Loopring

Loopring cryptocurrency guide advises where to buy and how to buy Loopring. This guide also contains the markets, value, trading, investing, buying, selling, transactions, blockchain, mining, technology, advantages, risks, history, legislation, regulation, security, payment, networks and many other interesting facts about Loopring as well its status in the world of cryptocurrencies.

Loopring, Thursday, 2025-06-12

Contents

What Is Loopring?

The primary goal of the blockchain technology is decentralizing operations to ensure that transactions are done on a peer2peer basis. This objective has been met by a huge percent in the industry. However, there is one part of the blockchain system that has been stuck to the centralized past; the exchanges. Because they are centralized, all the assets traded in them are at a very high of attacks. Besides, the exchanges' administrations closely follow traders and can easily block those they want to lock out. This is the problem Loopring was created to address.

Loopring is a decentralized and open source exchange protocol targeted at accelerating the adoption of fully decentralized exchanges. Here, it is important to point that Loopring is not a decentralized exchange, but a protocol. It facilitates decentralized exchanging of digital assets using order marching and ring sharing.

The platform was founded in August 2017 by Daniel Wang. The protocol opened a new way of addressing the thorny issue of cryptocurrency exchanges’ centralization. Many people feel that Loopring has come at the right time when many governments have been working on regulating cryptocurrencies through the centralized exchanges.

With its performance in the market between launch and mid-2018 growing with over 150%, Loopring has demonstrated its great potential to grow and even surpass other bigger networks. Here is a deeper look at Loopring.

Beginner's Guide to Loopring

Have you been looking forward to joining the cryptocurrency industry? One of the high potential platforms is Loopring. It is among the new platforms in the market that have demonstrated huge potential for growth in the coming months or years. Loopring operates as a protocol for facilitating decentralized operations. This has made it win the tag of the most potential network that could even rival Bitcoin in the coming years.

To join this network, you need to evaluate it comprehensively. This guide was designed to help you understand Loopring and get all the questions about it answered. It explores every component of the platform including what it is, where to buy, how it works, and major benefits. It also delves into the platform security, consumer protection, and history. Welcome to learn about these aspects of Loopring and more.

Where and How to Buy Loopring?

When many people hear of Loopring architecture, the first question they ask is how they can become part of its system. The best way to own part of the project and grow with it is buying the native Loopring tokens (LRC). To buy the tokens, there are two main channels that can be employed.

- Buy from cryptocurrency exchanges: Starting from 2009 when Satoshi Nakamoto launched the first Blockchain network, cryptocurrency exchanges have become the primary points for purchasing tokens and digital assets. They are to cryptocurrencies the way forex markets are to fiat currencies. To buy from these exchanges, you are required to start by acquiring an account. This means visiting their websites and signing up by providing personal information and then, verifying with government recognized details such as phone number. Some of the exchanges that trade Loopring include Binance, Gate.io, and Idax.

- Purchase directly from those who already have them: With the popularity and application of cryptocurrencies growing year after year, cryptocurrency clubs have sprout especially in top cities to help communities share cryptocurrency details easily. Now, the clubs such as London Cryptocurrency Club and Melbourne Cryptocurrency Club have also become primary selling points for cryptocurrencies such as Loopring.

Loopring Wallet

When you decide to join a cryptocurrency network such as Loopring, one must have thing is a digital wallet. Whether you want to mine the network, buy or use the network, you will need an appropriate Loopring wallet. A cryptocurrency wallet is defined as a digital location for storing tokens and cryptocurrencies. However, a closer look at the definition demonstrates that it is indeed a misnomer.

Native tokens such as LRC and Ether among others cannot leave their networks. Therefore, if you cannot move something from the mother network, it implies that it is very difficult to store it elsewhere. This brings about another question; what exactly does a Loopring wallet store?

Loopring wallet stores a set of codes that helps users to identify their tokens in the networks. The first code stored in the wallet is the private keys. This is a very important code because it calls your LRC tokens on the Loopring network to live. It the code is lost, it means that your tokens are also lost.

The second code stored in a cryptocurrency wallet is the public keys. This is a code that acts as your address. This means that those who want to send or pay you in LRC should use the public keys. Unlike the private keys that should always be kept private, the public keys can be shared with payers on the network.

The last code stored in the Loopring wallet is the seed. This is in many cases a 24 code phrase that helps with the regeneration of the private keys in the case of a loss. This code and the private keys should be kept safely and preferably away from the main computer.

As an ERC-20 token, it implies that LRC can be stored in most ERC-20 compliant wallets. Therefore, here are some of the top wallets you should consider for storing Loopring.

- Loopring wallet.

- Morpheus wallet.

- MyEtherWallet.

- Ledger Nano S.

- Trezor wallet.

Where to Buy Loopring with Credit Card?

Credit cards are some of the top payment methods used today because they are accepted both in conventional and online marketplaces. Now, you can also use credit cards to buy cryptocurrencies such as Loopring.

Note that because most of the exchanges such as Binance that list Loopring do not accept credit cards, you will need to start from another platform to buy a different crypto such as Bitcoin. A good platform to commence is CEX.io. Once you buy Bitcoins at CIX.io, move them to an exchange that lists Loopring such as Binance, and buy LRC.

Where to Buy Loopring with PayPal?

There is no direct method that can be used to buy LRC with PayPal. Since cryptocurrencies entered the market, PayPal has been looking at them as direct competitors. Therefore, transactions from PayPal directed to cryptocurrency networks are blocked. Though PayPal has indicated it will consider reviewing the policy to allow payment to the networks, such changes are yet to be implemented. Therefore, if you have cash in a PayPal account, the best way to buy Loopring is withdrawing into a bank account or credit card.

How to Buy Loopring with Wire Transfer?

If you ask many people about their most trusted institutions, the answer will probably be a bank. Banks have won a lot of trust from the people because they strictly follow rules and take a professional approach all the time. To buy Loopring with a wire transfer, you will need to start by purchasing an alternative coin such as Bitcoin from another exchange such as Changelly. Then, select an exchange that lists Loopring such as Binance or KuCoin and use this process.

- Visit the exchange website to open a trading account. Then verify the account by providing government recognized information such as phone number.

- On the created account, go to the section for purchasing digital assets and select the quantities of LRC wanted. Then, select pay with Bitcoin that you purchased from Changelly.

- Once you complete the transaction, the LRC quantity will be credited to your exchange account. Therefore, you will need another step to move them to your wallet.

- On your Binance trading account, go to withdraw section and provide the public address of your wallet. Then, complete the transfer to the wallet because it is considered more secure compared to the trading pool.

Where to Sell and Trade Loopring?

If you have some Loopring Tokens (LRC) and want to optimize profits, the best thing is trading them in the exchanges. Though can hold them and wait for price to go up, the option is only speculative. Here is what you need to understand about trading Loopring.

Trading cryptocurrencies is pretty like forex trading. However, the assets traded in the exchanges are cryptocurrencies as opposed to fiats. As you set out trading your tokens, it is important to appreciate that the cryptocurrency markets have proven to be the soft underbellies of the blockchain niche. They have become easy targets for attackers who siphon away users’ assets.

Every big attack and loss in the cryptocurrency industry is likely to have happened in the exchanges. From Mt.Gox of 2011 to Coincheck attack of 2018, everything happened in the exchanges. The main issue that people have when they see such attacks is the worry of whether they will be the next targets. The following are the top points to use when looking for Loopring trading platforms.

- Only go for the platform that has demonstrated the capacity to secure clients assets. This means checking for top features such as two-factor authentication and use of cold storage.

- The exchange should have a low transaction cost. This is important in helping traders retain the bulk of the profits they make at the exchanges.

- The selected exchange should provide users with advanced metrics that help them understand the emerging trends and operate like pros.

- Look for the exchange that has made a name in the cryptocurrency community for its efficiency. Some top communities to follow include Reddit and Bitcoin Org.

- Make sure to only use the exchanges that have good customer support systems. Good support is important because when there is an issue, it can be resolved promptly to ensure no opportunities slip away.

How Much Are the Transaction Fees of Loopring?

The Loopring system does not give a clear outline of its transaction costs. Because Loopring tokens are based on Ethereum, you have to pay GAS that goes to incentivizing miners who confirm transaction and add them to the public ledger. The transaction cost can be calculated using the following equation (transaction cost = gas used by transaction * gas price).

Loopring Markets

Cryptocurrency markets have been growing at a very fast rate to keep up with the fast-rising demand. Though Loopring has been in the market for less than one year, a lot of markets have agreed to list it. Here is a closer look at some of these markets.

i) Binance

Binance was one of the youngest cryptocurrencies in the industry by mid-2018. It was started in mid-2017 by Changpeng Zhao. Zhao was concerned that cryptocurrency trading was becoming very expensive and limiting the use of blockchain technologies. To address the issue, Zhao also released Binance native token referred to as BNB.

The greatest selling point of Binance is its low transaction charges for users. To use the platform, you only pay a small fee of 0.1%. However, you can reduce this transaction charges by 50% to 0.05% if you pay with BNB. This makes Binance one of the cheapest exchanges in the market today.

To provide users with more options when trading Loopring in the market, Binance lists a lot of cryptocurrencies. Whether you want to pair LRC with top crypto assets such as Bitcoin and Ethereum or newer ones such as NEO, Binance is a great platform. Whether you are new to cryptocurrency trading or have been in the industry for some time, Binance is probably the easiest to use. It has advanced metrics that help users to follow the market trends in order to make the right moves. They also have a very responsive support to assist you when issues arise on the platform.

The biggest issue with Binance is that it that it is a cryptocurrency only platform. This implies that you cannot make deposits or withdrawals using fiat or credit cards. For those with fiat currencies, using Binance has to start from another exchange such as Changelly or LocalBitcoins.com.

ii) OKEx

This is one of the relatively new cryptocurrency trading exchanges that operate as a branch of OkCoin with its head offices in Hong Kong and Belize. It was launched in May 2017 when OkCoin futures trading ceased. However, its API was introduced a few weeks later on June 7th, 2017.

The transaction charges for trading at OKEx ranges between 0.15% and 0.02% for the maker based on the traded volume. However, the taker pays between 0.2% and 0.05%. To enjoy lower rates, you should consider trading more LRC. This operational model has seen many new Loopring traders opt away from OKEx. They have been calling for levering of all trading charges like other exchanges such as Binance.

To make trading safe, OKEx uses offsite backups to store the bulk of the traders' assets. This implies that in the event of a loss, only a small volume of assets would be affected. Other security features used to secure Loopring and other asset traders include advanced encryption, and use of private keys.

The exchange lists very many cryptocurrencies. This is a great opportunity for traders to select what they want to trade based on expected profitability. However, the list of cryptocurrencies a too long and could easily confuse new traders.

iii) KuCoin

KuCoin is a multi-cryptocurrency platform based in China. The exchange is targeted at helping to pull down the cost of transactions as low as possible and ensuring users keep the bulk of the profits. Like Binance, KuCoin introduced a cryptocurrency token referred as KuCoin Shares Tokens that are used to help provide discounts to its users.

To help provide users with more trading options, KuCoin lists very many assets. You can opt to trade Loopring for ERC20 tokens, Bitcoins, or other assets. This means that traders will never lack a profitable option to jump to if their current pair proves less desirable.

To encourage more people to come and join the network, KuCoin has a promotional bonus for those who invite new users. If you have a blog, a site or a social media page where you can refer new users, the market will reward the efforts.

When you start trading at KuCoin, the customer support is very effective. There are many support channels that you can use for help. They pride of a 24/7 support team through their email support, FAQ page, and direct diagnostics to make trading more reliable.

Value of Loopring

Though Loopring is one of the young cryptocurrencies to enter the market, its value has done relatively well. About one year, between August 2017 and July 2018, the cryptocurrency had grown steadily and entered the top 100 cryptocurrencies on CoinMarketCap site. On July 10th, the value of Loopring market capitalization was $156,035,117 at a price of $1.5. This value means Loopring is well ahead of other cryptocurrencies such as NXT with a market capitalization of $86.7 million and Loom with $121.7 million. The community is expecting the value of Loopring to continue growing even though its price has grown only with a very small margin.

Is It Profitable to Invest in Loopring?

When coming to cryptocurrencies such as Loopring, many people anticipate getting high profitability. Between August 2017 and July 2018, the price of Loopring grew with over 150%. This is a significant margin for an investor over a period of only one year. Because of the unique design of Loopring, the community expects that that the coming years will experience additional growth and deliver higher returns on investment.

It is important to take note that the growth in cryptocurrencies is dependent on many factors. For example, the profitability of Loopring is likely to be affected by the looming regulations and competition.

Where to Spend or Use Loopring?

Most cryptocurrencies out there and respective development teams work hard to get their tokens accepted for payment in diverse areas. A good example is Bitcoin that has gained acceptance in a lot of online and conventional stores. By mid 2018, no store had come out to indicate that it accepts payment in LRC. This means that you can only use Loopring to pay the transaction fee in different exchanges such as OKEx and Binance that list it.

Can Loopring Grow to Become a Major Payment Network?

Yes, Loopring can grow into a major payment network. The architecture of Loopring was aimed at helping users make direct payments from one network to another. Because the price of its native token is relatively low compared to others such as Bitcoin and Ripple in the market, many people prefer it. The growing community is also expected to continue using the network for making payments.

Note that even though Loopring has a great opportunity to become a major payment network, the development has its work cut out because the competition is very stiff. It will have to compete with other older and more established cryptocurrencies such as Ethereum and Ripple that are forming partnerships with payment organizations to remain at the top. Besides, it will also have to contend with the looming regulations that threaten to cut short the growing popularity of cryptocurrencies.

How Does Loopring Work?

The Loopring system employs smart contracts to facilitate its decentralized operations. When you decide to use the Loopring platform, there is no need to deposit cryptocurrencies into an exchange. Note that in a conventional cryptocurrency exchange, you are required to deposit some cryptocurrencies into an exchange account before being allowed to trade. In fact, even some decentralized exchanges such as Bitshares, you are still required to deposit funds into them. This is different in Loopring.

In the Loopring system, your cryptocurrencies are traded right from the wallet. Besides, they are also not locked by orders. This implies that you have absolute autonomy on the funds you trade from the wallet and what remains there. You can also trim, cancel, or increase orders.

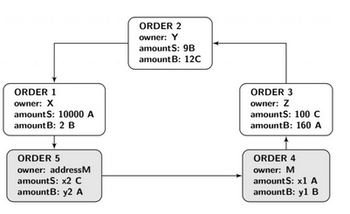

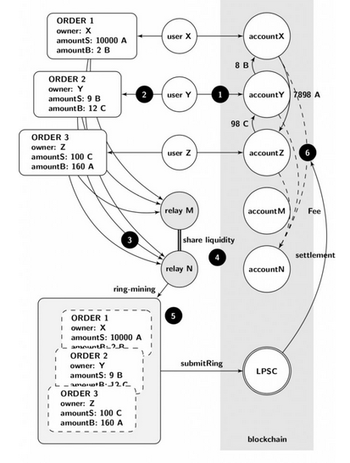

To set an order: A trader is required to submit an order via loopring.io wallet by signing with a private key. Then, the order is sent to a smart contract on the platform and moved via a relay of multiple off-chain nodes. The smart contract ensures that the order is matched so that funds in the wallet are traded for the preferred coins. The off-chain relays in this cycle help to maintain the order book. They also broadcast orders to the ring miners who ensure that they are filled through order rings.

Settling trade: After an order ring has been completed, the smart contracts on the Loopring evaluate them for assurance that they can be fulfilled. Once everything is okay, the smart contract transfers the traded coins to respective recipient. Note that this place takes place on a wallet-to-wallet basis.

Does Loopring Use Blockchain Technology?

Yes, Loopring uses blockchain technology. The Loopring platform utilizes a relay-mesh system that promotes order and liquidity sharing. The nodes that operate on the network can join an existing network and share liquidity with other relays over the blockchain to facilitate wallet-to-wallet trading.

The Loopring ecosystem is managed by the Loopring Smart Contract Protocol that oversees the operation of the ring miners and manages all tokens transfer. It also manages miners’ incentivization and event emittance in a transparent way.

Mining Loopring

Mining Loopring is done by nodes spread in the network referred to as ring miners. After clients initiate transactions, they are picked by offline nodes (relay mesh) that broadcast them to miners spread in the network. The ring miners ensure that all orders relayed to them are filled using rings until the preferred trade is reached for involved parties. Then, the miners are compensated for their work. The miners have the option of selecting to be paid in a portion of the margin generated during the transaction or simply keeping the transaction fee in the form or LRC token.

What Are the Advantages of Loopring?

The cryptocurrencies being designed today are targeted at addressing issues identified in the previous networks and taking blockchain to the next level. Loopring was created to help take the blockchain technology to the next level and comes with the following advantages.

- Loopring platform has helped to solve a major problem of centralized exchanges. The centralization was in many aspects reversing the gains that blockchain technology had gained over the years.

- By presenting a workable method of addressing centralization in the exchanges, Loopring has demonstrated a huge potential to grow and become the next big thing. Some experts indicate that Loopring has the potential of becoming the next Bitcoin.

- The network allows users to invest without worrying about third-party seizures. If you keep savings in a bank account, the details of the transactions as well as balances can be accessed by authorities or even frozen by a court of law. As a decentralized network, Loopring allows users to invest and trade without worrying about third-party seizures. No one can know the details of your Loopring account or even freeze the funds stored there.

- The network provides users with a cheaper and reliable method of sending value. Because Loopring is a decentralized network, all operations run free from centralized and profit-seeking organizations such as banks. This means that those using the network to send value locally or internationally are able to enjoy lower rates.

- Loopring provides a reliable way for people to use and own the network. When you join the network, you become part of the system and will be called upon to help confirm transactions and during major decisions.

- The native token is based on the Ethereum blockchain. By operating as an ERC20 token, it provides an additional layer of security. This makes it harder for attackers to gain access and steal from users.

What Are the Risks of Loopring?

If you are planning to join the Loopring network, it is advisable to extend the assessment beyond the outlined benefits to comparing with the main risks. Here are the risks to expect after moving to Loopring.

- The danger of getting attacked by hackers. Like other networks, Loopring is also prone to attacks from hackers. If you own LRC, you can be attacked at the network level, wallet, or even at the exchanges.

- The risk from the looming regulations. Most administrations around the globe have threatened to pass harsh regulations to tame cryptocurrencies because they feel threatened. They feel that the cryptocurrencies are taking away their roles, and are ready to use every method to curtail this influence. If the administrations live to their threats and pass harsh regulations, cryptocurrencies such as Loopring could easily go into recession.

- Newer cryptocurrencies joining the network. Just like Loopring entered the market with new technology that facilitates decentralized trading, newer networks entering the market could easily bring more competition. This could result to slowing down of the current Loopring growth.

- The cryptocurrency is relatively new in the market. This implies that though they have demonstrated how every component is expected to work, it will take time before all the features have been demonstrated to be stable. In many cases, at least five years are needed before the stability of all the features can be ascertained.

What Happens if Loopring Gets Lost?

Every time you visit a cryptocurrency community, the chances are that you will get somebody crying that her/his tokens were lost. Here is a closer look at what happens when such losses take place. One thing you need to appreciate is that native tokens do not leave their networks.

Loss through forgetting the private keys: If you forget or misplace the private keys, it implies that you can no longer call your tokens to live. However, the tokens are still in the network but in a dormant state. If you can manage to regain the private keys, the tokens will be reactivated.

Loss via damage to the Loopring wallet: Damage to the wallet can be caused by formatting the hard drive with the application or attack by malware. In the case of such a loss, it means that the tokens are still in the network idle but still under your signature.

Hacking and sending Loopring to the wrong address: Hacking and sending LRC to the wrong address signifies permanent loss. It implies that the tokens have changed hands and they now belong to another person.

Loopring Regulation

Starting from 2009 when cryptocurrencies debuted, many administrations have been seeing them as threats. The administrations feel threatened by the fast-growing popularity of the cryptocurrencies. In the EU, the EU Commission agreed with the EU Central Bank that there was a need for an urgent remedy to address threats emerging from digital currencies. The commission was categorical that if the problem is not addressed, it could eventually become a haven for criminals. But it is not just the EU that has voiced concerns. Other countries not sitting pretty with cryptocurrency growth include the US, the UK, and China. Here are some of the main issues cited by different countries.

- The danger of cryptocurrencies becoming platforms for funding terror.

- Lack of consumer protection in the Cryptocurrency networks.

- As decentralized networks that facilitate peer2peer operations, there is a risk of organizations such as banks closing down.

- The networks are anonymous and, therefore, impossible for administrations to follow on tax compliance.

While the countries have been clear on the threats facing them, it is interesting to note that none of them has installed a cryptocurrency regulatory framework by mid-2018. It appears that many of the nations are stuck. They neither know where to start nor navigate through the Cryptocurrency legal frameworks.

For others, it is the challenge of stifling what they have created. In Hong Kong, the administration started a Fintech Facilitation Office (FFO) to fast-track its efforts to remain a global business hub. Now, some of the products from such efforts are cryptocurrencies and tokens such as Loopring. Other administrations seeing this as a challenge include the US, China, South Korea, and the UK. Such administrations find it very difficult to suddenly draw regulations for limiting inventions that are partly their own.

Efforts to craft new regulations are further limited by the evolution of the subject. Because of the fast-growing popularity of cryptocurrencies such as Loopring and Bitcoin, the subject of regulation has become highly political. Now administrations that press to pass regulations are viewed to be against the people's will.

It is important to note that while such legal frameworks are no doubt difficult to craft, the resolve by administrations to draw them indicates that it is a matter of time before the laws come into place. Indeed, some of them are at different stages of passing cryptocurrency regulations. Take a look at the next section to learn where different jurisdictions have reached with cryptocurrency regulations.

Is Loopring Legal?

Yes, Loopring is legal in most countries depending on the stand taken by individual administrations. Though there is no administration that had passed a cryptocurrency regulation by mid-2018, some had opted for direct orders to restrict some or all operations.

1) The European Union

Loopring is legal in the EU. The EU is one jurisdiction that appears undecided about the actual route to follow when it comes to cryptocurrency regulations. The EU Parliament, the arm charged with the role of passing cryptocurrency regulations, points out that cryptocurrencies come with their own share of benefits and demerits that need to be studied before a regulation can be drawn. This stand appears to sharply go against other top organizations including the EU Central Bank and the EU Commission.

The commission was categorical that the risks from cryptocurrencies are many and cannot be wished away. Speaking to the press in January 2018, Valdis Dombrovskis, vice president of the European Commission said that the union was worried that cryptocurrency had opened to large security gaps that must be addressed with urgency. He cited some of the top concerns to include;

- High price volatility.

- Danger of complete loss.

- Operational risks.

- Security failures.

- Liability gaps.

- Market manipulation.

Even as the top administration appears to pull in different directions, individual countries have come out to express their support for an urgent legal framework. Germany, the UK, and France have already set up mechanisms to look at these regulations at the local level. It will be interesting to see the route that the giant union will take in the coming days.

2) Venezuela

While many countries have been demonstrating the threat they face when it comes to cryptocurrencies, one country that has taken a completely different route is Venezuela. The administration has its own cryptocurrency referred as petro cryptocurrency. When you dig deeper into this small country whose currency might not click much when it comes to global economics, it emerges that something other than love for blockchain technology is driving the blockchain agenda.

For years, Venezuela has become synonymous with human rights abuses under the leadership of President Nicholas Maduro. This has resulted in numerous sanctions by many countries including the United States. The sanctions that make it almost impossible for the administration to sell its petroleum forced the Maduro workers to think harder and search for a solution. They opted to go blockchain.

Because cryptocurrencies such as Loopring are encrypted and anonymous, transactions cannot be traced to the sellers. This means that Venezuela can sell its petroleum without raising a red flag. The use of blockchain technology has demonstrated that it can be used to facilitate payments even at the national level but also raises the threat of supporting oppressive regimes.

While everybody has been looking at the application of the petro cryptocurrency and thinking that it is simply a getaway option, the administration appears to be training the next move. In April, the Venezuela parliament adopted the presidential decree that all government departments start adopting the petro cryptocurrency as a legal tender. The focus has attracted interest from other countries with Russia, China, and India following the country to see whether they can replicate similar systems.

3) The United States

Loopring is legal in the United States. The United States was the first country to note the threats that come from cryptocurrencies. However, it was yet to install a legal framework for them by mid-2018. In a special communication from the Federal Bureau of Investigation (FBI) to the government, cryptocurrencies were noted to pose a huge risk to the financial system and even raised concerns of being used to raise funds for terror groups. Despite this, and additional threats associated with cryptocurrencies such as Loopring in the later years, the US had not crafted a legal framework by mid-2018.

Starting in early 2018, the administration appeared to adopt a global approach to crafting cryptocurrency regulations. In January 2018, the U.S. Treasury Deputy Director Sigal Mandelker, visited countries with highest cryptocurrency populations including South Korea, China, and Japan to try and forge a common front. While speaking in Seoul, South Korea, Sigal pointed out that the world was faced with the risk of a new form of Swiss accounts in the name of cryptocurrencies. He also lauded China for its firm stand on cryptocurrencies because the threats have become so imminent.

With the federal administration being unclear of the route to follow with cryptocurrency regulation, individual states have opted to look for local solutions on operations related to cryptocurrencies such as Loopring. In April 2018, Arizona became the first state to pass a cryptocurrency regulation allowing citizens to pay taxes in cryptocurrencies. After passing Bill 1091, Arizona citizens can now pay their taxes with Loopring among other cryptocurrencies. The law requires that the cryptocurrencies are converted to USD and credited to the payer’s tax account immediately after payment. While the new Arizona law was created out of goodwill to help raise the tax collected in Arizona, it has created huge ripple effects both in the US and away.

In the US, other states including New York, Georgia, and Nebraska have all lined up to pass similar regulations. Other countries have also started studying the Arizona law because it has opened a new way of looking at the positive side of cryptocurrencies.

4) Russia

Russia is one country that has dared to make the first bold step to craft a cryptocurrency law. Like most other countries, Russia was skeptical about cryptocurrencies and indicated that passing a regulation was tantamount to legalizing it. The finance ministry only cautioned people about the huge risks of using cryptocurrencies. In January 2018, everything changed. The finance ministry indicated that a legal loophole that made it impossible to tell whether people who accepted payment in Loopring or other cryptocurrencies had been identified. Therefore, the central bank and ministry of finance went into an overdrive and released a draft law referred to as Digital Assets Financial Bill.

The draft law seeks to create order in the cryptocurrency world, promote tax compliance, and enhance accountability. The ministry of finance and the Duma Committee on State Construction pointed that the bottom line of the law is protecting Russians from losses.

Digital assets are classified as properties and further categorized into tokens or cryptocurrencies. This implies that people cannot use the cryptocurrencies for payments in the country. To tame the fast-growing cryptocurrency trading, the law requires all entities issuing cryptocurrencies and exchanges to be registered because they are generating properties into the market. Even miners are also required to be registered entities.

Exchanges that want to operate in Russia are required to be registered with the authorities and to implement strict KYC (know your customers) strategies on all clients. This means that from tokens generation through trading, the administration wants to know who is involved. If the draft bill is passed into law, it could signal the end of anonymous trading.

Loopring and Taxes

If you thought that the topic of cryptocurrency regulation is complex, hold on until you delve into the taxes. Many people coming to cryptocurrencies are holding the view that the anonymity espoused in them was meant to help tax evasion. This is one of the primary drivers of many administrations to focus on crafting legal frameworks.

In the United States, Credit Karma reported that by February 2018, less than 100 of the approximately 250,000 files tax returns at the federal level reflected cryptocurrency related tax losses or gains. But it is not just the United States that is experiencing the problem. Thailand, South Korea, Japan, and the UK have all voiced concerns for tax evasion.

While many cryptocurrency traders see this as an opportunity to operate tax-free, experts are holding a completely different view. They indicate that though the cryptocurrencies can provide the anonymity to users at the moment, the cover cannot last forever. As new technologies get discovered, you are likely to get discovered and all the years of tax evasion through Loopring, Bitcoin, or other cryptocurrencies exposed.

Cryptocurrencies such as Loopring were not designed created to help people evade taxes. Rather, they were created to provide a more effective method of sending value, investing, and trading. Here are some of the things that you can do to avoid falling on the wrong side of the tax-related laws.

- Make sure to always note your income or losses from Loopring cryptocurrency trading.

- Ensure to treat revenue from Loopring as taxable income.

- If you are unsure of how to handle or fix balance sheet about trading through cryptocurrencies, consider working with tax experts.

Does Loopring Have a Consumer Protection?

No, Loopring does not have consumer protection. When Loopring founder released the platform online, he ceased its ownership to nodes spread in its system. This implies that the governance and all actions in the system are dependent on the users of the network. If something happens in the network, there is nowhere to report to. Unlike banks that confirm the address of both senders and recipients when running transactions, there is no centralized entity to follow the details. The issue is even worse because you cannot run to a court of law because cryptocurrencies are not regulated. To be sure of operating safely on the network, here are some useful tips to follow.

- Always triple check the public address before sending value.

- Keep the private and seed phrase safely and preferably away from the main computer.

- Avoid visiting risky sites from the computer used to transact Loopring tokens.

- Only work with exchanges that are highly committed to protecting all users’ assets.

- After trading LRC in the exchanges, make sure to move them to your wallet.

Illegal Activities with Loopring

When cryptocurrencies were discovered, many criminals believed that they had finally gotten a channel to assist them commit crimes without getting discovered. As an anonymous network with a high potential native asset, Loopring has been very attractive to both genuine users and even illegal users. However, no illegal activity had been reported by mid-2018.

Is Loopring Secure?

Yes, Loopring is a secure platform. When Daniel Wang worked on creating a great trading platform, he also wanted to provide users with a guarantee that their assets and information would be safe. Here are the main methods used to make the platform as secure as possible.

- It is a truly decentralized network. This means that there is no single point of failure like the way it happens with centralized exchanges.

- The nodes in the Loopring network help monitor accounts that look suspicious based on the public keys balance.

- The platform encrypts every detail about users so that no one can easily decode the information.

- The transactions are distributed by multiple off-chain nodes (relay mesh) that help to ensure all miners get a chance to confirm transactions. This reduces the risk of 51% attack.

Is Loopring Anonymous?

Yes, Loopring is an anonymous network. To keep users information as secret and secure as possible, Loopring uses advanced encryption. By encrypting all the details, it implies that even miners in the Loopring network who confirm transactions can only follow back to check the balance. However, they cannot know about the actual owners.

Has Loopring Ever Been Hacked?

Loopring has never been hacked. Since August 2017 when Loopring was released, no successful hacking had been reported by mid-2018. The development team has been very aggressive in identifying all the gaps in the core code and filling them before any attack becomes successful. Note that this does not mean that there are no hacking attempts in the network. Because of the fast-growing popularity of the network, hackers have been making regular attempts with no success.

How Can I Restore Loopring?

If you have lost Loopring tokens, it might be possible to restore them depending on how prepared you were before the loss. Here is a demonstration of how to restore Loopring depending on the nature of loss.

For those who lose their LRC through hacking or sending to a wrong address, there is no method that can be used to restore them. This implies that you have lost them completely because the transactions are considered complete and already added to the public ledger.

- If you lost Loopring through loss of private keys, the tokens can be restored. You will need to regenerate them using the seed phrase.

- If you lost LRC through damage to the wallet, you need to use a backup. This means that you need to be properly prepared well before the loss happens by backing up everything.

Why Do People Trust Loopring?

- The Loopring system has attracted support from top corporate. This is an indication of trust they have in it. Now, even those who had buts about it are lining up to join the network.

- The Loopring network pools some of the top blockchain minds in the market today. From the team leader who had many years decorated with success at top companies such as Google to its advisors such as the NEO founders, the entire group inspires a lot of confidence.

- The network employs the latest technology and commits to progressively add new features. This implies that users can expect to see the network grow over time raising the prospects of becoming the best cryptocurrency in the market.

- The platform is marketed as a better option. Unlike most platforms such as Bitcoin and Bitcoin Cash that only allow traders to hold and send value, Loopring had added a new feature that allows people to trade in total anonymity.

- The Loopring foundation supports the overall development of the blockchain niche. Though the foundation has its work cut out, focus on supporting additional technologies such as ring browser sites and WeChat mini-programs has endeared it to more people.

History of Loopring

The history of Loopring can be traced back to August 2017 when it was released. It also ran an ICO from 1st -16th August 2018 that raised $45 million. Here are other events that make Loopring history.

- On December 2017, Loopring entered into a partnership with the Jibrel Networks. Jibrel aims to use the Loopring protocol in eliminating counterparty risks.

- On February 2018, Loopring partnered with YBF Ventures and the Victoria Government to help expand the benefits of decentralized web ecosystem. The government of Victoria is seeking to create new platforms for nurturing startups to the next level.

- On March 9th, 2018 Loopring entered into another partnership with Morpheus Wallet. Morpheus Wallet is a desktop built wallet established on top of the NEO blockchain.

- The price of Loopring has been relatively stable compared to other cryptocurrencies in the market. When it was released in August 2017, the price was about $0.1. Then, it fell to a low of $0.6 in early September before climbing to a high of $0.22 a month later. The price remained at that range until mid-December 2017 when it shot up to $1.9 on January 10th 2018. This was the highest mark in its history by mid- 2018. In the subsequent three months, the price shot down again to reach $0.3 on mid-March and hit another high of $1 on April 30 following the signing of a partnership deal with Morpheus Wallet. Starting in early May, the price of Loopring went on a downward trend hitting $0.2 on July 10th 2018. It will be interesting to see how the price moves later in 2018 and 2019.

Who Created Loopring?

Loopring was created by Daniel Wang who is the current team leader at the network. After discovering the threats that many people faced when trading their cryptocurrencies at the exchanges, Wang decided to work on a lasting solution. Wang had previously worked as a tech lead at Google and also an Engineering Director at JD.COM.

To make his efforts successful, Wang sought advice and support from other top tech personalities. These include Jay Zhou, the risk operations expert at PayPal and Johnston Chen, the 3NOD CIO. The Loopring project was also supported by Da Hongfei who is the founder of the NEO project.

Loopring Videos and Tutorials

See Also

- Bitcoin | Ethereum | Ripple | Bitcoin Cash | Litecoin

- Cardano | NEO | Stellar | EOS | NEM | VeChain Thor

- Monero | Dash | IOTA | TRON | Tether | OmiseGO

- Bitcoin Gold | Ethereum Classic | Nano | Lisk | ICON

- Qtum | Zcash | Populous | Steem | Ontology | Waves

- DigixDAO | Bytecoin | Bitcoin Diamond | Binance Coin

- Bytom | Verge | Crypto Humor

- Cryptocurrency Dictionary | List of Cryptocurrencies | CEX.io

- Binance | Coinbase | Changelly | Coinmama | Bitpanda

- LocalBitcoins | Kraken | Paxful | Ledger Nano S | TREZOR