencies to thrive and flourish. The country's economic minister, Johann Schneider-Ammann, was categorical that the country will not relent in making the jurisdiction a crypto-nation. This positive approach has seen many founders of various crypto networks base their foundations in the jurisdiction and running ICOs (Initial Coin Offering) from there.

Nano and Taxes

When cryptocurrencies entered the finance industry, one of the reasons for their rapid growth is enhanced anonymity. The notion that you can send cash from one state to another state without any third party knowing about the personal details is very attractive. But a lot of people are more interested in in using cryptocurrencies to live tax free. They argue that because the transactions in the Nano network are anonymous, it is possible to stay without paying taxes

Though it is true that the anonymity provided by cryptocurrencies such as Nano can help to shield personal details, you cannot expect the cover to last for long. As technology continues advancing, experts are of the view that all the crypto details will ultimately be uncovered and everything done under it will be uncovered.

Around May of 2017, a strain of cyber attacks known as ransomware ravaged institutions in Europe and parts of Asia. The cybercriminals behind the attacks opted to be paid in cryptocurrencies because they are anonymous. However, the advancing technology around the cryptos made it possible to follow transactions and unmask users. This is the reason that these criminals were unable to withdraw their crypto coins from the Bitcoin network. This is the same risk that people who opt to operate on the Nano network without paying taxes should expect.

Saying that technology will continue progressing and expose tax evaders do not mean you cannot enjoy the many benefits that Nano has introduced. Here are four main tips that can help you to enjoy optimal benefits from Nano and remain compliant with tax laws.

- Consider every income from trading Nano taxable revenue.

- If you are using Nano as a payment method for your store, make sure to follow the standard procedures on your books of accounts with the emphasis on incoming revenue.

- Always take notes when trading Nano in the market. Special focus should be on noting the trade volumes and value of the tokens in fiat currencies.

- Consider working with a tax expert to get set right books from the period you operated on the Nano network without paying taxes.

Does Nano Have a Consumer Protection?

Nano does not have a consumer protection. Nano, like other cryptocurrencies, is not owned by a single entity. Rather, it is a network for sending the value that is owned by the people using it. What this indicates is that you do not have anyone to take complains to in case of a loss.

The fact that Nano does not have a consumer protection means that you are on your own in the network. Indeed, you cannot even report the misdeeds to a court of law because the cryptocurrencies are not regulated. To be sure of operating safely in the Nano network, here are some useful tips to apply.

- Always keep your wallet and computer updated.

- Select the cryptocurrencies to trade Nano with a lot of care.

- Triple check the public address when sending cash on the Nano network.

- Do not share the private keys with any person.

Illegal Activities with Nano

When cryptocurrencies entered the finance sector, many criminals thought that they had at last gotten the best opportunity to commit crimes and hide. The anonymous nature of the cryptocurrencies makes them easy for criminals to hide without getting discovered by authorities. Even as cryptocurrencies make it easy for criminals, the architecture of the Nano that requires both the sender and receiver to participate in confirming transactions has scared away criminals. It is because of this that no illegal activity has been reported with Nano.

Is Nano Secure?

The cryptocurrency community has developed a special interest in the Nano partly because of its unique focus on security. Like other networks, Nano is not 100% secure from attacks. However, its development team has been working extra hard to reduce the possibility of attack and keep the system extra secure. Here are the main tactics used by Nano development team to keep the network secure from specific attacks.

- (i) The danger of block gap synchronization: This is a risk where the block might not be appropriately broadcasted. The impact is making the network to ignore subsequent blocks. To address this problem, the network makes sure that unnecessary synching is avoided. This means that nodes have to wait until a high threshold of votes is attained when a block is suspected to be malicious. Any block that does not hit the threshold is considered junk.

- (ii) Sybil attack: This is an attack where an entity creates thousands of Nano nodes using a single computer. To address this type of attack, the Nano system of voting uses weighted balance. Therefore, generating many nodes will have limited or no effect unless they gain a stake in the Nano system.

- (iii) Penny-Spend attack: This is a type of attack where the attacker uses infinitesimal qualities to many accounts with an intention of wasting storage resources for the nodes in a network. However, Nano addresses this problem by utilizing minimal permanent storage space. This implies that the space needed to store more accounts is proportional to the size of open block and indexing. This is equal to one Gigabyte being capable of storing 8 million penny-spend accounts.

Is Nano Anonymous?

The main promise given by many cryptocurrencies when they debut is providing users with a completely private platform. At Nano, privacy is provided through advanced encryption. The Nano system ensures that all details are encrypted immediately the user flags off the transactions. Once you initiate a transaction, the nodes spread in the Nano network can only pick the details of the wallet to hold consensus in case of a conflict. However, they cannot uncover the details to establish who the owner is.

Has Nano Ever Been Hacked?

Nano has never been hacked. Before joining a crypto network such as Nano, the first question that people ask is how secure it is. You can tell this by examining the cases of hacking reported in the network. At Nano, no case of successful hacking has been reported since inception. This has been attributed to the unique design of the network and commitment of the development team. This hacking-free history is what the Nano community anticipates to get even in the coming months.

Note that this does not mean that hackers do not target the network. Hackers keep making attempts on the network every month. However, the development team has been very aggressive in checking for security gaps and sealing them before attacks take place.

How Can I Restore Nano?

Every time that the report of loss in the cryptocurrency system is reported, the entire community is thrown into a shock. In most of the cases, the values of the crypto assets respond with a downward shift. This is what happened after a cryptocurrency exchange was hacked in South Korea in December of 2017. However, all might not be lost. There are cases of Nano losses that are reversible. Here is a closer look at how you can restore Nano after a loss.

- (a) Loss through damage to the Nano wallet: If Nano was lost because the wallet has been damaged; you can use the backup to restore the coins. For those who use the web-based wallets, there is no danger of getting the wallet lost.

- (b) Loss through forgetting the private keys. Many people often indicate that they lost their digital assets after forgetting or misplacing the private keys. To recover Nano after forgetting the private keys, you need to use the private keys seed phrase.

To successfully recover lost Nano, the secret is getting prepared well before the loss takes place. It is important to anticipate such losses and ensure that every effort is taken to prevent a loss. For example, you need to pick the exchanges with great care, maintain backup, and store the private keys safely.

NOTE: If you lost Nano through sending to wrong address or hacking at any level (wallet, network, or exchange), no method could be used to restore Nano. You will simply have to accept that the coins were lost.

Why Do People Trust Nano?

After Satoshi Nakamoto discovered and released the first blockchain network, it appears that he only opened the door for others. Over 1700 cryptocurrencies had entered the crypto industry by early 2018. Now, the battle is shifting to winning trust of the community. Nano has become sensational with people moving to its network in droves. Here are the main reasons why the community has developed a lot of trust in Nano.

- The cryptocurrency has received a lot of publicity especially after RaiBlocks rebranded to Nano.

- Its architecture has introduced a new system that is stronger, secure, and more reliable.

- It is one of the few cryptocurrencies that are allowing people to send funds across the globe for free.

- The cryptocurrency has removed the need for miners which has helped to reduce conflict of interest with users.

- The focus of Nano is not raising cash through events like ICOs and other related efforts. Rather, the main target is improving the network to guarantee users of greater value.

- Like Bitcoin, they follow one mantra; do one thing and make it the very best.

- The crypto network is focused on simplicity. Like Bitcoin, the simplicity is helping the development team to remain focused on a few components and grow rapidly.

- The unique delegated Proof-of-Stake model has made people start seeing the gem in cryptocurrencies. It is referred as the true model aimed at helping people enter a cashless society.

- The cryptocurrency is one of the most secure options out there. Since its formation, no case of successful hacking has been reported.

History of Nano

Like most cryptocurrencies, there is little info about the history of Nano. This method of anonymity is used to help protect the founders and development team's security. It is also used as a cover for legal purposes. While it is clear that Nano rebranded from RaiBlocks at the end of January of 2018, additional information about the cryptocurrency is very scanty. RaiBlocks was first traded in the exchanges in March of 2017. By then, it was trading at less than one dollar in the markets.

Early in December of 2017, the value of Nano started rising. This process continued for about two months to hit an all-time high of $35 early January of 2018. The founder, Colin LeMahieu, has indicated that the development team will make sure that the network is the best in the market.

Who Created Nano?

The main person associated with Nano is Colin LeMahieu. LeMahieu, is a computing expert who wanted to address the cryptocurrency challenges that other crypto networks were experiencing. He was particularly interested in bringing the cost of transactions in the network as low as possible.

LeMahieu was an ardent follower of Bitcoin and always dreamt of coming with a solution that would not limit people’s ability to use crypto networks because of transaction costs. He argued that though the crypto networks were indeed helping to decentralize the finance niche especially making payments, they were becoming too much commercialized. This is why he had to come-up with a free payment network. He also noted other challenges such as limited scalability and space limitations.

Nano Videos and Tutorials

RaiBlocks Cryptocurrency Now Rebranded to NANO in Crypto Market

Nano / XRB Creator Colin LeMahieu Interview

Nano SWOT Analysis

See Also

- Bitcoin | Ethereum | Ripple | Bitcoin Cash | Litecoin

- Cardano | NEO | Stellar | EOS | NEM | VeChain Thor

- Monero | Dash | IOTA | TRON | Tether | OmiseGO

- Bitcoin Gold | Ethereum Classic | Nano | Lisk | ICON

- Qtum | Zcash | Populous | Steem | Ontology | Waves

- DigixDAO | Bytecoin | Bitcoin Diamond | Binance Coin

- Bytom | Verge | Crypto Humor

- Cryptocurrency Dictionary | List of Cryptocurrencies | CEX.io

- Binance | Coinbase | Changelly | Coinmama | Bitpanda

- LocalBitcoins | Kraken | Paxful | Ledger Nano S | TREZOR