Verge

Verge cryptocurrency guide advises where to buy and how to buy Verge. This guide also contains the markets, value, trading, investing, buying, selling, transactions, blockchain, mining, technology, advantages, risks, history, legislation, regulation, security, payment, networks and many other interesting facts about Verge as well its status in the world of cryptocurrencies.

Verge, Thursday, 2025-06-12

Contents

What Is Verge?

Verge is a decentralized and open-source cryptocurrency that offers anonymous transactions by obfuscating the user’s IP address and geo-location. The cryptocurrency aims at making all transactions untraceable while facilitating high throughput and prompt confirmations.

Unlike other cryptocurrencies, the Verge project is a community-led project. Indeed, no foundation or company is behind the cryptocurrency. The coin started in 2014 when it was referred as DogeCoinDark and later rebranded to Verge in 2016. In December of 2017, Verge price skyrocketed by more than 2500% to hit an all-time high of $0.28. This growth is being used as an indicator of great things to come.

The biggest selling point of verge is its stunt on anonymity. Its unique model has made it enter into the league of other top anonymous cryptocurrencies such as Monero, Zcash, and Komodo.

The cryptocurrency operates a public ledger that allows users to bypass centralized organizations such as banks. By linking both senders and recipients in the most anonymous way, Verge is touted to be the next cryptocurrency that will take the original idea of Bitcoin to the next level. Welcome to the most comprehensive review of Verge.

Verge partnership with Pornhub on April 17th

After the long wait, Verge finally announced its partnership with Pornhub. Interestingly, the announcement was viewed in bad taste. Both Verge community and the entire crypto community had expected the Verge would announce a partnership with other seemingly more influential partners. Top on that list was the Indian e-commerce giant Flipkart followed by Amazon. None of them was right.

After announcing the partnership, XVG took a sharp nosedive triggered by the massive selloff. The token values plummeted 30% in an hour of the announcement. This undid the earlier growth of more than 10% reported when Verge announced that a major partner was about to be announced. But Verge leadership appears to be undisturbed with the reports and indicated that it was interested in long-term benefits. Here are some of the top benefits to expect from the partnership.

- The private nature of the XVG makes Pornhub a great partner: Though Pornhub is considered an “unclean” partner to be associated with Verge, the truth is that a lot of people feel shy to use their credit cards to pay for adult content and sites. This has made most of them opt to stay away. By partnering with Verge, Pornhub has made it easy for anyone to pay for adult content anonymously. Verge has jumped a step ahead of others and raised its system as a payment network.

- The partnership helps to bring more industries into the crypto networks: Perhaps outrange reported in the Verge is justified based on the expectations that people had. However, the truth is that Verge has moved to an area where few others have dared to venture. This makes Verge one of the first to venture into the more than $500 billion industry where privacy is everything.

- The market will ultimately recover: Most of the people offloading XVG are reacting to the partnership but failing to appreciate the actual premise that attracted them to verge. The cryptocurrency is expected to recover in the second and third quarters of the year. If you are planning to invest, this is a great opportunity to take advantage of the shifting price.

Beginner's Guide to Verge

Have you been looking for a great cryptocurrency to join? The Verge might be the ultimate option you have been looking for. Prior to 2016, the cryptocurrency used to operate as DogeDarkCoin. The Verge team shifted to the new name and changed its approach to enhance anonymity.

The revamped team has excited the entire cryptocurrency industry with its new features. Starting with the advanced technologies such as Wraith Protocol technology and multiple PoW (Proof-of-Work) algorithms, Verge is now among the most anonymous cryptocurrencies out there. The development team is also working on facilitating smart contracts. From a distance, this is a cryptocurrency that is ready for takeoff. However, it is important to closely review it and establish all the features and their applications.

This guide is your comprehensive companion that will help you to walk through the Verge crypto. The guide closely analyzes the places to buy, how to buy, the value of Verge, and regulations. It also explores the topic of Verge and taxes, what happens when XVG gets lost, and the main pros & cons.

The guide completes by looking at why people are developing a lot of interest in the cryptocurrency. No matter the question or doubt you have about Verge, this is the place to get answers. Welcome to learn about these aspects and more about Verge.

Where and How to Buy Verge?

When the potential of Verge is discussed in social circles, one cannot resist but anticipate being part of the great network that will define the cryptocurrencies’ future. For example, there is a consensus that the Verge’s upward shift in value in December of 2017 is an indicator of the huge growth to anticipate in the coming years. However, where and how do you buy Verge?

There are four main places where you can buy verge from. However, all of them have one thing in common; a cryptocurrency wallet. A cryptocurrency wallet is a location that holds your Verge after a successful purchase. It also allows users to carry different transactions such as sending Verge, receive Verge, and even hold other cryptocurrencies if the wallet is multi-asset based. Here are the main places to buy from Verge from.

- Buy from cryptocurrency exchanges

- Cryptocurrency exchanges are the primary points of sale buying cryptocurrency exchanges. These are trading platforms that bring together XVG buyers and sellers like the standard forex markets. The price of Verge in the cryptocurrency exchanges is driven solely by market forces of demand and supply.

- To buy Verge from cryptocurrency exchanges, you are required to start by opening a cryptocurrency trading account. This account must also be verified using personal information such as phone number and proof of address among others. Note that the verifying information can vary depending on the selected exchange.

- Once you have created an account, go ahead and buy the Verge quantity of choice. In some cases, you might be required to buy a different cryptocurrency such as Bitcoin or Ripple and exchange it for Verge depending on the selected exchange.

- Note that once the buyout is through, the Verge or selected alternative cryptocurrency will be credited to the trading account. This means that you will need to move the Verge to the wallet. Some of the top cryptocurrency exchanges to consider include Binance, CEX.io, HitBTC, Coinbase, and Cryptopia.

- Buy Verge from cryptocurrency brokerages

- Cryptocurrency brokerages are platforms that run like the exchanges in many ways. In fact, it is very difficult to differentiate them from the exchanges by looking at the user interface. Though their prices closely follow those at the exchanges, they are adjusted upwards to cater for the brokerage fees. The good thing about brokerages is that they are direct and very easy to use. Though you will still be required to open a trading account, the procedure is short and direct. Some great examples of cryptocurrency brokerages include Coinmama and Bitpanda.

- Purchase from cryptocurrency ATM

- Cryptocurrency ATMs have emerged as unique points of purchase in the cryptocurrency niche today. They work like the standard ATMs where people can pop in and buy their preferred coins in minutes. Note that most ATMs are located in the cities with a lot of cryptocurrency communities and only trade Bitcoins. This means that you can only buy Bitcoins and exchange them for Verge in an exchange such as Binance.

- Consider buying from those who already have Verge

- One of the easiest ways of acquiring Verge is getting them from those who already have. Because of the fast-growing popularity of cryptocurrencies, small clubs that target helping people understand the new technologies are beginning to emerge. Now, these clubs have become crucial selling points for people who want to make direct sales without restrictions imposed by cryptocurrency exchanges. Some great examples of cryptocurrency clubs include LocalBitcoins.com and Bitcoin Subverse.

Verge Wallet

Are you contemplating to join the verge network? The first thing to acquire should be a Verge wallet. The wallet is the most important thing that will help you hold Verge and interact with the native network. In the case of Verge, the wallet is designed to make you one of the nodes so that you can participate in consensus building/ voting.

Though the accepted definition of a cryptocurrency wallet is a storage location for crypto assets such as Verge, the definition is indeed a misnomer. XVG, like other cryptocurrencies, do not leave the native networks. Whether you have bought or mined the XVG, they will always be in the native network. What changes is the identity. This brings about one major question; what exactly do cryptocurrency wallets store? A Verge cryptocurrency wallet stores three sets of codes.

- The private keys: This is a unique code that identifies your XVG in the Verge network. The keys call the XVG to live and must be used in every transaction on the Verge system. As the name suggests, the code is private and should never be shared.

- The public keys: This is a set of codes that help to point at your wallet. The code is provided to people who want to pay you in XVG and miners involved in confirming transactions. You should not feel worried about sharing the public keys.

- The recovery seed phrase: This is a unique code used for re-generating the private keys. In many cases, the seed phrase is the first to get generated by a cryptocurrency wallet. Then, users are required to use it to generate the other two keys.

There are five types of cryptocurrency wallets that you can select to store Verge. However, the choice depends on preferred convenience and notion of security. For example, you might prefer to use a mobile Verge wallet to a desktop wallet if you are always on the go. The main categories of cryptocurrency wallets include hardware wallets, desktop wallets, web-based wallets, mobile wallets, and paper wallets. The following are the top three best Verge wallets you can go for.

1) Verge Electrum wallet (desktop wallet)

- This was originally designed as an open source wallet for Bitcoin, but newer versions were created to cater for other cryptocurrencies. The Ethereum version of the Electrum wallet was forked to make adjustments for another version the Verge blockchain.

- The Verge electrum wallet is a light application that provides an easy option to store and manage XVG. It applies a Simple Payment Verification (SPV) technology for transaction verification in under five seconds. This implies that you do not require downloading the entire Verge blockchain to the computer in order to use the wallet.

- When you use the wallet for the first time, it generates the private seed phrase that will be used to generate the private and public keys. To keep your crypto assets safe, Verge electrum employs two levels of encryption. It is also compatible with multiple platforms including Windows, Linux, and Mac OS.

- The only disadvantage of using Verge Electrum is that it only supports Verge. Unlike other cryptocurrency wallets such as Ledger Nano S that allow users to store over five crypto assets, Verge Electrum can only store XVG.

2) Verge QT Wallet (Desktop wallet)

- The Verge QT wallet is one of the top options for users who want to run more operations in the Verge network. Like the Electrum wallet that only allows users to interact with the blockchain to perform specific actions such as sending value, the QT Verge wallet also makes you part of the main nodes.

- It is designed using C++ programming language, and it is available for multiple operating systems. Note that you are required to download the entire Verge blockchain to be able to use the wallet.

- Though the wallet is indeed relatively bulky when compared to other wallets out there, it is very simple to use. Besides, it makes you part of the Verge client which means that you can enjoy all associated security, anonymity features, and mine the network.

- Because the wallet requires downloading the entire blockchain, it is important for users to have ample space on the hard drive. Note that the wallet only works on the Verge network.

3) Coinomi (mobile wallet)

- This is one of the leading cryptocurrency wallets because of its ability to store multiple crypto assets. If you opt to use Coinomi, it supports more than 100 cryptocurrencies. This means that you are likely to find it extra useful compared to the standard wallets. Some of the crypto assets you can store in the Coinomi include Litecoin, Dash, Ethereum, Bitcoin and Bitcoin Cash, and Verge.

- The main selling point of Coinomi is the intuitive user interface. Even new comers to the word of cryptocurrencies find it very easy to learn and use the wallet features. Besides, the wallet stores the private keys on the device so that only you have access to it. To make the wallet even more secure, it is hierarchical deterministic. This means that the XVG in the wallet are secured using a 12-word passphrase that only needs to be backed up once.

- For people who target a lot of trading with their Verge, Coinomi might be the ideal option. As a mobile wallet, it means that you can always access the Verge blockchain on the go. Besides, the wallet has ShapeShift integrated into its system. ShapeShift is one of the fast-growing trading cryptocurrency trading platforms in the market today.

- The main shortcoming for using Coinomi is lack of 2-factor authentication. Besides, they do not have an app for Apple products such as iPhones and iPads. However, they have indicated that the apps are being created.

4) Tor wallet (mobile wallet)

- This is another fast growing Verge wallet that allows you to access VXG and Verge blockchain on the go. The wallet is designed for Android phones and allows users to easily make transactions and take advantage of the rapidly shifting prices of XVG.

- To use the Tor Wallet, you have to download the application on your phone and select create a wallet. Unlike other applications, including web and desktop options that only use pin codes, the Tor wallet app allows you to integrate the fingerprint to unlock it. This is an additional security layer which makes it hard for unauthorized people to break and siphon your XVG.

- If you have a paper wallet, Tor allows you to scan it and access your stored XVG. In addition to these unique features, the wallet has a very intuitive user interface and makes recovering XVG very simple. This makes it one of the easiest to use wallets on the market.

- The main shortcoming of the wallet is its developer’s poor response to clients’ issues. A closer look at their main page reveals that most of the users are unhappy with the services offered by the wallet. Even with these negative feedback, there is no doubt that the Tor development team only requires to fine tune it for better performance.

Where to Buy Verge with Credit Card?

Today, a lot of people are attached to credit cards in a great way. The cards are preferred because they provide high flexibility and are accepted in many online and conventional stores. Another great thing about them is that they can be used to buy cryptocurrency tokens such as XVG. Here are the main places where you can buy Verge with a credit card.

NOTE: You must have a cryptocurrency wallet to make a purchase. Besides, you might need to start by acquiring an alternative cryptocurrency such as Bitcoin and change it for XVG at another market. This is the case because not many cryptocurrency exchanges allow direct cash transfers or using credit cards.

Where to Buy Verge with PayPal?

PayPal is one of the top online payment methods preferred for making payments, especially in online stores. Unlike credit cards, PayPal operates as a digital wallet. However, it falls short of qualifying as a cashless system because the funds represent actual coins and notes held by PayPal on your behalf.

PayPal does not allow payment to cryptocurrency networks. Though the company has indicated it will start facilitating such payments, users will have to wait for longer until PayPal completes reviewing its policy. This implies that if you have cash in the PayPal system, you can only buy Verge by offloading to a method that is accepted such as credit card or bank account.

How to Buy Verge with Wire Transfer?

If there is one thing that people trust so much, it is a bank account. Many people believe banks because they are thorough, insure their assets and always carry due diligence when running transactions. The banks are trusted to process salaries and advise on investments. Now you can also use wire transfers to buy Verge. Here is the procedure.

- Start by acquiring an appropriate cryptocurrency wallet that will hold your verge after the purchase is completed.

- Select a cryptocurrency exchange that accepts wire transfers. Some of the great options to consider at this point include Coinbase and CEX.io.

- Create a trading account at the selected exchange and verify it with personal information such as phone number and proof of location. Note that the verification details might differ from one exchange to another depending on internal policy and location.

- On the trading account, you have just created, navigate to the section for buying digital assets and select Verge. If Verge is not on the list, you can select a different cryptocurrency such as Bitcoin. Once the purchase process is over, exchange the cryptocurrency for Verge.

- Select pay with wire transfer and complete the transaction. The transaction will immediately shift to the pending mode until the exchange makes a claim from the bank and the cash shits its bank account. This could take a couple of days.

- Once the purchase process is completed, the tokens are credited to the trading account. You will need to move them to the Verge wallet for extra safety and direct control.

Where to Sell and Trade Verge?

If you have been on the Verge network for some time, the chances are that you have some cryptocurrencies in your wallet. Now, what do you do with the coins? In many cases, people prefer to hold their XVG or other cryptocurrencies waiting for the value to grow. Even as others opt to recover the value by making direct purchases in the stores, the best way to get highest ROI (Return on investment) is selling and trading XVG. Here is an account of where to sell Verge.

One important thing that every Verge trader should know is that the trading platforms are the easiest targets by attackers. This means that you are likely to get hacked when trading Verge at the trading platforms. Most trading platforms are centralized and operate under the local regulations. For example, Bittrex is strictly guided by the local Nevada laws. This makes it operate like a sort of forex trading platform. However, cryptocurrencies trading platforms deal with crypto assets such as Bitcoin and VEN.

Because of the high risks that traders face at the exchange level, the secret to trading safely is ensuring you pick the right platform. Here are some tips to guide you when hunting for a reputable Verge trading platform.

- Highly effective security features: A great trading platform should be highly secure to guarantee the users of utmost safety for their information and assets. Some of the things to check at this point include a secure PIN, 2-factor authentication, and advanced encryption. The trading platform should also have highly effective security features.

- Trading device compatibility: What device will you use to trade Verge? Some people opt to use their desktops while others want to stick to the mobile because they are always on the go. It is, therefore, crucial to select the platform that is compatible with your trading device.

- Intuitive user interface: the ease of use is a very important parameter when picking a cryptocurrency trading platform. You want a platform that is easy to use and that has advanced metrics to make trading direct and profitable.

- Reliable customer support: As a trading platform based on the latest technologies, complex issues that need urgent address can arise. This is why you should only select and use the platform with top notch customer support.

- Good reputation: One thing you should appreciate when looking for a trading platform is that if it is good, other traders will have noticed the positive things about it. Follow the past users' feedbacks and expert reviews to narrow down to the platforms that have a good reputation.

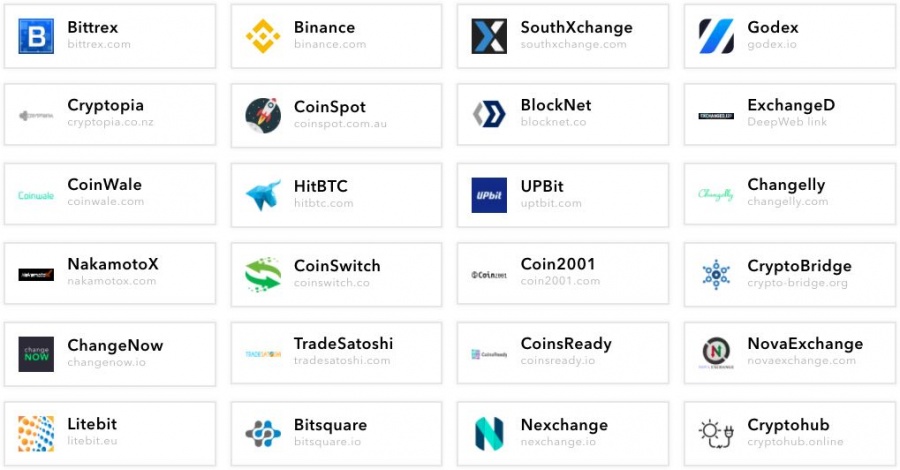

Note that though there are emerging decentralized exchanges that operate pretty like standard blockchain networks, the biggest percentage of crypto markets are still centralized. This implies that you must start by opening trading accounts and verifying them. Here are some of the top platforms to consider for trading Verge include Bittrex, HitBTC, Coinswitch, Trade Satoshi, and Binance.

How Much Are the Transaction Fees of Verge?

Cryptocurrencies have gained huge acceptance in the market today because of one promise; to lower transaction costs. Because they are peer2peer, it means that they have managed to bypass profit-seeking centralized organizations such as banks. While Verge has no doubt managed to achieve this objective, many people still feel that its transaction costs are still high compared to other cryptocurrencies. The cost of making transaction stands at one XVG when using the Electrum wallet. This translates to about $0.009 (based on the XVG value and USD value of March 2018).

As the value of XVG goes up, the cost of transactions is expected to keep growing. For example, if the value of XVG grows and reaches $100, it means that the cost of transactions will also shift with the same margin unless that Verge team reviews it downwards.

Verge Markets

Cryptocurrency markets are the trading platforms that bring together sellers and buyers the same way that forex markets operate. In fact, the crypto markets follow the same local rules that guide forex trading. However, they only trade cryptocurrency tokens. Having been in the market since 2014, Verge can be traded in a lot of markets including the following.

- Binance is among the leading cryptocurrencies in the market today. The market was founded in July of 2017 by a cryptocurrency expert, Changpeng Zhao. Zhao targeted removing the challenges that many cryptocurrency traders faced when trying to trade and send value. Zhao was particularly interested in making transactions faster and lowering cost of transactions.

- To make the two core objectives achievable, Zhao also released a native Binance token called BNB (Binance Coin). The token has been very instrumental in pulling down the cost of transactions. The standard cost of using Binance trading platform is 0.1% of the transaction volume. While this is one of the lowest rates in the industry, Binance provides users with an opportunity to further pull down the cost with about 50%. You only need to pay the transaction fee with BNB or trade Verge for BNB at the exchange to have the 0.1% transaction cut to 0.05%.

- Binance operates as a crypto-to-crypto trading platform. This means that you are only allowed to trade Verge for other cryptocurrencies such as Bitcoin and Ripple. For traders who have cash in their banks or credit cards and want to use the Binance market, it implies that they have to start from a different exchange. For example, you can buy Bitcoins at Changelly and convert them to Verge at Binance.

- Changelly was founded in 2015 by the MinerGate team. The cryptocurrency is preferred by traders because of its advanced trading features. The exchange utilizes special trading bots that link it to other top exchanges like Binance, Poloniex, and Coinbase. This implies that the insights generated at Changelly are more advanced and easily help users to make the right decisions.

- The transaction fee at Changelly is 0.5% of the transaction volume. Though the charges are considered very high when compared to other exchanges such as that of Binance, traders have the opportunity to enjoy lower rates if they trade higher volumes.

- Changelly, unlike most exchanges out there, allows traders to make payments or buy cryptocurrencies using fiat currencies and credit cards. This makes it one of the best starting points especially for new traders or users with cash on their credit cards.

- The main issue with Changelly is that the founder team remains anonymous. Unlike other cryptocurrencies such a Binance and Poloniex that provide their communities with details of the founders, the MinerGate team remains mysterious. This has made some people even think that it is a Ponzi scheme.

- HitBTC

- This is one of the fastest upcoming cryptocurrencies in the industry. A lot of cryptocurrency traders prefer it because of the unique design and ease of use. The cryptocurrency exchange is especially fast in identifying emerging opportunities through ICOs (Initial Coin Offering) and new tokens and listing them for users to take advantage of the emerging opportunities. Note that most cryptocurrencies start at the ICO stage before growing in value and delivering high ROI.

- Another notable benefit of using HitBTC is that it has a very low transaction fee. Like Binance, the transaction charges a very small fee of 0.01% of their trading volume. The cost makes it one of the most affordable platforms in the market. The advanced features especially the application building protocols makes it easy to access even on different devices.

- For new traders, it is the ease of using the dashboard that makes the platform more appealing. Whether you target the top performing cryptos or want to focus on emerging assets, it will only take a short moment to learn and start trading like a pro.

- The biggest issue with using HitBTC is its tainted history emanating from the hacking of 2015. Though the exchange has put a lot of effort in addressing the issues from the hacking of 2015 when hackers stole thousands of clients assets, many are those who do not want anything to do with exchanges that have hacking histories.

Value of Verge

Starting from early December of 2017, the value of Verge has been growing rapidly. Prior to May of 2017, the value averaged $0.000004. The development team has been working extra hard to change this trend and their efforts are now paying. After hitting the record mark of $0.28 in December of 2017, the value took a sharp decline to about $0.05 in early April of 2018. The market capitalization also took a downward shift to about $800 million.

Notably, a lot of people are very optimistic about Verge. The community indicates that after a long period operation starting from 2014, Verge is finally demonstrating its potential and will emerge to be stronger than most cryptocurrencies out there. The price shift will no doubt be worth following in the coming months.

Is It Profitable to Invest in Verge?

Yes, Verge is a highly profitable venture. Many people who are coming to cryptocurrencies are interested in the amount they are going to make a profit for holding tokens. The common trend followed by most cryptocurrencies is starting at a low level when they are issued for the first time and then growing to reach the optimal value.

After Verge entered the market in 2014, its value did not grow at the expected rate. Many people associate this with the name it had by then, DogeDarkCoin. When the development team changed the name to Verge, the value started growing and hit a peak in December of 2017.

The cryptocurrency community appears in agreement that Verge’s potential is very promising. A lot of people are running to Verge anticipating taking advantage of the enhanced anonymity. Here are other indicators that indicate you are likely to enjoy high ROI after joining verge.

- The cryptocurrency has joined the group of the networks considered highly anonymous.

- Its community has been growing progressively.

- The development team appears committed to progressively improve the network.

- It takes close resemblance to Bitcoin both in structures and growth trend.

Remember that profitability of cryptocurrencies is dependent on myriads of factors including the looming regulations. Therefore, it is advisable to diversify by investing a significant amount in Verge and directing the rest of the funds to other assets.

Where to Spend or Use Verge?

The acceptance of a cryptocurrency can be partially evaluated on the basis of the traders who accept its native coins for payment. Many cryptocurrencies have been working hard to get recognized and accepted as a payment network. On this front, Verge has done well by convincing many stores to accept the native XVG for payment. Despite this, it is important that the Verge development team continue growing its partnership with other stores to enhance its acceptability. It is particularly crucial that Verge targets major points of sales such as online stores and banks that have a lot of users. Here is a list of some of the stores where you can spend Verge.

- PexPeppers.

- Increbites.

- WhiskerMen.

- Falmouthy Boat Security.

- Meccamino.

- HeightCare.

- Reno Sports Bar.

- Trebaltek.

- Pornhub.

Can Verge Grow to Become a Major Payment Network?

Every cryptocurrency network out there is working towards getting accepted as a payment network and becoming a major payment network. For Verge, it appears that things are only starting to work in its favour and could rise faster than people expected to become a major payment network. Here are some important indicators showing that Verge could become a major payment network.

- The cryptocurrency is attracting a lot of community around it. As the community continued using the network, it will continue marching to becoming a major network.

- The Verge network and companies that support and accept it for payment keep growing. If the development team continues the same trend, more users will join to enjoy the simplicity and anonymity of making payments.

- The value of the cryptocurrency started growing from early 2018 and is expected to maintain the trend in the coming months and years. This anticipation is expected to continue drawing more users to the network and growing it over time.

- Because the value of Verge is still low, the cost of sending funds or transactions is still very small. This fact has been drawing more people to Verge especially from top networks such as Bitcoin that are very expensive.

How Does Verge Work?

When Bitcoin was created, the main goal was creating a completely decentralized cryptocurrency network. It was very successful. Now, Verge has taken the analogy a step higher by making transactions completely anonymous. Once you join the network, it is possible to make instant transactions that are completely anonymous.

Verge achieves this through the application of a highly advanced blockchain technology implemented on top of services such as 12P and TOR that help to mask personal data such as geo-location and IP-address. In future, Verge is planning to offer smart contracts by applying RSK (rootstock) technology.

The main reason why Verge team overlooked the VPN (Virtual Private Networks) is that VPN encryption is only done from the provider. This implies that VPN demands that you trust the provider will not disclose the information therein. This was too risky, and Verge opted for a method that did not involve third parties.

Verge operates as a completely open source project where the community has full input and inclusion at all levels of decision making. This makes it a form of grassroots project where the core development team is constantly working on improving the network. Like Bitcoin, there was no ICO or pre-mining involved in the Verge network. Verge employs the advanced Wraith Protocol and the following two integrations.

- Tor Integration

- Tor is a name drawn from the original name of the software, Onion Routeris. This is an IP obfuscation service that helps to facilitate private communication in layered circuit networks. It directs internet traffic via a free worldwide volunteer overlay that contains over 7000 relays to conceal user’s usage and location from those trying to survey the network. All the data packets sent through Tor allow users to operate with utmost confidence that their details cannot be accessed by third parties.

- Each of the 7000 relays encrypts only ample data packet wrapper in order to help determine where the data came from as well as the relay to hand over to. Then, that relay rewraps the package into a completely new wrapper and sends it. The final relay decrypts the data so that the correct information reaches the final destination without the risk of third parties knowing the details or who is involved.

- I2P integration

- I2P (Invisible Internet Project) was designed to help provide hidden services that allow people hider their servers in unknown locations. The benefits of I2P are similar to those of the Tor. Both Tor and I2P allow users to employ anonymous address and utilize layered encryption.

- The main difference between Tor and I2P is that the latter is crafted to work in the network and the traffic is contained within specific boundaries. The packet-based routing in I2P provides a unique benefit of permitting the system to dynamically route around congestions and service interruptions. This design means that Verge provides a higher level of reliability compared to other networks.

- The outlined two integration help users to operate based on a peer2peer network without involving third-party providers. This ensures assures users of faster, cheaper and highly reliable services. Other features of the Verge cryptocurrency include;

- Stealth addresses that allow users to create unlimited addresses when sending value.

- Atomic swaps that allow for interoperability between Verge and other blockchain networks that have Atomic Swap capabilities. This feature utilizes BIP65 Check Lock Time Verify (CLTV) that employs hash-locks and time locks through advanced cryptographic proof of payment.

Does Verge Use Blockchain Technology?

Verge like other blockchain networks is based on a peer2peer operational model that allows sending of value without relying on third parties such as banks. All that is required is for the sender and receiver to be on the Verge network. The Verge network employs the Wraith Protocol that allows the network to maintain two ledgers on the same blockchains; public ledger and private ledger.

The Wraith Protocol allows users to select whether they want to operate anonymously and maintain the details of such transactions in the public ledger or vanish the details by opting for the private ledger. The protocol combines Stealth addressing and SSL+Tor integration that takes the core QT users off the clearnet and immediately migrate them to TOR network.

When a user initiates a transaction, it is taken by the miners spread in the network who confirm and add new blocks in the Verge blockchain. Note that miners have the option of selecting the mining they prefer by selecting from the hashing functions. This means that more people with different devices and preferences can now use and mine the network.

Mining Verge

Mining in cryptocurrencies is the process of confirming transactions for a reward. The Verge uses Proof-of-Work consensus model which means that users confirm transactions based on the work they do. The Verge network is designed to operate on five different mining algorithms which make it possible for people with varying devices capable of mining and earning from the Verge system. The impact is more people joining the Verge network to mine the network and even distribution of the coins.

The Verge cryptocurrency has a total supply of 16.5 billion coins. The first nine billion tokens were mined the first year while the remaining will be mined at a rate of 1 billion every year. The five PoW (Proof-of-Work) algorithms used in Verge include Scrypt, X17, Lyra2rev2, myr-groestl, and blake2s. Note that all of them have a target of 30 seconds blocktime. Besides, the cryptocurrency mining difficulty is influenced by respective algorithm's hash rate.

To mine the Verge network, you need to acquire the right hardware. You can go for the GPU (Graphics Processing Unit) or ASIC (Application-Specific Integrated Circuit) depending on the PoW algorithm that will be used. Then, you will require downloading the Verge client (go for the Electrum wallet). Once you have the right infrastructure, install appropriate mining software such as CCMine.

To mine more from the Verge network, it is advisable to consider joining a mining pool. These established groups that consolidate the hashing power of your system to raise hashing power (mining power) and increase the chances of getting more tokens. Note that all the tokens are shared between the participating members of the respective pool.

NOTE: Select the mining pools with care to avoid falling into Ponzi schemes. You should comprehensively review the pool to confirm it is legit and determine that the XVG will flow to your wallet immediately and the tokens land into the pool’s account.

What Are the Advantages of Verge?

When people think of cryptocurrencies, what comes into their minds is Bitcoin. Between 2016 and start of 2018, Bitcoin grew tremendously and hit levels that people could not have thought about. But the value took a downward trend that characterized many cryptocurrencies in the first quarter of 2018. Newer cryptocurrencies such as Verge have demonstrated the capacity to grow and bring huge benefits to users. Here are the main benefits to anticipate after joining the verge network.

- It a completely anonymous network

- Verge is a network that is built on the premise of enhancing anonymity. Its structures and designed to help users operate in complete anonymity. Unlike banks that easily make your details accessible to cashiers, bank managers, and financial authorities, Verge allows users to stay completely anonymous.

- Verge provides users with the best opportunity to use and own the platform

- If you use a financial service such as PayPal, there is a great sense of passiveness. Many people feel that they are there to simply follow the rules when sending payments. However, Verge allows users to also own the network. This means that you are not simply using the network to send value. Rather, you become part of the Verge network that will help in making important decisions. You will be called to vote on different issues taking place in the network.

- It is a great option to invest and save without worrying of third-party seizures

- If make a cash deposit into a bank account, it is important to appreciate that the funds can be frozen with a strike of a pen. If a lawsuit hauls its way to your doorsteps, it only requires the attorney to request the judge to freeze the account. Indeed, if your account has a lot of cash, you become an easy target.

- However, putting your investment in Verge is the surest way to hide savings from third parties. Unlike using a bank, the blockchain network is anonymous and no one will ever know that you have an account, its content, or freeze it. It is the surest way to operate in absolute freedom.

- Verge provide users with a cheap, fast and efficient option to send value across the networks

- The primary objective of Verge was to advance the core principles of the Bitcoin network. When Bitcoin was started in 2009, Satoshi Nakamoto intended to provide a cheaper and highly reliable method of sending value. Now, Verge is taking these ideas to the next level. As a blockchain cryptocurrency operating on a peer2peer basis, it means that you can send value directly to the recipient without using third-party services such as banks. This means that transactions are fast and cheaper. Note that it does not matter where you are. All that is needed is both the recipient and sender to be on the same network.

- It is one of the fastest growing networks

- When DogeCoinDark changed to Verge, it appears that the shift was ample to mobilize a large community. Since 2016, the community and value of the cryptocurrency have been growing rapidly. Some people have even been indicating that it could end up being as successful as Bitcoin in the long run.

What Are the Risks of Verge?

Though the main attraction to cryptocurrencies is the benefits, it is important to also appreciate that the risks are equally many. Most people only want to hear about the Verge upward growth but end up making the wrong decisions for not factoring the involved risks. Here are the key risks you should know about when working in the Verge network.

- The looming regulations

- When cryptocurrencies entered the globe in 2009, they were viewed with a lot of suspicion. Many governments hold the view that the cryptocurrencies are out to wrestle their mandate from them. Because of this viewpoint, most of the states have threatened to pass very harsh laws that will halt the cryptocurrencies such as Verge on their tracks. If the laws are finally passed, Verge and other cryptocurrencies are at great risk of shrinking and losing their appeal.

- The cryptocurrency is completely anonymous

- Though being anonymous is considered a major advantage in cryptocurrency networks, it also opens it to serious risks. Because users are allowed to operate anonymously, users are at risks of getting involved with criminals without knowing. For example, a trader who sells products online and insists on getting paid with XVG can turn out to be a scammer who sends the wrong products. This implies that you will have lost funds and promoted illegal trade.

- The risk of sending XVG to the wrong address

- Like other cryptocurrencies, all transactions on Verge network are added to the public ledger after getting verified by miners spread in the system. However, unlike banks that follow both the sender and recipient, cryptocurrency networks are different. All you need is having ample XVG and adding an existing public address to send the coins. Because the public address is a lengthy code that is very difficult to remember, the danger of sending the tokens to the wrong address is very high. Remember that once such transactions are completed, they cannot be reversed.

- The danger of getting hacked

- When you join the cryptocurrency community, you need to be oblivious to the danger of attacks. Because of the fast growth experienced by top cryptocurrencies such as Bitcoin and Ethereum, hackers have found tokens to be easy cash cows. It is because of this that hacking reports have become very common in the recent past. You can be hacked at the native network level or the exchange levels. It is, therefore, very important to be extra careful with your Verge by storing the coins in cold storage and choosing the trading platforms with a lot of care.

- Threat of new and more attractive cryptocurrencies

- Today, new cryptocurrencies are hitting the market at a very high rate. No month ends without a new cryptocurrency joining the already growing list. With the new cryptocurrencies building on the successes of the previous models, there is a high risk of the existing networks such as Verge being rendered less attractive.

- Most of the cryptocurrency developers are not known

- In line with the spirit of maintaining utmost anonymity, Verge has opted to keep some of the founders anonymous. This has only served to raise suspicion that the entire network could actually be a Ponzi scheme.

What Happens if Verge Gets Lost?

One of the primary dangers of joining cryptocurrency networks is the risk of loss. Every other day, you will hear a member of the cryptocurrency community shout that he/she lost tokens through sending to the wrong address or hacking. The riskiest point where you are likely to lose Verge is the cryptocurrency markets. Because they operate as centralized institutions where buyers and sellers meet, hackers have found them perfect points to ambush and siphon XVG from unsuspecting owners.

One of the latest reports of successful hacking was Coincheck. This is a Tokyo based exchange that was hacked on 28th January 2018 and 58 billion Yen ($534 million) siphoned away. About one month earlier, another cryptocurrency exchange in South Korea referred as Youbit was hacked and forced to file for bankruptcy. One question that still lingers in people’s minds is; what happens when cryptocurrency such as Verge gets lost.

The answer to the question depends on the channel of loss. If the XVG were lost through hacking or sending to the wrong address, it means that they have changed hands. The coins are still on the desk but under a different identity. The bitter thing about it is that you cannot recover them.

If you lost Verge through forgetting the private keys or damage to the wallet, the tokens are still in the network but in a dormant state. This implies that they have not been lost, but are simply dormant awaiting you to get the right keys. If you fail to get the keys and the wallet, the tokens will forever remain dormant.

Verge Regulation

When blockchain technology entered into the globe, most governments were not happy. They felt that the cryptographic solutions were out to cause an unnecessary distraction to smooth running of their operations. Most of them wanted to block the cryptocurrency technologies directly but lacked a clear framework to do the same.

The United States was the first to note the entry of blockchain technologies and the dangers that cryptocurrencies posed. The Federal Bureau of Investigation (FBI), in one of the communique to the government, pointed that the new cryptocurrencies’ anonymity and peer2peer nature directly removed the ability of the government to control the flow of value. The FBI also noted that criminals and even terrorists could exploit such anonymity. Despite this early sense of threat, the United States had not installed a legal framework to control cryptocurrencies such as Verge by first quarter of 2018.

In a different scenario, China saw Verge and other cryptocurrencies as direct stumbling blocks to its ability to collect taxes. Besides, the new line of investment create by cryptocurrencies also compromised the country’s effort to cut on capital outflows. Therefore, China opted for direct banning of cryptocurrency related activities such as ICOs and crypto exchanges.

From Russia to Argentina, it is true that no administration feels comfortable about the fast burgeoning cryptocurrencies. However, a lot of people have been asking the question; why? Even after all the threats that the governments list, why are they not passing legal frameworks to ensure that cryptocurrencies are developed and run in line with the law? Here are some answers to the question.

- The cryptocurrencies have demonstrated the potential to address some of the problems that have dogged the governments and communities for many years. A good example is Big Data.

- Cryptocurrencies do not belong to one single entity. This means that, unlike banks that are owned by a known party, there is no one to target with the crypto laws.

- The blockchain technology is moulting at a very fast rate. Even if you regulate one cryptocurrency, the chances are that another type will sprout.

- Operations and applications of cryptocurrencies are run from different countries. This means that even regulating the cryptocurrencies in one country might have very small or no impact on the cryptocurrency’s growth at the global level.

- The cryptocurrency debate is fast taking a political angle where governments that aim at opposing the blockchain technology are being labelled anti-development, backward, and not worth being on the throne.

While the cryptocurrency laws might have taken long to arrive, one thing that every person intending to join the verge network should know is that they are coming. Many countries feel very aggrieved and are willing to go to extremes to have the registrations passed into law. Have a look at individual states in the next section.

Is Verge Legal?

Many countries are yet to pass comprehensive legal frameworks to guide cryptocurrencies. The focus of most of them is to try and understand how the blockchain technologies work and the best approach to tame them. In many cases, the countries are waiting to see how the big players such as the US, the EU, Russia and China go about the regulations before taking a specific stand. Here is a closer look at individual jurisdictions to demystify the Verge legal status in them.

- The United States

- The United States is one jurisdiction that was first to note the dangers that were posed by cryptocurrencies such as Verge. However, it has been slow to pass a clear legal framework because it will be the first beneficiary of faster crypto industry growth. Even if the federal administration was concerned about the emerging and fast growth of cryptos, it only provided a caution for users to be extra careful because of high volatility. It also clarified that Verge and other cryptocurrencies should be considered as commodities. This clarification was made to help traders pay taxes.

- It appears that the United States appreciated that the only way a cryptocurrency legal framework would work was through a global approach. Early in 2018, The US Treasury Deputy Director, Sigal Mandelker, visited China, Japan, and South Korea in order to try and find a common front in taming cryptocurrencies. Because there is no common law for application at the federal level, some states have moved on to craft local laws to guide crypto operations.

- In Arizona, the Arizona State has drafted a bill that targets to allow residents pay their taxes in cryptocurrencies such as Verge and Bitcoin. If the bill goes through, it will be interesting to see whether the State of Arizona will join different crypto networks as a corporate node and the methods of withdrawal that will be accepted. It will also be a major score for cryptocurrencies because other states are likely to follow the same path.

- China

- Verge is legal in China. The country, like the United States, does not have a clear legal framework for regulating the cryptocurrencies. Instead of exploring the legal avenue to control the growth of cryptocurrencies, China has opted for a more radical approach.

- In 2017, the country started by banning ICOs (initial coin offering). Then, it froze the accounts of exchanges that were facilitating trading locally and banned mining. Those who still felt they wanted to get involved in cryptocurrencies were left with one option; using exchanges that were located outside the country. Some local exchanges also opted to only deal with clients from other nations and not Chinese.

- China is now opening a new battlefront with cryptocurrencies. Starting from the end of February 2018, the country is now working on blocking international crypto exchanges from accessing local markets. The government is reviewing the accounts of banks that are facilitating payments to these foreign accounts and threatening to freeze accounts of the owners.

- Russia

- Russia is one jurisdiction that has decided to forge forward with passing a cryptocurrency related framework. Before 2018, the country had indicated that cryptocurrencies such as Verge could be used but they were not legal tenders. Early in 2018, the finance ministry took a different view and warned users to be cautious with cryptocurrencies. The government was quick to warn that traders who accepted payments in cryptocurrencies such as Verge risked being found guilty of various offenses.

- In January of 2018, the central bank indicated that it was impossible to tell whether using cryptocurrencies was legal or not. The legal gap made the ministry to promptly start working on a legal framework to guide cryptocurrencies use in the country.

- The ministry worked extra hard and released the Digital Finance Assets Draft bill. The bill seeks to provide a definition of cryptocurrencies and outlines the legal framework for mining and trading in the exchanges. Even before the draft is discussed in parliament, it has already attracted a lot of criticism. The cryptocurrency community in Russia feels that the law will stifle gains achieved in the fintech. The opposition in the country also feels that the country could have taken a softer approach such as the one taken by Japan.

- The European Union

- The EU is one jurisdiction whose members are yet to agree on a specific route to take when it comes to regulations. Indeed, the different arms of the giant block appeared to have been pulling in different directions until January of 2018. The EU Central Bank asked the citizens to be cautious and where possible avoid cryptocurrencies such as Verge and Ethereum because they were bubbles waiting to burst anytime. On the other hand, the EU Parliament appeared to appreciate that blockchain technology was the apex of the fintech industry. Therefore, it indicated that there was the need to understand the technology and pass a regulation that can help the benefits to trickle to all members.

- Starting from the first quarter of 2018, top leaders in the EU have come out to indicate the importance of a legal framework to reduce the danger of cryptocurrencies being used for fraud and tax avoidance. Mr. Valdis Donbrovskis, the EU Commission vice president, explained that there are huge risks associated with price volatility, the danger of investment loss, threats related to security failures and liability gaps. All of these require urgent and a clear legal framework to guide cryptocurrencies at all levels of their applications.

- Another top executive in the EU, the French Minister of Economy, pointed that a legal framework was long overdue. He created a working group to explore the cryptocurrencies at different levels and come-up with recommendations that can be used to guide a clear legal framework.

- Switzerland

- Switzerland is one jurisdiction that stood out for taking actions that appears to go against the grain. The country’s administration always looks at what is the best and takes every effort to support it. On the cryptocurrency issue, Switzerland has decided to go against the trend taken by its neighbours especially the EU. Instead of voicing its hate or even warning of the threats other countries consider imminent, Switzerland is reading from a different script. It is calling for support of cryptocurrencies.

- The economics minister, Johann Schneider-Ammann, indicated that the country would stop at nothing in ensuring that the country becomes a crypto nation. Mr. Johann explained that they would start by passing a legal framework that will support and guide ICOs use in the country. This means that even ICOs are banned in countries such as China; they have a place to take refuge such as Switzerland.

- In January, the minister established an ICO working group that targets to enhance legal certainty of every ICO coming to Switzerland. This effort has made the country to become a major attraction to top cryptocurrencies especially those that are run via foundations.

Verge and Taxes

The topic of cryptocurrencies and taxes is as complex as that of the regulation. Many people look at cryptocurrencies as the ultimate avenues that can help them live tax-free lifestyles. Verge has been attracting a lot of interest especially from people who find that tax havens are no longer suitable for them. Starting from 2014 when Common Reporting Standard framework was passed by OECD members, it has become increasingly difficult to stash cash in tax havens. The next best alternative is being considered as anonymous cryptocurrencies such as Verge.

When DogeCoinDark was changed to Verge, the development team enhanced its anonymity to ensure that it took to the primary objectives espoused by Bitcoin founder. While it is true that the anonymity in Verge can help to cover you from exposure to third parties including tax authorities, this protection cannot last forever. Tax experts argue that though you can hide from the tax authorities today, it is only a matter of time before more advanced technologies that can help to unmask you are discovered.

When Bitcoin was discovered in 2009, it was thought to be completely anonymous. However, more advanced technologies discovered years after Satoshi Nakamoto launched Bitcoin gave way to unmasking of users in the network. The same trend is expected to continue, and people who have been avoiding paying taxes are likely to get exposed and sued.

Many countries have indicated that the main reason for their efforts to pass crypto related regulations is stamping out tax avoidance. In Israel, the government has indicated that every form of income must be taxed. People trading in cryptocurrencies such as Verge and Ripple but fail to pay taxes are considered be already guilty of offenses in Israel. The same focus is evident in other countries including Japan, China, the UK, and Russia among others.

However, tax experts have pointed that you can still enjoy all the benefits that come from cryptocurrencies such as Verge and remain tax compliant. Here are some tips you can apply.

- Consider revenue from trading Verge as taxable income.

- Make sure to capture loss or profits from trading Verge when filing tax returns.

- Capture important details about the trading transactions such as XVG value and corresponding figures in fiat.

- Consider working with a tax expert.

Does Verge Have a Consumer Protection?

Verge does not have consumer protection. It operates as a decentralized and open source cryptocurrency that is fully owned by the community. This implies that all decisions on the network are made through consensus as opposed to a company, foundation or a centralized organization the way it happens in other networks such as Ethereum. If you have a complaint or have sent funds to the wrong address, it is too bad because there will be nowhere to launch complain. Remember that cryptocurrency networks are not legalized. Therefore, you cannot seek redress in a court of law.

Because Verge does not have consumer protection, you are on your own. You have to take every step to keep your tokens under the network safely. Here are some useful tips to guide you operate safely on the Verge network.

- Never share the private keys with third parties.

- Always backup the Verge wallet and secure the private keys and seed phrase away from the main computer.

- Keep the main computer used for Verge related transactions as secure as possible. This means keeping its operating system updated and system secured with an appropriate antivirus.

- Pick cryptocurrency exchanges for trading Verge with a lot of care. Consider using those with unique structures for securing clients assets.

- Make sure to move all the Verge coins to cold storage when they are not being transacted.

Illegal Activities with Verge

Anonymous cryptocurrencies such as Verge are considered great platforms for illegal activities. Because criminals can easily hide on the networks, they prefer them to run illegal activities and defraud unsuspecting clients. However, no illegal activity has been reported with Verge. To avoid falling into the hands of scammers and illegal traders, here are three things you can do.

- Always vet the traders you are buying products from and ensure they are genuine. Saying that they allow payment using Verge does not block you from reviewing their operational model and reviews over time.

- Before participating in new sales especially through ICOs, it is important to carefully assess the premises they are based on. If you are unsure, consider following experts advice and being part of communities such as Bitcointalk.

- Always follow your instincts when making cryptocurrency related purchases. Besides, avoid investing all your funds into one project. Consider spreading them to other cryptos and even conventional hard assets.

Is Verge Secure?

When reports of security lapses are reported in the cryptocurrency industry, many people start wondering how secure their networks are. Is Verge cryptocurrency network secure? Starting from 2016, the Verge development team has progressively worked to enhance the cryptocurrency security to prevent the dangers of attacks. Though there was a successful hacking at the start of April 2018, Verge is still one of the most secure networks out there. Here are three methods used to secure the network.

- Advanced cryptography.

- Enhanced anonymity through Tor integration, I2P integration, and Stealth addressing.

- A highly responsive development team that progressively reviews the network, anticipates security gaps and fixes any issue identified in the network.

- It employs multi-algorithms that help to achieve even distribution of miners and reduce the risk of 51+ related attacks.

Is Verge Anonymous?

Yes, Verge is one of the anonymous cryptocurrencies out there. It employs advanced technologies that help to block user’s addresses and location. The Tor integration employs over 7000 data relays that help to conceal usage as well as location. Using the relays, the data movement is broken down into stages where each relay encrypts the clients’ details so that no surveillance entity can follow the details.

Verge also uses I2P integration that makes it easy for the network to hide the location of the users. It is the same technology that companies use to hide their servers for security reasons. Besides, the I2P integration allows users to create multiple addresses when sending value so that no one can try triangulating the sender’s location. Other technologies used to enhance anonymity include the Stealth addressing and the wraith protocol.

Has Verge Ever Been Hacked?

Yes, Verge was hacked on 5th of April 2018 and about 15,000 coins siphoned away before the development team fixed the problem. The attack was first discovered by an ocminer, one of the top posters on Bitcointalk forum. The attacker employed a number of bugs that helped to mine an extraordinary large number of new blocks. In return, the attacker managed to get a reward of very many coins.

The attack is referred as 51% attack and has sent shockwaves to other cryptocurrencies operating on the PoW algorithms. Bitcoin and Ethereum developers are reported to have gone on high alert after the report of Verge attack on 5th April of 2018 hit the news.

How Can I Restore Verge?

Have you ever lost cryptocurrency tokens? It can be very painful especially if you had invested so much in them or had taken a lot of time mining. However, this is the reality that is happening every other day. However, all might not be lost because some types of loss can be reversed. Here are the main methods you can use to restore lost XVG.

- If you lost XVG through damage to the cryptocurrency wallet, you could easily restore them by reinstalling the wallet. You can also install a different but compatible cryptocurrency wallet and use the private keys seed phrase to reconcile it with the main network.

- For those who have lost their XVG because they forgot their private keys, the restoration is done using the seed phrase. When you first used the Verge wallet, it generated the private keys seed phrase. This is the code that you MUST use to regenerate the private keys.

- If you have lost the private keys through hacking or sending to the wrong address, there is no method that can be used to restore them. They are lost forever, and you can only work hard to get more.

What these restoration efforts imply is that the success in restoring Verge is dependent on how prepared you were before the loss occurred. Note that you should not conclude that a loss cannot occur because only you have access to the main computer or the Verge private keys. Rather, you should take every precaution to ensure that the private keys, the seed phrase, and the wallet are carefully backed up away from the main computer.

Why Do People Trust Verge?

Starting from 2009, the race to become the best cryptocurrency was started. By early 2018, more than 1500 cryptocurrencies had entered the market. However, the competition is shifting from simply being another cryptocurrency to a battle for trust. Verge has been fighting tirelessly to win the people's hearts, and its efforts are now bearing results. Here are some indicators on why a lot of people have trust in Verge.

- The cryptocurrency features an improvement over the previous model used in DogeDarkCoin. The new network integrated the Wraith Protocol technology that allows users to easily switch between the public and private ledgers on the same blockchain.

- The Verge provides users with a lot of flexibility through different versions of the Proof-of-Work algorithm. These algorithms make it easy for many groups of users depending on their expectations. For example, if one mining algorithm is requiring more mining resources, it is easy to switch to a different algorithm.

- The cryptocurrency value has been growing steadily especially starting from the last quarter of 2017. In December of 2017, the value of Verge grew and hit an all-time high of $0.28. With the community expecting the same growth to be maintained in the coming days, things can only get better.

- The transaction cost on the network is very low. Most people coming to verge from other networks are interested in taking advantage of the low transaction costs of sending value.

- The transactions at Verge are Ultra-fast transactions. The transactions at the Verge network employ Simple Payment Verification that makes it possible to complete transactions in about five seconds.

- Though the value of the cryptocurrency is relatively low compared to others in the industry today, the Verge community argues that it has been on the market long enough and its structures can be trusted.

- The Verge development team is very responsive to address issues affecting the network. For example, it responded swiftly after hackers broke into the network on April 5th of 2018 and corrected the problem.

- The Verge development team is working on enabling the platform to support smart contracts. This means that the network is likely o become a major rival to Ethereum and others implementing similar technologies today.

History of Verge

The history of Verge can be traced back to 2016. Prior to 2016, Verge operated as DogeDarkCoin. The main reason for shifting from Dark Coin was to shed away the dark tag and take a more adaptive tag.

Even after the shift, the cryptocurrency trading remained around $0.000078 until May of 2016 when it grew rapidly to $0.000424 and grew further to reach $0.005919 by June of the same year. In December of 2017, the cryptocurrency value shot up to $0.28. This was the highest point that Verge reached.

On April 17th, 2018, Verge partnered with the Pornhub. Though the announcement was waited with a lot of expectations, the cryptocurrency community viewed it as a failed deal arguing that Sunerok had failed to strike a serious partnership with a more influential partner. Earlier on, in March 22nd of 2018, Verge had raised 75,000 XVG to facilitate the partnership.

On April 5th, Verge suffered a hacking attack (51% attack) and lost over 15,000 coins siphoned away. The attack saw the value of the Verge shift downward by over 20%.

Who Created Verge?

The original project was started by over 200 passionate community members who wanted to see the cryptocurrency grow over time. The Verge currency has evolved over time to facilitate faster growth and success. Some of the key members include.

- Sunerok (Justin Vendetta).

- CryptoRekt@cryptorekt.

- Sasha.

- Kieran Daniels.

- Cees Van Dam.

- Cyano.

- Spookykid.

- Emanuel.

Verge Videos and Tutorials

Welcome to Verge Currency

See Also

- Bitcoin | Ethereum | Ripple | Bitcoin Cash | Litecoin

- Cardano | NEO | Stellar | EOS | NEM | VeChain Thor

- Monero | Dash | IOTA | TRON | Tether | OmiseGO

- Bitcoin Gold | Ethereum Classic | Nano | Lisk | ICON

- Qtum | Zcash | Populous | Steem | Ontology | Waves

- DigixDAO | Bytecoin | Bitcoin Diamond | Binance Coin

- Bytom | Verge | Crypto Humor

- Cryptocurrency Dictionary | List of Cryptocurrencies | CEX.io

- Binance | Coinbase | Changelly | Coinmama | Bitpanda

- LocalBitcoins | Kraken | Paxful | Ledger Nano S | TREZOR