Basic Attention Token

Basic Attention Token cryptocurrency guide advises where to buy and how to buy Basic Attention Token. This guide also contains the markets, value, trading, investing, buying, selling, transactions, blockchain, mining, technology, advantages, risks, history, legislation, regulation, security, payment, networks and many other interesting facts about Basic Attention Token as well its status in the world of cryptocurrencies.

Basic Attention Token, Thursday, 2025-06-12

Contents

- 1 What Is Basic Attention Token?

- 2 Beginner's Guide to Basic Attention Token

- 3 Where and How to Buy Basic Attention Token?

- 3.1 Basic Attention Token Wallet

- 3.2 Where to Buy Basic Attention Token with Credit Card?

- 3.3 Where to Buy Basic Attention Token with PayPal?

- 3.4 How to Buy Basic Attention Token with Wire Transfer?

- 3.5 Where to Sell and Trade Basic Attention Token?

- 3.6 How Much Are the Transaction Fees of Basic Attention Token?

- 4 Basic Attention Token Markets

- 5 Where to Spend or Use Basic Attention Token?

- 6 How Does Basic Attention Token Work?

- 7 Basic Attention Token Regulation

- 8 Is Basic Attention Token Secure?

- 9 History of Basic Attention Token

- 10 Basic Attention Token Videos and Tutorials

- 11 See Also

What Is Basic Attention Token?

Basic Attention Token (abbrev BAT) is a blockchain based token designed for digital advertising and based on the Etherleum blockchain. It was designed by Brendan Eich. Note that this is the same person who designed JavaScript and was a co-founder of Mozilla. Eich and his development team realized that the digital advertising norms are at a critical stage and will soon shift to meet the market demands.

The team also wanted to address the current challenges faced by publishers and advertisers such as getting tracked, difficulties monetizing content, and becoming victims of fraud. Eich was also concerned that digital advertising has become so much monopolized by top players such as Google and Facebook. This reality has made it almost impossible for other players to enter and compete. By the close of 2017, over 70% of the online digital advertising went to Google and Facebook.

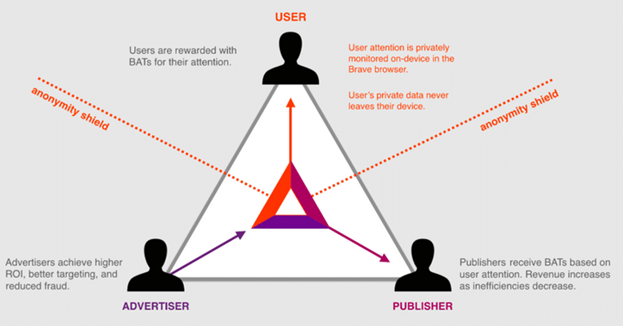

BAT is targeting to cut down all the middlemen by linking the advert watchers with the publishers. The tokens are designed to make it easy to exchange between publishers, users, and advertisers. When you get BAT, they can be used to get a wide range of advertising as well as attention based services on the Brave Browser.

The advertiser pays for an advert while the viewer is paid for viewing in BAT. The peer2peer model is likely to disrupt the current setting of the advertising industry in a great way. It is this anticipation that has seen the value of BAT keep growing steadily since inception.

Beginner's Guide to Basic Attention Token

Have you been looking forward to joining the cryptocurrency industry? One of the top option in the market is the Basic Attention Token. This is a project designed to help redefine the digital advertising space. It targets to create a direct link between advertisers, viewers, and publishers. The project has attracted a lot of interest from both individuals and great multinationals. This is an indication of its huge potential. To make a decision on whether to join BAT, it is advisable to make a comprehensive review of the the network.

This post is a comprehensive guide to assist you digging deeper into the BAT system. It seeks to answer every question you might have on BAT. It explores what is BAT, where to buy, BAT value, and risks of joining the network. It digs into the network further to establish how BAT works, consumer protection, and history among others. Welcome to discover these and more about BAT.

Where and How to Buy Basic Attention Token?

Basic Attention Token is one cryptocurrency that has taken the crypto community by storm. When it was released through its ICO in May 2017, the tokens were depleted in the shelves in seconds raising more than $30 million. Though the token price has not gained much, the community is upbeat that the token will become the next Bitcoin. Now, if you want to buy BAT, here are the two main methods to use.

- Buy from the exchanges: The exchanges are the primary markets for cryptocurrencies. They bring the buyers and sellers together so that the price is driven by the market forces of demand and supply. Some of the top exchanges that list Basic Attention Token include UPBit, Binance, and Bitfinex.

- Buy from those who already have BAT: Buying BAT or other tokens from the exchanges requires one to open a trading account. This process is considered herculean because users have to provide a lot of information that can be used to identify them. The next alternative that you can go for is purchasing from those who already have the coins. You can reach them through cryptocurrency clubs that bring together people with interest in cryptocurrencies. A great example is the Cryptocurrency Club of London.

Note that though buying direct appears easy and direct, getting a person who wants to sell the tokens you want to buy can take long. Besides, you should also be extra cautious to avoid getting scammed because the clubs are independent.

Basic Attention Token Wallet

Basic Attention Wallets wallet is a digital location designed to help hold your tokens. The wallet is also used to help you make payments. Here, it is important to appreciate that the wallets do not in reality store BAT tokens. What they hold is a set of codes that help to link and control your tokens on the Basic Attention Token network.

- Private keys: This is a special code used to call your BAT to live when making transactions. The keys, like the name suggests, are private and should never be shared.

- Public keys: While the private keys point at your tokens in the Basic Attention Tokens, the public keys help to point at the wallet. The code should be given to those who want to pay you in BAT.

- The seed phrase: This is the last code stored in the wallet. Unlike the private and public keys that are used regularly, the seed phrase is only needed when the private keys get lost. Therefore, it is very important to store the private keys and seed phrase carefully and preferably away from the main computer.

Because Basic Attention Tokens are ERC20 compliant, they can be kept in most ERC20 compliance wallets. The wallets include Ledger Nano S, Jaxx, MyEtherWallet, and Exodus.

Where to Buy Basic Attention Token with Credit Card?

Credit cards are perhaps the most used method of payment across the globe today. You can easily swipe them in most points of payment or even use them online. Now, they have also become the preferred method of buying cryptocurrencies. You can buy BAT with credit cards at UPbit or Bancor. For other exchanges such as Binance and Bittrex, those with credit cards have to start from other platforms that accept cards such as Changelly.

Where to Buy Basic Attention Token with PayPal?

There is no exchange that allows people to buy BAT with PayPal. Indeed, PayPal used to look at cryptocurrency exchanges as direct competitors and, therefore, blocked payment associated with them. Though they have indicated that the policy is under review, it is not until such changes are implemented that such payments will be possible. Therefore, if you have funds in a PayPal, the best method of buying BAT is withdrawing to a bank account or credit cards.

How to Buy Basic Attention Token with Wire Transfer?

The banks are perhaps the most trusted organizations in the globe today. People trust them because they are professional and always insist on following the laid down procedures. For example, a lot of people trust them to process their salaries, give investment advice, and even act as a trust for their properties. Now, banks have become the main points of payment for those who want to buy cryptocurrencies such as BAT.

If you are in South Korea, the process of buying BAT can be completed directly through a bank transfer using UPbit. However, other exchanges such as Binance and Bitfinex will require a longer process. Here are the main details of buying BAT from crypto-to-crypto only exchange such as Binance.

- Start by acquiring an appropriate cryptocurrency wallet. As an ERC20 token, you can select Legder Nano S or MyEtherWallet.

- Visit a platform such as CEX.io and buy an alternative cryptocurrency such as Bitcoin. These are the coins that will be used to pay for BAT at Binance.

- Visit the preferred cryptocurrency exchange such as Binance or Bittrex and create a trading account. Then, verify the trading account using personal information such as phone number and proof of location. Note that the verification information varies depending on the selected exchange.

- On the selected exchange, navigate to the section for trading crypto assets and select BAT. Then, tick pay with Bitcoin (or the cryptocurrency you bought on the second step).

- Finally, move the Basic Attention Tokens form the exchange’s account to the wallet. This is because your wallet is safer compared to the exchanges.

Where to Sell and Trade Basic Attention Token?

If you have some BAT, one question that might be running through the mind is how to optimize profits. There are two ways you can get more from BAT; holding and trading. Though holding is a great way to invest, many people recommend trading in the exchanges.

The exchanges are the primary platforms that bring together buyers and sellers in the same way forex markets operate. Some of these exchanges include UPbit, Huobi, Liqui, and Mercatox. To select the preferred trading and selling platform, it is important to appreciate that they are the soft underbellies of the blockchain niche. This means that you are at a risk of getting attacked by hackers and losing the BAT than at any other point in blockchain system. Think of any major hacking in the past and the chances are that it took place in an exchange. For example, YouBit was hacked in December 2017 while Coincheck was attacked in January 2018 resulting in losses of millions of dollars in cryptocurrencies.

How Much Are the Transaction Fees of Basic Attention Token?

When cryptocurrencies entered the market, the primary goal was to help users operate on a peer2peer basis. They were also targeted at helping to pull the cost of transactions as low as possible. Basic Attention Token has not disappointed on this. Note that because they are based on Ethereum blockchain, you will need to pay Gas. The average transaction fee of Basis Attention Token is $ 0.00062.

Basic Attention Token Markets

Since 2009 when Satoshi Nakamoto launched Bitcoin, the cryptocurrency market has been on a race. By mid-2018, more than 1600 cryptocurrencies had been introduced into the industry. To keep up with the fast-growing demand for cryptocurrencies, the markets have also been growing at the same rate. Here is a closer look at the main Basic Attention Token markets.

1) Binance

Binance is one of the youngest cryptocurrency markets in the industry today. The market is based in China and was created by Changpeng Zhao who got concerned that trading was getting overly complex and expensive. He assembled a team that crafted a raft of measures to help lower cost of transactions and making trading fun.

To achieve his objective, Zhao introduced a native token referred to as BNB on the exchange. BNB is used to help pull down the transaction costs. If you pay transaction charges at the exchange with BNB, it is pulled down by 50%. This means that the standard fee of 0.1% will be cut to 0.05%; the lowest in the industry.

Binance has stood out in the industry for listing very many assets. The exchange has maintained its focus on ensuring that traders have many profitable options to pair with BAT. Whether you prefer to trade BAT for the older cryptocurrencies such as Bitcoin and Ethereum or newer ones such as KuCoin Shares or Loopring, Binance is a great place for you.

The main shortcoming of Binance is that it is a cryptocurrency only market. This means that those who have cash or credit cards cannot deposit directly or withdraw from Binance. To buy or withdraw BAT in cash, you will be required to use another platform such as CEX.io.

2) Bittrex

This is a US based cryptocurrency market that was started in 2014. Since then, it has grown steadily to become one of the leading markets and a preference for many because of its special focus on customer security. The market was founded by Bill Shihara and a team of cryptocurrency trading enthusiasts including Rami Kwach and Ryan Hentz.

The main strength of Bittrex is its commitment to help users trade securely all the time. Before listing cryptocurrencies, Bittrex vets them comprehensively to ensure that pump-and-dump tokens that pose huge risks to users are not listed. For example, forked tokens such Bitcoin Gold and Bitcoin Diamond were denied entry into Bittrex immediately after release because they were thought to be pump-and-dump models. They had to undergo a comprehensive review to protect investors.

Bittrex lists a very large number of altcoins to ensure that traders will never miss opportunities to operate profitably. By mid 2018, Bittrex had more than 250 listed altcoins. To ensure that traders have a better opportunity of trading profitably, Bittrex provides advanced metrics that help to showcase emerging trends. This means that you can easily tell the right time to make a move for better returns.

The transaction fee at Bittrex is a flat 0.25%. The exchange does not have any rebates or incentives for those who trade higher or lower volumes. This makes it easy to calculate the charges and know your profitability. However, traders have been calling for Bittrex to lower its transaction charges to the level of others such as Binance and KuCoin.

The greatest challenge for using Bittrex is that it does not support margin trading. Besides, it is a cryptocurrency platform only. This means that those with fiat currencies have to start from a different platform in order to trade BAT at Bittrex. To use US dollars on the exchange, you will have to become a VIP trader.

3) UPbit

This is a South Korean based cryptocurrency exchange that was started in October 2017. Despite the short period it had been in the market by mid-2018, it had already grown into one of the top markets based on market volume. The exchange was founded by So Chi-Hyung, who also owns Dunamu Company. To make the stint into the cryptocurrency trading more successful, UPbit partnered with Kakao Corp and the US trading Giant, Bittrex.

One of the strong points of UPbit is its large number of cryptocurrencies. It lists more than 100 cryptocurrencies. If you want to trade BAT with the top cryptocurrencies based on market cap, UPbit will probably have them on the list.

The transaction charges at UPbit follow the Bittrex model. All traders are charged a flat fee of 0.25%. Though this is not the cheapest, it is considered to be in range within the local context.

For those who want to make deposits with fiat currencies, UPbit accepts the South Korean Won. Though this is a great addition compared to other exchanges that do not support fiats, people outside South Korea can only use cryptocurrencies for trading.

4) Gate.io

Gate.io is another new cryptocurrency market that only entered the market in 2017. It was started by Gate Technology Inc that targeted to help make trading in cryptocurrencies simple, secure, and reliable.

Like most exchanges in the globe today, Gate.io lists very many cryptocurrencies to ensure that BAT traders will always a good option. It is also packed with great features including two-factor authentication and Super secured SSL Link for enhanced security.

The transaction fee at Gate.io is 0.2%. This is considered within the range of other exchanges in the market today. You will also be charged an additional fee when you withdraw from the Gate.io account.

Like Binance and Bittrex, Gate.io does not allow the use of fiat currencies. This means that new traders or those with cash in their banks have to start from a different platform such as LocalBitcoins.com.

Value of Basic Attention Token

Though Basic Attention Token was only founded in May 2017, its value has grown rapidly and reached top 50 cryptocurrencies based on market capitalization. On July 13th, 2018, BAT market capitalization was $316,845,000 at a price of $0.316. This places it well ahead of other tokens such as Bytom with a market cap of $290.4 million, and Nano with $303.4 million. If the value keeps growing at this rate, it is expected to surpass even other top cryptocurrencies.

Is It Profitable to Invest in Basic Attention Token?

When BAT was launched in June 2017, its price was only $0.17. However, it has grown over time to reach $0.31 in June; a 14% growth. While this might not sound much, the fast-growing demand of BAT is a pointer that it could ultimately pull the price to very high levels. As more partners continue joining the BAT platform, its value, price, and ultimately ROI will take an upward shift.

If you are planning to invest in BAT, it is important to appreciate that the profitability growth described here is only speculative. You need to also factor the things that can easily pull down the price and compromise the expected ROI. Such factors include the looming regulations and emerging competition.

Where to Spend or Use Basic Attention Token?

When Brendan Eich and his team worked on BAT, they wanted it to be used in the digital advertising industry. The token is particularly used for the Brave Browser. The Brave browser is fast gaining popularity because of its commitment to enhancing the privacy of users. It is expected to rival other top browsers including Apple Safari, Google Chrome, and even Mozilla Firefox. Note that BAT and Brave Browser are two different entities. Besides, BAT is not restricted to Brave Browser only.

Can Basic Attention Token Grow to Become a Major Payment Network?

BAT was designed as a token for the BAT system. This means that the designers targeted the token to be used in promoting the direct liaison between ad publishers and viewers. Therefore, there is a high likelihood of BAT emerging as the major payment network for online advertising. Unless the designers and the BAT community redefine the primary goal, it is unlikely that BAT will become a major payment network on top stores and even conventional markets.

How Does Basic Attention Token Work?

BAT attention was created to help revolutionize the browsing the digital advertising platform. The main browser that was able to use BAT by mid-2018 was only Brave. However, BAT is not limited to Brave Browser and could get implemented in other browsers.

BAT works using smart contracts. The contract requires advertisers to send their adverts and make payment which is locked immediately in the system. Then, when users view the ad, a portion of the token is released to them. A small portion also goes to the Brave Browser. Then, the rest of the payment goes to the publisher who hosted the advert.

Users are allowed to spend the BAT they receive for viewing in areas such as donations to content providers, premium articles, data services, and high-resolution photos. The system benefits all including publishers while users can browse the net privately while monetizing their attention.

Does Basic Attention Token Use Blockchain Technology?

The BAT system employs blockchain technology. This can be seen in two ways. One, the tokens are hosted on the Ethereum blockchain. This implies that when a transaction involving sending of value is initiated, it is picked and confirmed by nodes spread in the Ethereum network. These nodes are paid in Gas.

The second part of the blockchain technology is the use of smart contracts. These are transparent and inviolable agreements executed by blockchain networks towards a specific goal. In the BAT ecosystem, the smart contracts mapped the main rules that guide advertisements and flow of associated revenue between advertiser and user. This automation is what has helped the BAT and Brave system to greatly appeal to both old and new users.

Mining Basic Attention Token

There is no mining in the BAT system. Unlike most networks that employ Proof of Work of Proof of Stake consensus models to help with release and distribution of tokens, the model used at BAT is different. Basic Attention Tokens are released using user growth pools that are aimed at incentivizing users participating in the BAT ecosystem. Note that you are required to use the tokens after receiving them or risk getting them taken away and returned to the incentive pool.

What Are the Advantages of Basic Attention Token?

When Basic Attention Tokens were released through Initial Coin Offering (ICO), they were mobbed in seconds. People had already seen the potential of this network and could not wait to become part of it. Here are mother benefits to expect after joining the Basic Attention Token network.

- Basic Attention Token platform has been targeted at one of the most valuable and fast-growing areas; digital advertising. By creating a new peer2peer model for the niche, both advertisers and viewers are likely to shift to BAT. This will have the overall effect of pushing the value of the network up.

- The tokens provide an easy and direct way of sending value on a peer2peer basis. As a decentralized network, it implies that you can enjoy sending value faster and cheaply because the profit-seeking entities such as banks have been edged out.

- BAT value has continued to grow progressively since inception. Even though it only entered the market in 2017, the market capitalization had grown progressively to join the top 50 cryptocurrencies by mid-2018.

- By eliminating the middle parties, BAT has introduced a new method of matching ads with viewers. This is not all. The BAT ecosystem helps to protect the privacy of users in the network.

- BAT is a great way of investment with near-guaranteed returns. Whether you target to hold BAT waiting for value to go up or trade in the exchanges, the growing demand is likely to deliver good ROI in the future.

- The BAT ecosystem has helped to eliminate fraudsters by clearing away the middlemen in the advertising niche. This implies that users are assured of receiving more from direct views.

What Are the Risks of Basic Attention Token?

If you have been looking forward to acquiring and using BAT, it is important to compare the advantages with risks. This will help you to provide the correct picture of the cryptocurrency for a more informed decision. Here are the main risks associated with BAT.

- BAT has played right into the heart of the biggest multinationals such as Google, Apple and Facebook. These giants are likely to wage a highly aggressive battle to protect their niche. Such moves could slow down BAT growth and even curtail its success.

- The danger of the looming regulations. By taking the power of advertising from the centralized organizations such as Google and Facebook that pay huge amounts in taxes, BAT is likely to accelerate the current drive by governments to pass very harsh legislations. Such laws could easily see the currency growth of BAT receding.

- The danger of getting attacked by hackers. Cryptocurrencies have become center of focus for hackers because of the anticipated growth. Like other cryptocurrencies, you are at a risk of getting attacked at the network, the wallet and even the exchanges. It is very important to exercise extreme caution when trading, storing and using the private keys.

- The threat of high volatility. The cryptocurrency market has become highly volatile with the prices shifting to the extremes even when minor things hits the market. For example, the cryptocurrency rush of December 2017 and early 2018 saw the price of BAT shoot to the highest point and then falling sharply in the subsequent months.

- Competition from emerging cryptocurrencies. New cryptocurrencies have been emerging at a very fast rate. With emerging cryptocurrencies building on the advances of the former, there is a high risk of more advanced ones joining the market. This could result to lack of appeal for BAT.

What Happens if Basic Attention Token Gets Lost?

Every time you visit cryptocurrency forums, the chances are that one or several people will be lamenting they have lost their tokens. To keep your Basic Attention Tokens safe, it is important to understand what happens when such loses strike.

- Loss through sending BAT to the wrong address: If you send BAT to the wrong address, it means that they now belong to a new person. Note that the tokens are still actively circulating in the network. The bad thing about it is that the transactions on the network cannot be reversed.

- Loss through forgetting the private keys: The private keys is probably the most important thing when dealing with cryptocurrencies. Because the keys help to call the BAT to live when initiating transactions, losing them implies that the tokens are also lost. However, they will still be idle in the network waiting for you to regenerate the right keys.

- Loss through damage to your cryptocurrency wallet: If you lose the wallet that has the Basic Attention Tokens, it implies that they are also lost. However, they will still be in the network until you reinstall the wallet.

- Loss from hacking: Hacking in cryptocurrency networks is considered like completed transactions. This implies that the BAT tokens have simply changed hands.

Basic Attention Token Regulation

Many governments have been feeling greatly threatened by the fast growth of cryptocurrencies. The new digital assets allow people to send value on a peer2peer basis. This implies that they bypass the conventional financial services such as banks and credit card that faithfully pays taxes. BAT is promising to edge out tax paying institutions such as Google and replacing them with untraceable nodes spread in the network. Most users/ nodes in cryptocurrencies have not been paying cryptocurrency related taxes. After trading and making good returns, most people hide under the anonymity cover of cryptocurrencies.

In the EU, the executive arm of the giant union has been at the forefront of demonstrating the threats that come from cryptocurrencies. From lack of consumer protection to the threat of total loss, the commission has been calling for speedy regulation. Other countries that have been categorical on the threats that come from cryptocurrencies include China, Russia, the UK, and India.

Despite the growing disquiet about cryptocurrencies, it is very interesting that no country had installed a regulatory framework by mid-2018. This has made some people start wondering whether the countries are actually serious about the problems. It is now emerging that passing cryptocurrency regulations is not as easy as many would want it to be.

- The blockchain technology has been molting very fast. Even before one technology is comprehensively reviewed others will have entered the market. For example, though many countries have been targeting the cryptocurrency users at the exchanges, the rise of decentralized exchanges is very difficult to contain.

- The cryptocurrencies are part of the technologies that governments initiated. In the last 18 years, most countries have been working extra hard to support the fintech industry. For example, Hong Kong had established a Fintech Facilitation Office to catapult tech developments to higher levels. Now, one of the resulting products is cryptocurrencies such as Basic Attention Token. Most administrations are unable to limit the advancement of the products they initiated.

- The cryptocurrencies are not owned by any one single party. Once the mainnets are released, the cryptocurrencies no longer belong to the founders. All decisions and management are controlled by the nodes spread in respective networks across the globe. This makes it very difficult to target a specific entity for regulations enforcement.

- The subject of cryptocurrency regulation is fast molting into a highly political outfit. Because they help people to send value cheaply, invest and get good returns, those calling for their limitation are considered to be against the popular majority.

Even as the countries continue dragging their feet about cryptocurrency regulations, one sure thing that those with interest in the technologies should know is that they will finally dawn. It is only a matter of when they will come and not if they will ever be created. Indeed, some countries have marched right ahead and are at different stages of passing cryptocurrency regulations. Take a look at the next section to establish where different jurisdictions have reached with cryptocurrency regulations.

Is Basic Attention Token Legal?

Basic attention is legal in many countries because none had established a clear cryptocurrency regulation. When you take a closer look at the cryptocurrency regulation, it appears that a number of countries do not have an idea of where to start. It appears that these jurisdictions are only waiting to see the direction that major countries such as the US, Russia, and the EU take. Here is a closer look at these jurisdictions.

1) The United States

While the US was the first to note the threats that come from cryptocurrencies such as BAT and Bitcoin among others, it had not installed a clear legal framework by mid-2018. Instead, it only gave a clarification through the Commodities Futures Trading Commission (CFTC) that cryptocurrencies should be considered properties. This was meant to help people in cryptocurrencies to pay taxes promptly. However, this approach did not bear much because only a handful of those in cryptocurrencies pay taxes in the US.

In January 2018, the US changed its tactic by adopting a global approach. The federal administration holds the view that if the cryptocurrencies are regulated from a global level, it will be easy for the laws to trickle to individual countries. Speaking in Seoul after a tour of the top Asian countries, U.S. Treasury Deputy Director Sigal Mandelker argued that cryptocurrencies were becoming a serious threat that could bring down successes achieved in governance over the years. He lauded China for its firm stand on cryptocurrencies.

Even as the United States appears to lack a clear approach to regulating cryptocurrencies, individual states are marching right ahead. In April Arizona passed SB 1091 bill that allows its citizens to pay taxes in cryptocurrencies. The bill was inspired by the fact that a lot of people in Arizona were into cryptocurrencies such as Basic Attention Token but were not paying taxes. It will be interesting to establish whether the law will help raise tax collected from citizens.

With Arizona making the first move, more states and countries have started changing their view on cryptocurrencies. The states of Georgia, Nebraska and New York are all working on passing similar regulations. The Arizona bill is also being considered as a crucial learning point that the federal government is looking keenly when enchanting a cryptocurrency legal framework.

2) Venezuela

While many countries have been indicating the threats that come with cryptocurrencies, one nation that has taken an interesting approach is Venezuela. The country has established its own cryptocurrency referred as petro cryptocurrency. So what exactly is driving this country whose currency does not tick any significant impact at the global front?

Venezuela has resulted to blockchain technology as an option of last resort. The reign of President Nicholas Manduro has come to be associated with human right abuses. This has attracted a lot of sanctions from international communities. The country established the petro cryptocurrency that helps to sell petroleum anonymously. After successfully applying the petro cryptocurrency in beating international sanctions, Venezuela is now seeking to make it the local legal tender.

In April 2018, the Venezuela parliament adopted the presidential decree that petro cryptocurrency be employed in all government departments alongside the national currency. This is seen as a new way of taking Venezuela products to the international font. Though Venezuela’s application of blockchain technology was inspired by the need to beat sanctions, many countries are now using it as an example of how they should handle cryptocurrencies to their advantage. For example, Russia has already expressed interest to study the petro cryptocurrency with a view of implementing a similar model back home.

3) Singapore Singapore is one country that has demonstrated its love for cryptocurrencies and other blockchain products. Like other countries, Singapore administration was initially skeptical about cryptocurrencies. The Monetary Authority of Singapore (MAS) had all along pointed the many risks that were associated with cryptocurrency markets. However, this suddenly changed at the beginning of 2018.

Early in January 2018, the Deputy Prime Minister Tharman Shanmugaratnam pointed out that Singapore law did not make a clear distinction between payments done using fiat and cryptocurrencies. He added that the primary target was to simply transfer value. The MAS chief added that there was a very low risk of Lehman Brothers-like financial meltdown with cryptocurrencies such as Basic Attention Token and Bitcoin among others.

The country has indicated that it will put its main focus on installing consumer protection framework and supporting cryptocurrency growth. This need came to the fore after the $530 million was stolen from a Japanese exchange referred as Coincheck in January 26th, 2018. It emerged that the hack was targeted at the Singapore-based NEM coins.

4) The European Union

Like the United States, the EU did not have a clear approach to cryptocurrency regulations. Indeed, different organs of the giant union appear to be pushing in different directions. The EU Parliament, the legislative arm of the EU has indicated that there is a need to further study cryptocurrencies so that the laws are comprehensive. But this stand appears to go against the EU Commission; the executive arm of the union.

The EU Commission is categorical that the threats from cryptocurrencies are so dire and must be addressed urgently. The Deputy Chairman of the commission, Valdis Dombrovskis, vice president of the European Commission pointed out specific risks including liability gaps, market manipulation, loss of investment, and security failures that need to be prevented. The stand of the commission has received overwhelming support from top administrations in the union.

Germany, France, Austria, and the UK have all stated that they are working on fast-tracking local frameworks to counter the risk of fraud. The UK was especially concerned with the threat of money laundering and cryptocurrencies becoming conduits of raising funds for terror.

Basic Attention Token and Taxes

The topic of cryptocurrencies and taxes is proving to be a highly complicated one. Like many governments have noted, people in cryptocurrencies do not pay taxes. Most of them believe that the anonymity provided through advanced technology such as encryption is ample to protect them from third party seizures including tax authorities.

In the United States, Credit Karma indicated that of those people who filed their tax returns for the 2017 fiscal year, only a handful indicated about their income from cryptocurrency activities. But the US is not alone. The EU, the UK, China, and India have all voiced their concerns. This is one of the core reasons why many governments remain committed to passing very harsh regulations.

Tax and cryptocurrency experts have, however, voiced a different opinion when it comes to taxes. They indicate that cryptocurrencies were actually not intended to help people evade paying taxes. Rather, they simply introduced a new way of doing things. The experts caution people that though they might feel secure under the cover of anonymity right away, such privacy might not last for long. When new technology gets discovered, it could become easy to pull out the details of people who evaded taxes from public ledgers. But things do not have to go that way. You can actually enjoy all the benefits espoused from the BAT without breaking tax related laws.

- Make sure to consider revenue from trading BAT as taxable income

- Always capture important details about trading in your journal or diary for clarifications should they be needed.

- Whether you made losses or profits trading BAT, ensure to include the details when filing annual returns.

- If you find it difficult to capture the details of BAT trading in a business balance sheet, do not hesitate to seek the services of an expert.

Does Basic Attention Token Have a Consumer Protection?

Basic Attention Token does not have consumer protection. Basic Attention Tokens, like other cryptocurrencies, are decentralized. This means that they are not owned by any single entity. Rather, they belong to the users and nodes spread in the network. This implies that you are alone after joining the network. In the event of a loss or something bad happens on the network, there is nowhere to seek redress. You cannot even seek help from a court of law because cryptocurrencies are not yet regulated. Therefore, how do you protect yourself when working with Basic Attention Tokens?

- Always triple check the public address before sending BAT.

- Consider designating one computer to BAT operations only.

- If you must multi-task the computer being used for BAT operations, try to keep off risky sites.

- Always store the private keys and the seed as safely as possible.

- Only use the exchanges that have demonstrated full commitment to keeping users' digital assets as secure as possible.

- Make sure to move the Basic Attention Tokens from the exchanges to your wallet when not trading them. The exchanges are very risky.

Illegal Activities with Basic Attention Token

Cryptocurrencies have become the next main target for fraudsters and criminals because they are anonymous. The criminals prefer them because they are assured of defrauding clients without worrying about third-party seizures. Despite this appeal, no illegal activity had been reported with Basic Attention Token by mid-2018.

Is Basic Attention Token Secure?

Basic Attention Token has demonstrated to be a highly secure token in the market. The development team has been working extra hard to ensure that the network is secure and reliable. Led by the team leader, Brendan Eich, the entire team believes that the bottom line to success in the emerging digital platforms is making them more secure. Here are the main methods used to help keep BAT secure.

- The BAT tokens are based on the Ethereum platform. This implies that Ethereum acts as an additional layer of security.

- Basic Attention Tokens are distributed using a unique method of user growth pool grants. This strategy ensures that there is even distribution and users are amply motivated to avoid the danger of 51% attack.

- BAT uses a highly aggressive team and technology to identify and seal any gaps on the network. This is what has helped the network to easily keep off hackers.

Is Basic Attention Token Anonymous?

To address the issues mainly associated with conventional advertising, the development team of BAT was highly committed to providing high privacy. They used advanced encryption that helps to keep the details of users anonymous.

Has Basic Attention Token Ever Been Hacked?

Since 2009 when the first blockchain was released, the digital assets have become a primary target for hackers. They prefer them because of ease of operations and the ability of the tokens to deliver high returns faster. However, BAT system had not been hacked by mid-2018. This is attributed to the commitment of the BAT team to progressively strengthen the core code and update the network progressively.

How Can I Restore Basic Attention Token?

Basic Attention Token can be restored. The moment you acquire some BAT, it is important to appreciate that they face an imminent threat of getting lost. However, depending on the nature of loss and how prepared you were before the loss; it might be possible to restore the tokens.

- Forgetting the private keys: When you lose the private keys, the access to the Basic Attention Tokens is lost. Therefore, the tokens are considered lost. The good thing about this loss is that the tokens are still under your signature. To restore them, you will need to regenerate the private keys using the seed phrase.

- Damage to the BAT wallet: When your BAT wallet is lost or damaged through deleting of the hard drive or malware, the tokens will be lost. To restore them, you need to reinstall the wallet from a backup.

- Hacking: If hackers attack the BAT network and siphon away the tokens, they cannot be restored. Hackers can also attack and steal the tokens from the wallet or even the exchanges.

- Sending BAT to the wrong address: Sending BAT to the wrong address implies that you have handled ownership to another person. There is no method that can be used to restore the tokens.

Why Do People Trust Basic Attention Token?

- BAT has a very clear roadmap demonstrating the expected growth that no one wants to miss. The growth is expected to go hand in hand with a positive value and price shifts.

- BAT ecosystem plays into a highly lucrative niche of digital advertising. By putting BAT as the common denominator for the advertisers and viewers, the network is likely to grow progressively.

- The BAT network and its operations are associated with a highly advanced and successful development team. For example, the founder is credited with some of the greatest projects people know of today. Good examples include Mozilla and JavaScript.

- BAT has been crafting numerous partnerships that target helping the system to grow. For example, Washington Post, Wall Street, WikiHow, Smashing Magazine and Market Watch have all formed some sort of relationship with BAT.

- BAT is marketed as the better option compared to the existing networks. Many people largely see it from the viewpoint of the core objective. This puts it at a unique position where even those holding other cryptocurrencies want a piece of BAT.

History of Basic Attention Token

The history of BAT can be traced back to March 2017 when the founder announced it. In May, about two months after the announcement of the project, BAT held a very successful ICO. A total of $35 million was raised in less than a minute. Here are other events that marked the history of BAT.

- In December 2017, the first round of the BAT user growth pool grants was released. The 300 BAT were distributed to new users on the Brave web browser payment program.

- In mid-January 2018, the second phase of user growth pool grant equivalent of $1 million worth of BAT was released as a promotional giveaway.

- In Mid February 2018, a one million dollar referral program was launched. Under the program, publishers who bring more users to the Brave browser are rewarded with $5 per user. Note that the new users have to be active for not less than 30 days.

- In March 2018, the Brave payments support streamers on the Twutch.tv were expanded to include more players. The referral program was also expanded by one million dollars worth of BAT.

- In April 2018, BAT announced it was entering into a partnership with Dow Jones Group. Dow Jones Media Group said it wanted to start experimenting with blockchain technology. What this implies is that BAT will not just be tested on the Dow Jones Media Group only, buy also on MarketWatch and Wall Street Journal.

- The price of BAT has been moving on a trajectory that is similar to that of Bitcoin. On 1st June 2017, the price was $0.166 before taking a sharp rise in the subsequent few days to hit $0.27 on June 5th. Then, it sank to the $0.069 in June 16th before growing slowly in the subsequent months to reach $0.30 on 1st September. Between September and mid-December, the average price remained around $0.2. Then, the price took an upward shift to $0.86 on January 9th, 2018; the highest mark in its history. Then, it sank to the $0.2 mark in March, gained a little in May and settled around $0.27 mark in June 2018.

Who Created Basic Attention Token?

Basic Attention Token was founded by Brendan Eich. Eich is renowned for his previous highly successful computing projects especially JavaScript and Mozilla. He co-founded Mozilla, the Mozilla Foundation, and worked as the technical officer at Mozilla Corporation. Today, he is the CEO of Brave, the main BAT browser.

Other important people who helped to make the BAT become a reality include Yan Zhu who is an open web standards author for W3C and a Tech Fellow at the Electronic Frontier Foundation. Marshal Rose was also very instrumental during the development and management of BAT. Marshall is the inventor of the Simple Network Management Protocol (SNMP).

Basic Attention Token Videos and Tutorials

See Also

- Bitcoin | Ethereum | Ripple | Bitcoin Cash | Litecoin

- Cardano | NEO | Stellar | EOS | NEM | VeChain Thor

- Monero | Dash | IOTA | TRON | Tether | OmiseGO

- Bitcoin Gold | Ethereum Classic | Nano | Lisk | ICON

- Qtum | Zcash | Populous | Steem | Ontology | Waves

- DigixDAO | Bytecoin | Bitcoin Diamond | Binance Coin

- Bytom | Verge | Crypto Humor

- Cryptocurrency Dictionary | List of Cryptocurrencies | CEX.io

- Binance | Coinbase | Changelly | Coinmama | Bitpanda

- LocalBitcoins | Kraken | Paxful | Ledger Nano S | TREZOR