Waltonchain

Waltonchain cryptocurrency guide advises where to buy and how to buy Waltonchain. This guide also contains the markets, value, trading, investing, buying, selling, transactions, blockchain, mining, technology, advantages, risks, history, legislation, regulation, security, payment, networks and many other interesting facts about Waltonchain as well its status in the world of cryptocurrencies.

Waltonchain, Thursday, 2025-06-12

Contents

- 1 What Is Waltonchain?

- 2 Beginner's Guide to Waltonchain

- 3 Where and How to Buy Waltonchain?

- 4 Waltonchain Markets

- 5 Where to Spend or Use Waltonchain?

- 6 How Does Waltonchain Work?

- 7 Waltonchain Regulation

- 8 Is Waltonchain Secure?

- 9 History of Waltonchain

- 10 Waltonchain Videos and Tutorials

- 10.1 Waltonchain (WTC) - Visit and Product Demo (Part 1 of 3)

- 10.2 Waltonchain (WTC) Interview and Demo - (Part 2 of 3)

- 10.3 Waltonchain (WTC) in A Nutshell (Part 3 of 3)

- 10.4 Market Falls Asleep? Walton (WTC) Caught Red Handed

- 10.5 WaltonChain GPU Mining with Wallet and CLI

- 10.6 WTC Coin Review

- 10.7 Walton Coin (WTC) - How RFID And The Blockchain Will Change The World

- 11 See Also

What Is Waltonchain?

Waltonchain is a project that combines IoT (Internet of Things) with blockchain technolgy to generate a supply chain management system. The project specifically focuses on RFID (Radio Frequency Identification) technology and was named Waltonchain in honour of the RFID founder Charlie Walton. The founders appear committed to building on the foundations of RFID technology to take it to the next level.

It is important to appreciate that the logistics niche is very complex. In most cases, it entails bringing various components together. However, the system becomes very complex as the system grows progressively. This makes following the supply chain complex and almost impossible to collect the right data. This is the problem that Waltonchain came to solve.

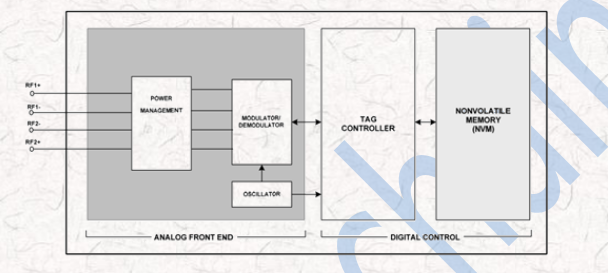

Waltonchain employs the RFID technology that helps in identifying targets, reading, and writing data through radio signals. The Waltonchain system integrates RFIDs into the blockchain system so that data is generated continuously enabling users to track their production and supply chains with precision. Data gathered on every item is added to immutable Waltonchain public ledger to guarantee users of utmost accuracy no matter the stage in the production line.

Beginner's Guide to Waltonchain

Have you been planning to join a cryptocurrency network? One of the high potential networks you should probably consider is Waltonchain. This is a project that brings together the blockchain technology and RFID applications with the target being to revitalize the logistic niche. Because of the complexity involved in the supply chain networks, the niche has largely been left unattended as cryptocurrencies focus on other areas.

Between launch and the second quarter of 2018, Waltonchain has already demonstrated its huge potential. This is what has been driving the fast growth of its value in the markets and strong preference by the community. Now, though all indicators might point that it is the ultimate project, you need to take a closer look. This is why this guide was created.

This guide is a comprehensive review of Waltonchain to determine its design, operations, security consumer protection, and history. This is not all. The guide digs deeper to follow the advantages associated with Waltonchain and even risks. It has all the answers about the network. Welcome to learn more about the cryptocurrency and make the right decision about joining it.

Where and How to Buy Waltonchain?

While cryptocurrencies have been making inroads into most niches in the market today, their entry into the supply chain has been limited. This was attributed to the complexity involved in supply chains. By targeting this lucrative area, people agree that the potential of Waltonchain is really huge. To be part of this network and enjoy the espoused growth, you need to start by acquiring the native coins. Here are the two main methods you can use to buy WTC.

- Purchase from the exchanges. The cryptocurrency exchanges are the primary markets for digital assets. You can visit the exchanges that list Waltonchain such as Binance, KuCoin, and Coinnest. Note that in all the exchanges, users are required to start by registering for trading accounts and verifying them with additional details such as phone number and proof of location.

- Buy Waltonchain from those who already have them: The fast-growing popularity of cryptocurrencies has resulted to the emergence of crypto clubs such as London Cryptocurrency Club and Cryptocurrency Collectors Club. These are special organizations created to help people share information about cryptocurrencies. The clubs have also become important points for people who want to sell their WTC. The clubs are preferred because they are not bound by strict rules such as those required by the exchanges. The biggest challenge of these clubs is that you can take a very long time before getting a person targeting to sell the quantities of WTC that you want to purchase.

Waltonchain Wallet

If you want to join the Waltonchain network, one must have thing is a cryptocurrency wallet. This is the location that will hold the Waltonchain coins. It is also used to make payments in the network. It is also used to help make transactions related to the network. Before checking at the types of Waltonchain wallets, it is important to look closely on this concept of cryptocurrency wallet.

Though the accepted definition is the location that holds the Waltonchain coins, the description is indeed a misconception. The native coins, WTC, can only reside in the Waltonchain network. This means that they cannot be moved outside the network or even stored elsewhere. What the Waltonchain wallet stores are a set of codes that help to point at your WTC in the system.

The first code generated by a Waltonchain wallet is the private keys. This is a special code that points at your WTC in the system and calls them to live when making transactions. The code is private and should never be shared.

The second code generated by the Waltonchain wallet is the public keys. This is a code that points at your wallet. If you have a person who wants to pay you in WTC, you provide public keys. The keys are also used in mining to confirm whether you have ample WTC to spend.

The last code generated by a Waltonchain wallet is the seed.' This is a special code designed to help users regenerate the private keys in the case of a loss. The seed and the private keys should be kept carefully and preferably away from the main computer. They should also not be shared with third parties.

To know the best cryptocurrency wallets to use for Waltonchain, it is important to factor their safety, ease of use, and charges. You can indeed use most of the Ethereum based/ ERC20 compatible wallets including the following.

- Ledger Nano S.

- MyEtherWallet.

- Trezor.

- Parity.

Where to Buy Waltonchain with Credit Card?

Credit cards have become the primary method of payment in most shops. Because they are accepted in both conventional and online marketplaces, no one wants to stay without a card. Now, you can also buy the preferred crypto asset such as WTC with a credit card from Coinnest. However, most of the platforms do not accept credit cards. To buy WTC from a crypto-only exchange such as Binance, you will need to start on a different platform. For example, you can consider buying Bitcoin at CEX.io and exchange them for WTC at Binance.

Where to Buy Waltonchain with PayPal?

There is no direct method that can be used to buy Waltonchain with PayPal. PayPal looks at crypto networks as direct competitors. Though the network administration has indicated that it will start supporting the crypto networks, there are no signs that such payments will be happening any time soon. Therefore, people with cash in their PayPal accounts can only buy Waltonchain by downloading to the bank account or credit card.

How to Buy Waltonchain with Wire Transfer?

Banks are some of the most trusted institutions in the globe today. People trust them because they strictly follow expert procedures and demonstrate a lot of commitment to deliver results. They walk with you until the expected results are realized. Now, more people prefer to use wire transfers to buy crypto assets such as WTC. Here is the procedure to follow when buying WTC with wire transfers.

- Start by acquiring an appropriate cryptocurrency wallet. This is the location that will hold your digital assets after the purchase is over.

- Select the exchange that lists WTC and open a trading account. You also need to verify the trading account in the exchange by providing additional information such as telephone number and proof of location.

- On the selected exchange platform, select buy Waltonchain with a wire transfer. The transaction will immediately go into a pending mode until the cash hits the exchange. This will take about two to three days depending on the exchange of choice and its location.

- Once the transaction is completed, you will need to move them to your wallet. Your wallet is safer because you are the only one with the control through private keys.

NOTE: If you select a cryptocurrency exchange that does not support wire transfer, the purchase process might need to start from a different platform such as Changelly. Simply visit Changelly to buy Bitcoins or Ethers and use them to buy Waltonchain from the exchange of choice.

Where to Sell and Trade Waltonchain?

If you have accumulated some WTC, one of the thoughts running through the mind might be how to optimize profitability. Though many people prefer holding the coins waiting for the value to grow, a better method is trading in the markets. These are the exchanges that allow those with different digital assets to sell and trade them.

While the Waltonchain and other networks operate as decentralized and peer2peer systems, the trading platforms are different. Because they are guided by local laws, the platforms operate like the standard forex markets. This implies that you are required to open a trading account and verify it before starting to sell your WTC.

When selecting trading platforms, it is important to appreciate that they are the soft underbelly of the cryptocurrency industry. Most hackers target them because they are centralized. Indeed, most of the hackings you have heard in the cryptocurrency industry were probably done in the crypto exchanges. For example, YouBit cryptocurrency exchange was hacked in December 2017, and millions worth of crypto coins lost. The platform was forced to file for bankruptcy. A month later, another exchange in Japan called Coincheck was hacked and a lot of coins lost. This leaves one main question; how can one identify a great secure trading and selling platform? Here are some useful tips.

- Only work with a cryptocurrency that puts a lot of effort on users' security. You can check for features such as the use of cold storage, 2-factor authentication, and insurance.

- Make sure that the selected exchange has been in the market for some time and its stability ascertained. You can know this by reaching the crypto communities such as Bitcoin Talk and Reddit.

- Go for the exchange that has great support for its users. This will simplify the process of resolving issues when they arise.

- A great platform should have advanced trading metrics that allow users to easily analyze the market.

- Look for a platform with affordable transaction charges. This will help you to keep the bulk of the profit made when trading WTC.

The top cryptocurrency platforms that will allow you to trade and sell Waltonchain include Binance, Okex, Latoken, Idex, and COSS. Remember to check for the platform that allows traders from your area.

How Much Are the Transaction Fees of Waltonchain?

When cryptocurrencies entered the market, one of the primary aims was to help pull down the cost of sending value. Because Waltonchain operates as a peer2peer system, the centralized and profit-seeking organizations are bypassed. This has been the primary reason for the low transaction costs at the network.

The cost of the transaction is called byte fee. This is the fee paid by the node that initiates a transaction. The byte fee is used to meet the cost of Waltonchain bandwidth utilized. The accounting node (validator) is allowed to set the minimum accepted cost while the initiating node (initiator) is free to set the maximum cost to be paid. This means that there is no specific transaction fee at the network.

Waltonchain Markets

Since 2009, the cryptocurrency niche has been growing rapidly. The markets have also been growing at a very fast pace to keep up with the rising demand and growing list of cryptocurrencies. Note that most Waltonchain markets, except those using decentralized exchanges, require users to open trading accounts before allowing them to trade or sell. Here is a closer look at some of these markets.

1) Binance

This is a Chinese based cryptocurrency market that has won a lot of affection from traders because of its unique features. The market was started in mid-2017 by Changpeng Zhao. Zhao wanted to help remove challenges related to speed, efficiency, cost, and security when trading digital assets. To achieve these goals, he also launched a native Binance Coin referred to as BNB.

The biggest selling point of Binance is its low transaction charges. Users trading Waltonchain on the network only pay a flat fee of 0.1%. This makes it one of the cheapest platforms in the market today. But this is not all. You can even bring down the cost of transactions by 50% to 0.05% when traders pay the fee in the network using BNB.

Binance lists very many cryptocurrencies and does not shy away from including emerging assets. This means that user will always have something to pair with Waltonchain and enjoy high profitability. By listing new assets, it implies that those in the network are assured of picking great opportunities before others can get a wind of it. It is a great way to access and buy new tokens to sell sell later when the value increases.

The greatest shortcoming of Binance is that it is a cryptocurrency only network. This means that those with fiat currencies will have to start from another platform. A great platform that accepts fiat cash and credit cards is CEX.io. Besides, traders have been wondering whether the exchange will become a victim of the current Chinese purge against the cryptocurrency.

2) KuCoin

Like Binance, KuCoin is another Chinese based cryptocurrency exchange that has aroused a lot of interest from the crypto community because of its operational design. Its most outstanding thing is that it is always among the first networks to list new digital assets when they are released. This provides users in the KuCoin system with a great opportunity to take advantage of investment opportunities when they emerge through ICOs. For example, KuCoin agreed to list Bitcoin Private immediately after release while other exchanges such as Bittrex considered it too risky.

The cryptocurrency exchange has a very low transaction fee of 0.1%. They also provide regular discounts to users. If you pair WTC with the KuCoin Shares, you will get an additional discount on the transaction fee. It is indeed more affordable compared to other top markets such as Bittrex and Liqui. Besides, it lists very many trading assets so that you will never lack a profitable option to pair with WTC.

The biggest issue with the KuCoin is that it is a cryptocurrency platform only. For those who have cash in their banks or credit cards, trading at KuCoin will require them to start elsewhere. For example, you can buy Bitcoins at LocalBitcoins.com and use them to buy WTC at KuCoin.

3) COSS

COSS is one of the latest platforms to join the market. The term COSS (Crypto One Stop Solution) is a unique platform designed to offer all cryptocurrency related transactions. This implies that COSS operates as an exchange and wallet. The exchange puts a lot of focus on users’ assets by moving them to cold storage and further employs 2-factor authentication to limit access by third parties.

Like Binance, COSS lists very many cryptocurrencies. You can opt to trade WTC against emerging crypto assets or more established ones. Besides, the exchange allows users to move their assets to wallets immediately after closing trade. This is very important because assets in the exchanges are an easy target for hackers.

4) HitBTC

HitBTC is one of the top exchanges preferred by traders because of its reliability. The exchange charges users a very small transaction fee of 0.1%. This puts it at par with other top networks such as Binance and allows users to keep the bulk of their profits.

To make trading more profitable, HitBTC stocks a very large number of crypto assets. Whether you prefer top assets such as Ether or emerging ones such as VeChain, rest assured of getting them at the platform. The HitBTC trading metrics makes it very easy even for new traders to join the network and start trading like a pro.

The main issue of using HitBTC is its hacking history. Though the management addressed most of the issues that gave way to loopholes resulting to the attack, the hacking tag still remains. When new traders hear that the exchange was hacked, most of them simply walk away.

Value of Waltonchain

The value of Waltonchain has grown progressively thrusting the cryptocurrency to the top 60 cryptocurrencies based on market capitalization. On June 2nd, Waltonchain value was $357,742,927 at a price of $11.49. The progressive growth has seen Waltonchain climb ahead of Komodo, DigixDAO, and even Ardor.

Is It Profitable to Invest in Waltonchain?

Since its launch, Waltonchain has demonstrated the capacity to grow and deliver high ROI (Return on Investment). By the close of August 2017, the price of Waltonchain was only $1. However, it grew progressively and settled around $10 by the close of May 2018, a rise of more than 900%. Now, the network is promising even higher ROI as more corporate organizations seek partnership and the community keeps growing.

Note that even though the indicators point that Waltonchain could be a highly profitable network, everything depends on the challenges that lay on the way. For example, if countries pass harsh crypto regulations, the interest in Waltonchain and associated profitability could wane.

Where to Spend or Use Waltonchain?

Though a lot of partners have come out to indicate their commitment to work with Waltonchain, no store has pointed that it accepts direct payment with WTC. Therefore, if you have some WTC, the best method is converting to the accepted coin. The most accepted coins in the market today include Bitcoin and Ether.

Can Waltonchain Grow to Become a Major Payment Network?

Yes, Waltonchain can grow into a major payment network. Between 2009 and 2018, very few crypto networks had put their focus on the supply chain system. Now, Waltonchain has pulled a first and no player in the industry wants to be left behind. Here are some of the reasons that are likely to make Waltonchain grow into a major payment network.

- There is less competition in the supply chain niche.

- The transaction fee at Waltonchain network is very small.

- A lot of companies have already expressed interest to work with Waltonchain. This and the fast-growing community will ultimately grow the network into a major payment network.

How Does Waltonchain Work?

Waltonchain operates through four main components that help users to track production network and their products using the blockchain technology. The four include Value Internet of Things (VIoT), The Waltonchain and sub-chains, smart contracts and the native asset in the network WTC.

- The Value Internet of Things (VIoT)

- The concept of VIoT is a combination of the blockchain technology and RFID technology. The RFID tags make it possible for the blockchain to store even data on physical items on the chain.

- The RFID tags utilize electromagnetic fields to identify objects in the supply chain. The tags are used in library systems, tracking, and product kiosks such as Redbox. Now, Waltonchain provides users with all the details they need. For example, it is very easy to track where a product is, the path it has followed, the person who handled the item, and other pertinent data. Some of the major benefits of applying VIoT in the logistics sector include improved security via blockchain, accuracy in tracking the products to their origin, and reduced labour-related costs.

- The Waltonchain and sub-chains

- Waltonchain is the parent chain in the Walton ecosystem. The chain helps to track transactions involving WTC, executes smart contracts, and managing sub-chains.

- If you are using the Wanchain technology, it means that you are allowed to create own sub-chains and own your tokens. Indeed, you can even opt to use your own consensus algorithm that is completely different from the main chain. If you decide to separate your chain from the main chain, it becomes easier to customize the system to specific needs. In the event that the parent chain suffers from a problem, your side chain will not be affected.

- The smart contracts

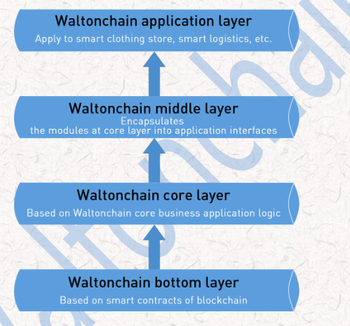

- The smart contracts are based on the programmable features designed to build the platform logic. This breaks the Waltonchain into four layers; the bottom layer, core layer, middle layer, and application layer. The smart contracts were designed by Ethereum and applied in electronic contracts, electronic crowdfunding, and token release. This process utilizes data on the received transaction, data stored in the account, and block status. Note that the smart contracts only executes when all the present conditions are met.

- Waltoncoin (WTC)

- This is the native asset in the Walton network. A total of 100 million WTC were created when the genesis block was created and are the only ones that will ever exist. The coins will be used in the Waltonchain as dividend interest, issuing sub-chains, and governance system. They will also be used in the credit and mortgage system and distributed asset exchange.

Does Waltonchain Use Blockchain Technology?

Yes, the Waltonchain employs blockchain technology. The network operates as a public ledger that hosts all the product information so that the owners can track movement with great precision. The blockchain operates in line with automated RFID tags that generate the details of a specific product into the blockchain.

The blockchain technology also comes into play when sending value. Once you initiate a transaction, it is picked by nodes spread in the network that follow back to confirm you have the amount of WTC you want to send. If you have ample assets, the transaction will be completed and the details added to the public ledger. Note that this is the final stage and the details added to the blockchain are permanent.

Mining Waltonchain

The Waltonchain system employs their unique proof of stake & trust (POST) algorithm. The algorithm operates like the standard PoS (proof of stake) that WTC to reward nodes for holding the native tokens. But Wanchain goes a step further to add reputation.

To mine the Waltonchain network, you need to start by acquiring a node in the Waltonchain system. Then, you have to buy some WTC to be selected to confirm the transactions. When your turn comes and you confirm a transaction, a reward will be given in WTC. This is the main method used to release Waltonchain coins into the network.

What Are the Advantages of Waltonchain?

When people purpose to join cryptocurrencies, they anticipate getting the benefits that were espoused by the first blockchain founder, Satoshi Nakamoto. However, Bitcoin was mainly targeted at sending value while newer networks are introducing new features to enhance their usability. Here are some of the main advantages to expect when you decide to join Waltonchain.

- The cryptocurrency provides users with an opportunity to use and own the network

- When many people visit their banks to run transactions such as sending value, they feel passive. Indeed, they feel disconnected after the transactions are over. However, joining and using Waltonchain means that you also own the system. You will be called to help with building consensus on the network.

- Waltonchain provides a sure way to invest without worrying of third-party seizures

- When you purchase WTC as an investment, they cannot be accessed by third parties. Even if a court battle hauls its way into your doorstep, no one can know about your investment or even freeze it.

- Waltonchain helps people to make transactions in total privacy

- If you use a bank to make savings or run different transactions, a chain of people such as cashiers, management, and even financial systems’ admin can easily pull out your details. As a truly anonymous network, Waltonchain allows users to send value and make other investments without worrying that third parties can know about them.

- The price of the cryptocurrency has been doing very well since launch

- Good performance of a cryptocurrency system is an indication of the strength of its features and trust that people develop in it. Between launch and mid-May 2018, the price of Waltonchain had grown with more than 900%.

- The Waltonchain community has been growing steadily

- Since launch, it is not just individual users who have shown interest in Waltonchain. A lot of corporate organizations have been coming out to express their support and need for partnership with the network. This is considered a positive indicator of the direction Waltonchain will take.

- The Waltonchain system allows users to create their own chains

- If you have been looking at crypto networks and wondered how they are created, there is no need to wonder anymore. After joining the Waltonchain network, you can also create and own your side-chain.

What Are the Risks of Waltonchain?

To make the right decision about joining a cryptocurrency such as Waltonchain, do not simply stop at exploring the positive edge. Make sure to also follow the expected risks in order to make the right decision. Here are the main risks that come with joining the Waltonchain network.

- The cryptocurrency is relatively new

- When a new cryptocurrency enters the market, it requires some time for all the features to get tested and proven stable. With Waltonchain being less than two years old, it will take more than five years for all the features to be proven stable and reliable.

- The danger of WTC getting lost

- Sending value on cryptocurrency networks requires people to use the public address of the targeted recipient. This is a lengthy code that is never easy to remember or even follow. This is the reason why a lot of people have been losing their WTC and even other digital assets through sending to wrong addresses. Note that such transactions are not reversible.

- The looming crypto regulation

- One of the primary reasons for the fast growth of cryptocurrencies is because they are unregulated. However, most administrations feel threatened by the networks and have vowed to pass harsh legislation to contain them. If such laws are finally installed, there is a serious danger of Waltonchain reneging or even dying off altogether.

- The risk of getting attacked

- Crypto networks and even wallets have become new targets for hackers because of the fast-growing popularity of crypto networks. Attackers can target your coins either at Waltonchain network, wallet level, or even the exchanges.

- High volatility

- Cryptocurrencies have been demonstrated to be very volatile. Every time that something new happens in the crypto industry or financial sector, the price of cryptocurrency asset such as WTC respond with immediate price swings. For example, Waltonchain was among the cryptocurrencies that experienced extreme price swings between launch and early 2017. Some of the issues that contribute to this price volatility include attacks on crypto networks, news on looming regulations, and new networks.

- The Waltonchain operates on the Ethereum network

- Though operating on top of the Ethereum system might be seen as an advantage for Waltonchain, it is also a major disadvantage. Being dependent on Ethereum means that related changes will also affect Waltonchain. For example, if the transaction charges are altered or a fork is implemented on the Ethereum network, the impacts can have far-reaching implications on dependent networks.

What Happens if Waltonchain Gets Lost?

If you take a closer look at most cryptocurrency networks, someone will come indicating that his/her crypto coins were lost. The losses can happen through sending WTC to the wrong address or even hacking. However, have you ever wondered what really happens when WTC gets lost?

- If you lost Waltonchain through damage to the wallet or forgetting the private keys, it means that the coins are still in the network but in a dormant state. The good thing is that the lost WTC can be restored if you regenerate the right keys or reinstall the Waltonchain wallet.

- If you lost WTC through hacking or sending to the wrong address, it means that the coins are still in the network. However, they have changed hands and now belong to a different person. This type of loss cannot be reversed.

Waltonchain Regulation

When Bitcoin was first introduced into the market, many countries were fast to note the threats it brought. Now, close to two thousand new cryptocurrencies have joined the market and governments are finding it unbearable. In the United States, the Federal Bureau of Investigation was the first to note the threats associated with cryptocurrencies. In a special communiqué to the government, the FBI noted that development of cryptocurrencies could become the conduit for funding terror and Ponzi schemes. But it is not just the United States that is sensing the threats.

In the European Union, the EU Commission has indicated that cryptocurrencies pose huge risks to the stability of the union. The commission indicates that crypto networks lack appropriate consumer protection models that expose investors to huge risks of loss. But it is the danger of more people avoiding to pay taxes that has jolted most states to act. Interestingly, no country had passed a cryptocurrency related legal framework by the second quarter of 2018.

It has now emerged that passing such legal frameworks is no walk in the park. Most countries do not know where to start and are opting to use direct orders. For example, China banned ICOs from the country as opposed to installing a crypto framework. Here is a closer look at some of the reasons making it extra difficult to pass a cryptocurrency related legal framework.

- Cryptocurrency networks are decentralized, global and with no single point of ownership. Therefore, there is no single entity to target with the network.

- Cryptocurrency networks such as Waltonchain have demonstrated the capacity to help address issues that have been big challenges to governments in years. For example, the problem of Big Data.

- Blockchain technology is considered the apex of the fintech that most administrations have been nurturing for many years. Now, not many administrations want to stand in the way of the inventions they founded.

- The cryptographic solutions have been malting so fast that many countries are forced to play catch-up. Indeed, some do not even know where to start or go about the cryptocurrencies.

Though many governments appear far behind creating legal frameworks for cryptocurrencies, one thing that remains clear is that the laws will finally dawn. Therefore, people investing in Waltonchain and other related networks should do it with a lot of focus on long-term applicability. Be prepared for possible after-shocks that might hit the cryptocurrencies once legal frameworks are finally installed.

Is Waltonchain Legal?

Waltonchain is legal in most of the states across the globe. Because most countries are yet to install legal frameworks to guide the use of cryptocurrencies, it means that you can invest in Waltonchain and use the network without worrying about breaking the law. However, it is important to note that some states have indeed outlawed the use of Waltonchain and other networks in their jurisdictions. Here is a closer look at the Waltonchain legal status in individual jurisdictions.

1) The United States

Waltonchain is legal. The United States was the first to note the threats that come with cryptocurrencies. Despite this, the federal administration does not appear to be in a hurry to craft a local arrangement to guide cryptocurrency operations. The government holds the view that a global regulatory approach will have a greater impact both in the US and internationally too. The Treasury fears that even if a local solution is crafted, the fast-growing anonymous networks are still likely to flourish from other jurisdictions.

In January 2018, the Treasury Deputy Director, Mr. Sigal Mandelker, visited China, South Korea, and Japan to craft a common front in creating crypto laws. Speaking at a conference in Tokyo, Sigal indicated that the threats posed by cryptocurrencies have to be tackled urgently. He supported the stand taken by the G20 that cryptocurrencies need to be controlled to prevent them turning into new Swiss accounts.

Even as the United States keeps searching for the right global footing in addressing cryptocurrencies, the local states have started crafting some legal frameworks to fit their needs. In March 2018, Arizona passed the famous Bill 1091 that allows citizens to pay their taxes in cryptocurrencies. The bill was passed after it emerged that many people in cryptocurrencies were avoiding paying taxes because of associated inconveniences. Under the bill, the crypto assets used to pay taxes are immediately converted to US dollars and credited in the payer’s account.

Though Arizona was only working on a model that fits its own situation, it has become an important point of reference. More states have lined similar laws to help them raise more in taxes. Even other countries are now softening their stand after realizing that good crypto laws can be used to help increase the tax collected.

2) The European Union

Like the United States, the EU is yet to come up with the common stand when it comes to crypto regulations. Indeed, different arms of the giant union have been pushing in different sides. The EU Central Bank was the first to warn the citizens about the threats that come with cryptocurrencies. The bank called for caution by indicating that cryptocurrencies are highly volatile and could result in total losses.

The EU Parliament, unlike the central bank, was subtle in its commitment to immediately crafting a crypto law. The legislative arm indicated that cryptocurrencies represent the apex of the fintech. Therefore, they cannot be simply quenched. The parliament called for a comprehensive study about cryptocurrencies before a legal framework can be installed.

To give the need for a legal framework some impetus, the EU Commission has come out to demonstrate the dangers associated with cryptocurrencies such as Waltonchain. Speaking to the press in Brussels, the EU Commission Vice President, Valdis Dombrovskis indicated that there are serious gaps in the application of cryptocurrencies that must be addressed through a clear legal framework.

- High price volatility.

- Clear risk for investors.

- The danger of total loss.

- Operational risks.

- Security related risks.

- Price manipulation.

- Liability gaps.

Individual EU countries have already started coming out to support the commission’s focus in crafting a comprehensive legal framework for cryptocurrencies. For example, France created a working group that will share its findings with the commission. Other countries supporting the initiative include the UK, Germany, and Austria.

3) China

China is one country that has not had kind words for cryptocurrencies. Though the administration appears to be softening its stance on crypto networks, it has been the roughest of all nations in dealing with crypto related activities especially in 2016, 2017, and early 2018. The country started with banning of ICOs in its jurisdictions. The administration indicated that after following all the ICOs that were launched in China by 2017, over 90% of them were found to be scams.

After banning ICOs, China went ahead and froze the accounts of cryptocurrency exchanges that supported them and miners kicked out of the country. To demonstrate that it was willing to go even further, China has indicated that it will disallow even exchanges based outside China from accessing the local market. This approach has seen many exchanges opt to relocate from China and select neutral jurisdictions for their operations.

When Sigal Mandelker, the US Treasury Deputy Director, visited China in January 2018, the suggestion by China that all crypto related info be shared between nations caught the cryptocurrency community by a surprise. The Chinese administration supports the G20 suggestion for a comprehensive legal framework and further seeks to have it operate as an extension of the CRS (Common Reporting Standards) framework of the OECD.

4) Singapore

Singapore is one country that has taken a hasty shift in its focus on cryptocurrency regulation. Initially, the Monetary Authority of Singapore (MAS) was quick to point at the threats that come with the use of cryptocurrencies up to December 2017. However, the approach shifted completely in 2018.

On January 9th, 2018, the Singapore’s Deputy Prime Minister, Tharman Shanmugaratnam, was the first to endorse the use of cryptocurrencies such as Waltonchain. Tharman indicated that the nation's laws do not differentiate between any transaction done via fiat or cryptocurrencies. All the methods simply underscore the process of transmitting value. The position was supported by Sopnendu Mohanty, the MAS chief who indicated that it was unlikely for cryptocurrencies to cause a Lehman Brothers-like financial meltdown. However, the two leaders agreed that a legal framework was important for consumer protection.

Waltonchain and Taxes

The topic of taxes is as complex as that of the cryptocurrency regulations. Because most cryptocurrencies are anonymous, some people using them hold the view that they can live tax-free. This is one of the primary reasons driving countries into crafting very strict regulations.

In the United States, Credit Karma Tax reported that only a handful of people pay their crypto related taxes. Many people do not even capture in their tax reports, the transactions they did trading assets such as Waltonchain. But the United States is not alone. In Russia, the country has crafted a draft digital assets bill that amplifies KYC (know your customers) efforts at the exchanges and requires all entities releasing tokens or mining them be registered. The efforts are aimed at curbing tax avoidance and crime.

Tax experts are of the view that people who fail to pay taxes are abusing the technology. They further argue that the anonymity provided by different cryptocurrencies can only last for a short time. When newer and more advanced technologies are discovered, all the years you failed to pay taxes will be exposed. This could open a gate to dozens of tax avoidance related lawsuits.

However, saying that you should pay taxes should not dim your prospects of enjoying one of the most promising networks, Waltonchain. To enjoy all the benefits associated with it, here are some tips to apply.

- Make sure to consider all cryptocurrency related income as taxable revenue.

- Ensure to cite in the annual books of accounts the profits or losses from Waltonchain or other cryptos related trading.

- If you run a business that accepts payment in Waltonchain, ensure to re-examine the books so that they are in line with the accepted standards.

- If you find it hard to navigate about the entire Waltonchain trading or want to reconcile the years you were not tax compliant, do not hesitate to talk to a tax expert.

Does Waltonchain Have a Consumer Protection?

Waltonchain does not have consumer protection. Like other cryptocurrencies such as Ethereum, Waltonchain employs Proof of Stake (PoS) consensus model which means that the network and all the decisions made there are owned by the users. If you have an issue such as sending value to the wrong address, it means that there is nowhere to take a complaint to. To operate safely in the Waltonchain, here are some useful tips to employ.

- Always triple check the public keys of the target recipient before flagging off payments.

- Only select the exchanges with great commitment to user security.

- Ensure you are on the latest Waltonchain and computer update.

- Transfer most of your Waltonchain coins to cold storage as opposed to leaving them in the exchanges.

- Avoid visiting dangerous websites that can give hackers easy access to your computer and system.

Illegal Activities with Waltonchain

When cryptocurrencies debuted, criminals saw a new line of defrauding their targets. Because the networks are anonymous, criminals believe that they cannot be easily identified or even nabbed by authorities. Despite this focus by criminals, no illegal activity had been reported with Waltonchain by the second quarter of 2018.

Is Waltonchain Secure?

The greatest concern for people looking to join the cryptocurrencies is security. People want to know that their assets are free from attacks. At Waltonchain, the development team has been very aggressive in releasing new updates to fix emerging bugs. Waltonchain also employs the following measures for extra security.

- The system uses PoST (proof of stake and trust) that requires nodes to have both stake and reputation. This reduces the danger of 51% attack on the network.

- The Waltonchain system is implemented as an overlay on the Ethereum network. It is, therefore, an added layer of security.

Is Waltonchain Anonymous?

Yes, Waltonchain is an anonymous network. The Waltonchain system integrated the RFID tags into its blockchain technology so that users can easily track their products, know who handled them, and every other relevant data stored in the blockchain. This information is encrypted and only you have access to it. For those who want to send value in WTC, the personal details are encrypted at the node so that no other person can have access to it.

Has Waltonchain Ever Been Hacked?

Waltonchain has never been hacked. When the Waltonchain founders set out working on the network, they were very concerned about rampant attacks especially those directed at the networks that resulted in huge losses to investors. Therefore, they put a very strong system that has helped to prevent hacking at the network.

NOTE: Though Waltonchain has never been hacked does not mean that it is not targeted by hackers. The development team reports that they note attacks very many times but thwarts the attempts before they can become successful.

How Can I Restore Waltonchain?

Have you lost Waltonchain coins? Depending on the method of loss, there is a possibility that the crypto coins could be restored depending on the nature of loss.

If you lost WTC through damage to the wallet, restoration can only be possible through re-installing from a backup. However, those who lost their WTC through forgetting the private keys can only restore them regenerating the keys with the seed. This implies that you need to be prepared well before the loss happens. Make sure that everything is backed up preferably away from the main computer.

NOTE: If you lost Waltonchain through hacking of sending to the wrong address, there is no method that can be used to restore the coins. They are lost forever.

Why Do People Trust Waltonchain?

As more cryptocurrencies continue entering the market, the competition is becoming very stiff. People are becoming more analytical and only join the crypto networks they can trust. Here are some of the main reasons why people have a lot of trust in Waltonchain.

- The Waltonchain system development is led by a very enthusiastic and tech-savvy team. With most of them having a long experience in the supply chain system and computing, both the crypto community and businesses see huge potential for growth.

- While it is true that China is very negative about cryptocurrencies, Waltonchain appears to be on good terms with the administration. For example, the Waltonchain’s Professor Wei Songje was part of the panel invited to speak during the Big Data Industry Expo at the end of May 2018.

- The Waltonchain is created on top of the Ethereum system. This provides an additional layer of security and trust that people need when joining the crypto industry.

- The value of the cryptocurrency has grown steadily between launch and the first quarter of 2018. The cryptocurrency community is optimistic that the growth will be maintained.

- The niche targeted by Waltonchain does not have a lot of competitors. This implies that f Waltonchain could enjoy near monopoly operation in the supply chain niche before other interested parties join in.

History of Waltonchain

- In August 2016, Waltonchain was released and an ICO held successfully. By early 2018, a total of 70 million of the total 100 million had been released into the network.

- on 25th January 2018, Waltonchain entered into a partnership with Mobius. Mobius will help to enhance how the real world data, as well as the existing apps, connect to the blockchain. It will also help to allow smart devices share resources.

- In April 2018, Waltonchain announced the partnership with Huodull to help facilitate deploying blockchain in the logistics platform.

- The price of Waltonchain started at $1 by the close of August 2017 before shifting upward sharply to $8.48 at the onset of October and then falling with about 50% to reach a low of $4.4 by the close of November. The price grew to the highest point in its history, $40.75, by the close of January 2018 before shifting down and stabilizing at around $10 by the close of May 2018.

- In June of 2018, Postal Bank of China announced its partnership with Waltonchain that is aimed at helping the two organizations work on growing together even faster.

Who Created Waltonchain?

Waltonchain was created by Xu Fangcheng and Do Sang Hyuk. Xu is an expert in business management with huge experience from previous assignments at companies such as Septwolves Group Ltd. He is also the director of Shenzhen Silicon and one of the leading Angel Investors.

Sang is an IT expert with many years of experience in the Korean market. He has served as the Chairman of the China-Korea Cultural Exchange Development Committee, Director of ET News, Chairman of Small and Medium-Sized Enterprise Committee in Seongnam, and Representative of Jiangsu Mingxing Liangcheng Environmental Protection Co., Ltd., China. His experience has been very helpful in crafting the vision of Waltonchain.

Waltonchain Videos and Tutorials

Waltonchain (WTC) - Visit and Product Demo (Part 1 of 3)

Waltonchain (WTC) Interview and Demo - (Part 2 of 3)

Waltonchain (WTC) in A Nutshell (Part 3 of 3)

Market Falls Asleep? Walton (WTC) Caught Red Handed

WaltonChain GPU Mining with Wallet and CLI

WTC Coin Review

Walton Coin (WTC) - How RFID And The Blockchain Will Change The World

See Also

- Bitcoin | Ethereum | Ripple | Bitcoin Cash | Litecoin

- Cardano | NEO | Stellar | EOS | NEM | VeChain Thor

- Monero | Dash | IOTA | TRON | Tether | OmiseGO

- Bitcoin Gold | Ethereum Classic | Nano | Lisk | ICON

- Qtum | Zcash | Populous | Steem | Ontology | Waves

- DigixDAO | Bytecoin | Bitcoin Diamond | Binance Coin

- Bytom | Verge | Crypto Humor

- Cryptocurrency Dictionary | List of Cryptocurrencies | CEX.io

- Binance | Coinbase | Changelly | Coinmama | Bitpanda

- LocalBitcoins | Kraken | Paxful | Ledger Nano S | TREZOR