Augur

Augur cryptocurrency guide advises where to buy and how to buy Augur. This guide also contains the markets, value, trading, investing, buying, selling, transactions, blockchain, mining, technology, advantages, risks, history, legislation, regulation, security, payment, networks and many other interesting facts about Augur as well its status in the world of cryptocurrencies.

Augur, Thursday, 2025-06-12

Contents

What Is Augur?

Augur is an Ethereum-based, open-source, peer2peer, decentralized oracle and prediction market platform. The platform was started in 2014 by Joey Krug and Jack Peterson, and operates as a Dapp (decentralized application) that allows users to create questions about markets and make profit from trading purchases as people acquire either positives or negative shares based on expected outcomes.

In speculation markets, people are allowed to predict outcomes of future events. Then, they win some rewards when their prediction comes true. They also lose cash when their prediction is incorrect. Utilizing Augur, users on the network can trade in the prediction market at a very small fee. The only cost that the users will incur is the compensation set for the market creators as well as reporters who bring the news about specific outcomes.

In the past, most prediction markets were centralized. Because they relied on a single centralized point, they could not be trusted because of ease of outcome manipulation. They also limited the number of markets that could be created on specific platforms. For example, in sports prediction markets, companies in betting can limit users to specific games such as soccer or athletics. They could also limit participation to a specific region. These are the issues that Augur comes to address.

Augur serves as a decentralized and trustless network running as a smart contract in the Ethereum network. These smart contracts are automated so that developers do not have any control over how the market resolves or even spend funds. Also, they cannot approve/ reject trades, undo trade, modify, or even cancel orders. Once a position is taken, it has to wait until the market closes.

The Augur oracle moves all the information gathered from real world to the blockchain without needing to use intermediaries. Augur covers a very wide range of markets including climate, crypto, politics, agriculture, sports, housing, medicine, stocks, and science among others. Here is a closer look at the Augur network.

Beginner's Guide to Augur

Are you interested in cryptocurrencies and speculation markets? The traditional prediction markets were highly centralized and marred with huge manipulation. People no doubt needed a new way of predicting outcomes in various markets. This is why Augur was created. It is an Ethereum-based and decentralized oracle and prediction market platform.

The platform employs blockchain technology, smart contracts, and decentralized oracles to provide users with the next generation market prediction system. Its native token, Reputation (REP), has been performing very well in the crypto markets. If you are planning to join a cryptocurrency with a huge potential, well, this is a great option to consider. But it is critical to carry your personal evaluation and make an informed decision. This is why this guide was created.

The guide is a comprehensive analysis of the Augur prediction market. It explores every component of the platform to determine how it works, the advantages, security, and consumer protection. No matter the questions or doubts you might be having about Augur, this guide provides the comprehensive answers to assist with making the right answers. Welcome to discover more about Augur and make the right decision.

Where and How to Buy Augur?

The prediction industry has been growing steadily and users have been looking for platforms that can allow them to create and optimize returns. This is the reason that Augur platform has been attracting a lot of interest especially in the last couple of years. To be part of this potential platform, you have to start by purchasing some Augur (REP), create a market, and trade the outcome shares. Here is an account of where and how to buy the tokens.

The first step to buying Augur is acquiring the right cryptocurrency wallet. This is the location that will hold your tokens after the sale is completed. Then, buy the tokens from the following places.

- Cryptocurrency exchanges: These are the primary trading platforms for cryptocurrencies. The markets are designed to operate like standard forex markets. However, they trade crypto assets as opposed to fiat currencies. To uses these platforms, you are required to open a trading account and verify it with personal info such as phone number and date of birth. The verification info can vary depending on the selected exchange. Some of the top cryptocurrency exchanges you can buy from include Bittrex, Binance, Poloniex and Liqui.

- Purchase REP from those who already have them: If you can get a person who already has some REP, it is possible to buy directly from him. You can get such people in cryptocurrency clubs. These are groups created to help crypto community meet and share ideas about the market. The clubs have also become important points of sale for those who have some tokens to sell without following the lengthy procedures required by the exchanges. Note that though these clubs are easy to use, getting a person willing to sell the same quantity of REP you want to buy is never easy.

Augur Wallet

Are you planning to join the cryptocurrency industry? One of the most important things to get is a cryptocurrency wallet. This is a digital location designed to hold your crypto coins. However, the definition is actually a misconception. In reality, the native tokens, REP in the case of Augur, can only reside in the native networks. They cannot leave or exist outside the native networks. Therefore, if the Augur tokens do not leave the network, what actually is stored in the wallets? How do the wallets work?

The Augur wallets are designed to help users link and take control of their tokens in the Augur network. This is done through a system of codes that help to link with your tokens in the network. The first code generated by Augur wallets is private keys. This is a special code that helps to point at your REP in the augur network and call them to live when making transactions. Like the name suggests, the private keys are private and should not be shared with third parties.

The second code generated by the Augur wallet is the public keys. This is a special code that helps to point at your wallet. This means that it acts as an address to your home. The code is provided to those who want to pay you in REP. Like the name suggests, the code is public and can be shared with others in the network who want to make payment to your wallet.

The last code generated by the Augur wallet is the seed. This is a special code that is meant to help users regenerate the private keys in the case of a loss. In some cases, the seed is the first to be generated by the wallet. Then, it can be used to generate the other two keys, the private keys, and public keys. It is very important that private keys and seed are kept safely and away from the main computer. As an ERC20 token, you can store REP in the following wallets.

- Trezor.

- Ledger Nano S.

- Jaxx.

- MyEtherWallet.

- Mist.

Where to Buy Augur with Credit Card?

Credit cards are some of the most widely used forms of payment in the market today. Most people prefer them because they are easy to use and are accepted in both conventional and online marketplaces. Now, you can also use credit cards to buy crypto assets such as REP from exchanges such as Kraken.

Where to Buy Augur with PayPal?

If you are a fan of purchasing things from online marketplaces such as Amazon and eBay, one of the preferred methods of payment is PayPal. The online wallet allows users to make their payments to the target addresses using their email addresses. Despite the fast growth in adoption of PayPal, its administration is yet to allow direct payments to crypto networks such as Augur. Therefore, you will need to follow the longer route of withdrawing to a credit card or bank account before purchasing REP.

How to Buy Augur with Wire transfer?

Almost everybody out there has a bank account. Some use them to secure loans while others consider them primary platforms for their savings. Banks’ wire transfers are now an accepted method of payment for cryptocurrencies in some exchanges. Some of the cryptocurrency exchanges that list Augur and accept wire transfer include Kraken and UpBit. To buy Augur with a wire transfer, you will need to follow the following procedure.

- Start by acquiring a cryptocurrency wallet.

- Select the preferred cryptocurrency exchange.

- Open a trading account and verify it.

- Select the quantity of REP you want to buy and select pay with a wire transfer.

- Because the REP will go to the trading account, you will need the final step of withdrawing them to your wallet.

Where to Sell and Trade Augur?

If you have been on the Augur network for some time or have some REP tokens, you might be wondering about the best way to optimize ROI (Return on Investment). One of the methods is holding the coins and waiting for the value to go up before recovering it. However, many people recommend selling and trading in the markets.

Cryptocurrencies are like fiat currencies in many respects. This means that you can pair them and trade depending on the market forces of demand and supply. To trade Augur, you will need to join the right markets where most of the tokens are traded.

As you set out looking for an appropriate market, it is important to appreciate that they are the softest underbellies of the crypto sector. Since 2009 when the first blockchain network was revealed, every major loss you hear of most probably took place in an exchange. Because most of them are centralized, hackers work extra hard to break in and siphon away the users’ assets. The most recent hackings include YouBit exchange of South Korea that was attacked in December 2017 and millions worth of crypto coins siphoned away. The exchange was forced to file for bankruptcy. In January 2018, another exchange in Japan referred as Coincheck was also hacked and millions worth of crypto coins siphoned away.

The report of attacks in trading platforms sends chills in the spine of crypto traders. Is there a trading platform that is 100% safe? Where can people trade without worrying about losing crypto coins? Though there is no platform that is 100% safe, the safety of your information and coins depends on the trading platform you select. Here are some tips for picking the best platforms.

- Only go for the platform that puts a lot of effort on clients’ coins security. Some platforms use 2-factor authentication, move most of the clients’ assets to cold storage, and even insure the assets against losses. You might also want to follow the exchanges that do not have a hacking history.

- The ideal platform should have a low transaction fee. Low transaction charges mean that you are free to keep most of the profit made when trading in the exchanges. You might need to compare the transaction fees and consider the charges alongside other factors such as security.

- As a trading platform, it should provide you with many tradable assets for assurance that you will always have a profitable option.

- Go for the exchanges that are critical with the assets they list to help protect users. You should be wary of some tokens being floated in the market because a large number of them are indeed scams.

- Only select the exchange that has a good rapport with the market. Here, it is important to check the feedback that trusted crypto communities such as Reddit have. If the community has a positive report, you can also expect to get good results by joining the selected platform.

Note that most trading platforms, except for the Decentralized exchanges, are operated strictly under local laws. This means requiring all users to open trading accounts and verifying them with personal information. Some of the top markets to trade and sell REP include Kraken, Bitfinex, Binance, and UpBit.

How Much Are the Transaction Fees of Augur?

At Augur, the average transaction fee between March and April 2018 was $0.029. The transaction charges that cater for the market creator fee and reporting fee is dependent on the value of the crypto coin. This implies that the fee is likely to keep growing as the value continues on an upward trend. Despite this, the transaction fee is far below what other top cryptocurrency networks such as Bitcoin and Ethereum charge their clients.

Augur Markets

As the popularity of cryptocurrencies continues growing, the markets have also taken a similar trend. Cryptocurrency markets are the primary platforms that bring together traders, sellers, and project owners releasing new tokens for users to buy. Here is a closer look at individual Augur markets.

1) Binance

This is a Hong Kong-based exchange that was created by Changpeng Zhao in mid-2017. Zhao, though his company, Beijie Technology was concerned that the trading platforms in the market were overly complex and ineffective. To make trading direct, cheap, and easy, Zhao created a native token referred to as BNB (Binance Coin). After launch and taking off very well, Binance was hit hard by the Chinese authorities banning ICOs. The exchange had to relocate its IP’s offshore to guarantee users access without interference.

The biggest selling point of the Binance market is its low transaction fee. When you trade on the platform, a transaction fee of 0.1% is levied. However, traders can cut this cost by 50% to 0.05% if they pay in BNB. This makes Binance one of the cheapest trading platforms out there.

The exchange also lists very many crypto assets for users to select the profitable options. Whether you want to trade REP for top cryptocurrencies such as Bitcoin Cash or emerging cryptocurrencies such as Wanchain and NEO, be sure of getting them at Binance. Other strengths of the market include a responsive support team and developers with proven development record. The community appears optimistic that the exchange will continue being one of the top options for Augur and other crypto assets traders out there.

The biggest challenge of using Binance is that it is a crypto-to-crypto only platform. This implies that you cannot buy directly with a credit card or fiat currencies. Therefore, those who want to make deposits or withdraw their cryptocurrencies to credit cards have to use other platforms such as CEX.io, Changelly or Coinbase.

2) Kraken

Kraken is a US-based cryptocurrency exchange founded in 2011 by Payward Inc. The exchange was created to help facilitate Bitcoin trading in the early years and help to advance the adoption of cryptocurrencies. The biggest selling point of Kraken is its support for fiat currencies. As other exchanges such as Binance and Bittrex shy away from allowing fiat currencies, Kraken stands out for supporting them. This makes it a perfect place for people intending to join Augur for the first time or those who want to convert their REP immediately after trading.

Kraken has a long list of tradable assets that users can pair with REP. This gives them the assurance of a profitable option when the current one is no longer desirable. The exchange’s transaction fee is between 0.16% -0.26%. This is considered relatively high compared to other top Augur markers such as Binance that charge as low as 0.05%. The community has been calling for the management of Kraken to lower the transaction fee to less than 0.1%.

The biggest challenge of using Kraken is its user interface. When you use the trading platform for the first time, it can be really confusing. This has become a serious challenge especially for first-time traders on the platform. Besides, the exchange has withdrawal limits of $2,500 and $20,000 in cryptos daily and monthly respectively. This is a great limitation for those targeting to move a lot of REP or other assets.

3) Liqui

This is a Ukraine based cryptocurrency exchange that has thrilled users with its unique features. The biggest selling point of the exchange is its large number of traded crypto assets. The exchange is also very active in listing new assets that are yet to hit the market. While this is a great opportunity to present investors with a great opportunity to invest before tokens’ value starts growing, it can also be very risky. It has been demonstrated that most of the ICOs hitting the market today are scams and could end up causing huge losses to users.

The exchange has a transaction fee of 0.25% for the taker and 0.1% for the maker. These charges have made the exchange to be referred as one of the most expensive options out there. In some of the exchanges such as HitBTC, the makers are not charged and are even provided with rebates.

The exchange operates as a crypto-to-crypto trading platform. However, it has introduced additional features such as savings that offers an interest of 24% annual percent rate (APR). Though many people have indicated that the interest is unrealistically high, it appears that the exchange is using the savings interest to attract more users.

4) Bittrex

Bittrex is a US-based cryptocurrency market that was started in 2014. The founders, Bill Shihara (co-founder and CEO), Richie Lei, Rami Kawach, and Ryan Hentz were concerned about the emerging insecurity of the exchanges and huge losses the crypto communities were incurring. They were dedicated to ensuring that the platform was simple, secure, and operates in total compliance with local trading laws.

The exchange, like Binance and Poloniex, lists most of the top crypto assets out there. However, Bittrex vets all the assets before listing them to guarantee users of extra safety when trading them. This is the reason that most traders have been flocking to the platform to trade Augur for top assets such as Bitcoin or newer assets such as Bitcoin Cash.

The transaction fee at Bittrex is 0.25% of the transaction volume. This is considered to be on the higher end because some exchanges such as Binance are charging as low as 0.05%. The community has also been complaining that the customer support at Bittrex is wanting. When a complaint is reported, it can take several months before getting resolved. Even accounts that have issues or are suspended take a lot of time before the problems get resolved.

Value of Augur

Augur is one cryptocurrency that has done relatively well since its launch in 2014. Its value has continued to grow progressively and was ranked among the top 50 cryptocurrencies by market capitalization early in the second quarter of 2018. In early June 2018, the market capitalization of Augur was more than $400 million at a price of around $40. This places only a few steps behind Waves with a market cap of around $450 million. The value of REP is expected to continue on an upward trend in the coming years.

Is It Profitable to Invest in Augur?

The primary expectation for people joining cryptocurrencies is that they get high return on investment. Between August 2015 and mid-May 2018, the price of REP grew with more than 3500%. This is incredible. This means that if you had invested $1000 in 2015 on REP, the investment would now have grown to around $35,000 by mid-May 2018. The Augur community is optimistic that the growth will continue on an upward trend in the coming months and years.

However, it is important to appreciate that profitability trend could easily get distorted depending on the prevailing market conditions. For example, the profitability is dependent on the ability of the development team to keep the Augur free from hackers and growing the community. If the governments pass harsh regulations as they keep threatening, the value and profitability of Augur could also be affected negatively.

Where to Spend or Use Augur?

As cryptocurrencies continue growing rapidly, the focus has shifted to the acceptance of the native assets in the mainstream markets. Many crypto networks' development teams such as Ripple and Bitcoin have been working on winning the affection of traders and corporate organizations. On this edge, Augur appears to lag behind. Though it has been on the market for longer when compared to other networks, there is no store or organization that has come out to say it accepts payment in REP. Though this could be understood because Augur is mainly targeted at the speculation industry, the development team needs to also optimize acceptance of REP even outside the prediction market.

Can Augur Grow to Become a Major Payment Network?

Yes, Augur can become a major payment network. Like other cryptocurrencies out there, Augur is in the race to becoming a major payment network. This is possible because of the low transaction fee charged by Augur for people using the network. While the fast value growth of top cryptocurrencies such as Bitcoin is desirable, the cost of sending value is equally high. This has been a limiting factor that is pushing people away from large cryptos to smaller but high potential networks such as Augur.

Augur also stands a great chance of becoming a major payment network in the fast-growing prediction markets. It is clear that most people had been searching for a great solution in the market with little success. Now, Augur has made it easy to use the market securely without incurring a lot of costs.

While Augur is no doubt in a great position to emerge as a major payment network, the development team has to work extra hard to demonstrate its value especially to other payment networks such as banks. This is the strategy being used by Ripple to gain popularity. It should also target winning a larger market share by drawing a bigger community and creating more innovative features.

How Does Augur Work?

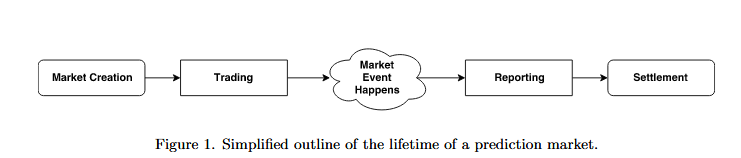

Augur operates primarily on two key actions; creating a market (forecasting) and reporting (trading event share). For every action taken by a user, a share of Reputation coins is provided as a reward. Have a look at the simplified outline of a lifetime of a market prediction.

- Creating the market

- To create a market in the Augur system, you will need to spend some amount of Ethereum. The Augur market can be anything from political prediction to sports. You could even predict businesses events.

- Once you create a market, you will need to set the maker and taker fee. The taker fee has to be set between 1.0% and 12.5%, while the maker fee cannot exceed half the taker fee. As the creator, these are the fees you are going to receive after the market closes. It is important that the market creator takes a lot of caution when setting the prices to avoid discouraging the market with very high/low prices.

- Note that the fee has been replaced by the creator fee. The fee is paid to the market creator while additional profit is generated from rewards of correct predictions.

- Trading event shares

- In trading an event-share, you will need to buy and trade shares using the amounts held and representing selected odds of an event taking place/happening in a specific way in the future. You can buy the shares if confident the selected event will happen. The higher the price that you buy the prediction shares for, the more the chances of the selected event happening according to you.

- Users can even make money by purchasing shares at a lower price and selling them when the share price goes up. For example, you will earn REP tokens by predicting the event correctly and still remain with the shares after the market closes.

Does Augur Use Blockchain Technology?

Yes, Augur employs blockchain technology. It was created to help anchor per2peer ledger functionality of the blockchain technology. This idea is based on the game theory and providing financial incentives to gather the wisdom of the crowd and make accurate predictions of different events.

Initially, the Augur development team had considered using the Bitcoin network. However, they preferred the Ethereum network because it offered smart contracts and better security benefits. The development team indicated it would later connect to the Bitcoin network using side chains.

It is important to appreciate that Augur is designed to operate with a locally-functioning Ethereum node. This means that you will need to have an Ethereum node. One of the recommended Ethereum nodes that guarantee great experience is Geth. This is because all the requests will have to be sent to the Ethereum node for execution via the consensus model. However, those who do not want to run full nodes can go for the hosted Ethereum node that is maintained by the Augur development team.

Mining Augur

When the Augur development team was established, it also created native tokens referred as Reputation (REP). A total of 11 million REP were created and are used by people on the network to report or predict outcomes. Unlike the common cryptocurrency models such as Bitcoin and Ethereum, Augur cannot be mined. You can only earn REP through truthful reporting about the markets. You can also earn REP by making the right predictions. If you report untruthfully, you lose REP tokens.

What Are the Advantages of Augur?

As the popularity of cryptocurrencies such as Augur come to fore, it is important to check carefully to understand the benefits to anticipate. Here are some of the advantages of joining and using the Augur network.

- Augur system allows users to diversity prediction markets more compared to standard centralized models.

- Once you join the Augur network, the system allows you to create markets and earn from interested followers who come to buy shares.

- It is a unique way to invest in crypto networks. You can create markets, predict outcomes in the present markets, or trade/hold the native tokens to earn REP.

- The network provides users with a truly anonymous network that is free from third party seizures.

- The project is led by a tech-savvy team with a lot of energy. This is one of the reasons a lot of corporate organizations especially in the prediction niches are interested in the network.

- The value of the network has continued to grow steadily. Though some might argue that it is slower than other cryptos founded in 2014, the progress has been steady. The community is very optimistic that the value will grow to even higher levels.

- If you want to send value using REP, the network allows users to do it anonymously. It is a great way to make payment without worrying that other people will know about the details. Even the nodes that confirm transactions can only follow to check the balance but can never know the owners.

What Are the Risks of Augur?

The same way Augur comes with many advantages, it is also important to appreciate that it also has a lot of risks. You need to know about these risks to be able to make the right decision on whether to join Augur or not.

- Like other cryptocurrencies, Augur’s native asset, REP, is subject to high volatility. The price can fluctuate because of market interference, looming regulations, and developments in the fintech.

- The looming regulations are likely to be harsh and suppress Augur and other blockchain networks. This is because most administrations feel threatened by the fast growth of blockchain networks.

- The Augur network lacks independence because it operates as a DApp in the Ethereum network. This means that anything that happens on the Ethereum network will affect Augur.

- The parasitic markets have a potential of threatening the stability and success of Augur. Such markets fade the interest and demotivate reporters through lower repayment charges.

- Other cryptocurrencies are likely to enter the prediction market and threaten the existence of Augur in the coming future. If the newer cryptocurrencies are better and more appealing, they could attract a bigger community and threaten the value of REP.

- The danger of getting attacked. Because of the fast-rising cryptocurrency popularity, hackers are finding them very attractive. Even though Augur’s development team is very committed to security, the network cannot be 100% secure.

What Happens if Augur Gets Lost?

Today, it has become a common thing to hear people say that their crypto assets have been lost. Have you ever wondered what happens when such loss takes place? One thing you must appreciate is that REP does not leave the native network even when such losses take place.

- Loss through forgetting the private keys: In this case, the coins are still in the network but in a dormant state. You can restore them by acquiring the right keys.

- Loss through damage to the wallet: Your Augur wallet can be lost through formatting the computer drive, malicious attack, or entire loss of the computer. In such a case, the REPs are still in the network but in a dormant state. You have to reinstall the right wallet to get back your coins.

- Loss through hacking and sending REP to the wrong address: These types of losses mean that your Augur has been lost forever. The coins are still in the network but have changed hands and cannot be restored.

Augur Regulation

The fast development of cryptocurrencies has rattled most administrations. When the first blockchain based cryptocurrency, Bitcoin, was launched by Satoshi Nakamoto, the United States Federal Bureau of Investigation (FBI) reported that the technology posed serious risks. In a special communiqué to the government, FBI observed that cryptocurrencies could easily become platforms for advancing fraud and even funding terror.

Though not many countries noted the threats that came from Bitcoin immediately after its launch, it did not take long before the effects started spreading globally. Now, no country is sitting pretty because of the numerous threats associated with cryptocurrencies. Here are some of these threats.

- Most countries indicate that their banking and financial institutions are threatened because cryptocurrencies are peer2peer and cheaper networks compared to institutions such as banks. The threats to such institutions have wider effects of shrinking financial industries and result to layoffs.

- Cryptocurrencies such as Augur that allow users to operate anonymously have become the primary blocks for users to stay without paying taxes.

- The crypto assets are seen as more preferable investment opportunities compared to the conventional bonds and shares. This shifts the resources to a point where most administrations cannot reach or even control.

- Most administrations feel that cryptocurrencies are could be used to fundraise for terror activities. Because most crypto assets such as Augur are anonymous, criminals can easily use the networks to trade and raise funds for terror activities.

Even as the administrations outline the threats that come from cryptocurrencies such as Augur, you will be surprised that none of them has passed a legal framework to guide them. Indeed, some of them have opted to completely ban crypto operations in their jurisdictions. Good examples include China and Venezuela.

Now, these administrations have indicated that the process of crafting legal frameworks for cryptocurrencies is no walk in the park. Some of them do not even have an idea of where to start. The following four points that indicate why most administrations find it difficult to craft crypto related regulations.

- The blockchain technologies are molting too fast. Many administrations are only being forced to play catch-up when it comes to matters cryptocurrency.

- The cryptocurrencies are owned by a large crypto community spread across the globe. Unlike banks that have specific ownership, many governments are left wondering how and who to target with the regulations.

- The cryptocurrencies have demonstrated to be a major solution to serious issues such as Big Data. This means that most administrations are reluctant to chock them.

- Cryptocurrencies are now evolving to emotive issues with those opposing them being considered to go against the majority. This way, not many administrations want to lose the support of their citizens.

Even if the laws have no doubt taken so long, they will finally come. Therefore, do not relax wondering what might happen if the laws come, start thinking about what to do because they are for sure dawning. For example, such laws could push the value of crypto assets down with a huge margin. They could even cause them to cease existing altogether. To know the status of individual jurisdictions, check the next section.

Is Augur Legal?

Yes, Augur is legal. Because no country has passed a cryptocurrency regulation, it is legal to join cryptocurrency networks, own native assets, and trade them without worrying about breaking the law. However, different countries are at different stages of crafting legal frameworks. Here is a closer look at individual jurisdictions.

1) The United States

The United States is one jurisdiction that has been shifting its focus to cryptocurrencies and creating a legal framework. Clarification from the government only came via the Commodities Futures Trading Commission (CFTC) that indicated all crypto assets were commodities. The main focus of the clarification was to ensure that the rising number of crypto traders paid their taxes on revenue generated through trading cryptocurrencies.

Early in 2018, the government took a global focus in the search for a workable legal framework. The Treasury Deputy Director, Sigal Mandelker, visited the top crypto countries to try and take a common position on regulations. “We strongly need to have these regulations all over the globe,” Sigal restarted the government position when he visited Japan.

In his part, Steven Mnuchin, the Secretary of Treasury voiced his preference for fiat over cryptos such as REP. When speaking at the Economic Club in Washington, DC, Steve said that there was a huge threat of the cryptocurrencies becoming channels for fraud. He also announced the formation of a cryptocurrency working group under the Financial Oversight Council (FSOC). With the federal administration not having a guideline on Augur and other cryptocurrencies, individual states have taken the role and are marching right ahead.

In March 2018, Arizona became the first state to pass a cryptocurrency regulation. Bill SB1091 was passed on 7th March to allow residents to pay their taxes in cryptocurrencies. Once a person makes payment in cryptocurrency, the conversion is done immediately to US dollars and the payment credited in the records. Now, it appears that Arizona was only opening the door. Other states that have lined up to pass similar legislation include Nevada and Georgia.

2) The European Union

The EU, like the United States, does not appear to have a specific approach to cryptocurrency regulations. Both EU leadership and institutions appear to pull in different directions. The first to fire the salvo was the EU central bank. The influential bank warned that citizens who wanted to invest in cryptos such as Augur should be careful with the looming threats of loss, high volatility, and even scams. The EU parliament appeared to take a precautionary approach by pointing that there were numerous benefits from cryptos as the apex of the fintech niche.

For the European Union leadership, the primary concerns are mainly on three things; risk of fraud, tax evasion, and loss to investors. The Vice President of the EU, Valdis Dombrovski, pointed that the liability gaps and danger of total loss were serious issues that could not be simply wished away. Now, other leaders from individual countries have joined the race to call for a clear framework to regulate cryptocurrencies.

In January 2018, the United Kingdom’s Prime Minister, Theresa May, when addressing the World Economic Forum in Davos, raised the concern of cryptocurrencies being used as channels for funding terror. Other leaders who have come out to call for a cryptocurrency framework to regulate cryptocurrencies include Germany, Italy, and France. France has already crafted a cryptocurrency working group to guide the crypto industry.

3) Russia

Russia is one country that has taken the bold move of marching forward with the regulations even as other jurisdictions get stuck. Note that the effort to craft a crypto framework is a departure by the Russian authority from the earlier stand that it would not regulate cryptocurrencies. The administrations only indicated they were not legal tenders and warned its citizens of the numerous risks that came with investing or using crypto assets.

The need to craft a law and super fast action started at the close of 2017 when the finance ministry indicated there was a gap in the law that made it impossible to tell whether traders accepting payment in cryptocurrencies were committing a crime. The ministry and central bank worked and released the draft Digital Financial Assets bill by close of January 2018. The bill is probably one of the most comprehensive pieces of crypto regulations in the history of cryptocurrencies.

If the parliament passes the draft into law, it defines digital assets, creates ICO procedures, determines the legal regime for crypto trading, and mining. For example, the law requires that all miners to be registered entities because they are involved in generating commodities (tokens). This means that trading, mining, and release of tokens will require proper authorization by the administration.

Even before the draft becomes law, it has already generated a lot of resistance from the crypto community. The community indicates that the law will limit the burgeoning fintech and even make investors run away. However, the government indicates that the time to reign on cryptocurrencies is now and the law will anchor growth because everybody can operate in a legally acceptable manner.

4) Switzerland

Even as more countries come out to indicate how cryptocurrencies are threatening them, one jurisdiction that appears at peace with them is Switzerland. The country’s administration has indicated it will spare no effort ion making cryptocurrencies blossom. In one of the posts on Financial Times, Johann Schneider-Amman, the country’s economic minister indicated that they want to make the country a crypto-nation.

Starting with the ICOs, Johann indicated that they would start with ICOs because they presented the country with a great opportunity to raise funds for fintech and local projects. To fast-track the process of supporting ICOs, the economic minister formed an ICO working group and mandated it to come up with modalities of crafting tech-neutral regulations. One thing that the crypto community needs to appreciate is that even if other states pass laws to outlaw cryptocurrencies, there is no doubt that Switzerland will be a reliable Oasis for them.

5) Singapore

Singapore is another country that appears at peace with cryptocurrencies. Until the close of 2017, the Monetary Authority of Singapore (MAS) warned its citizens of the risks associated to cryptocurrencies such as Augur. However, the administration changed the view early in January of 2018 when Tharman Shanmugaratnan, the country's Deputy Prime Minister pointed that the nation's laws do not make a distinction between cryptocurrencies, fiats, or other novel methods of relaying value.

The position taken by the government was supported by the MAS fintech chief who indicated that he does not see cryptocurrencies bringing about a Lehman Brother’s -type of financial slowdown. The government only asked regulators to take all precautions necessary to protect digital currencies and anchor their growth. The crypto community has indicated that the trust, if protected and nurtured, could help to demonstrate how cryptocurrencies are supposed to work alongside fiat currencies.

Augur and Taxes

The topic of cryptocurrency and taxes is as complex as that of regulation. Most people hold the view that because blockchain networks are anonymous, they can hide them from all third parties including tax authorities. This is the reason why only a handful of people report the income they get through cryptocurrency trading. In the United States, Credit Karma Tax reported that most people believed they are out of reach and could evade taxes when operating anonymously. However, tax experts are having a completely different opinion on this.

Though the anonymity that people enjoy under the crypto networks can help to safeguard them at the moment, the situation will change in the coming days. To demonstrate this, take a closer look at the largest crypto network, Bitcoin. When Bitcoin was launched, a lot of people believed that the solution to help them operate tax-free had finally dawned. Even criminal networks such as wannacry group and outlawed organization such as Wiki Leaks started accepting payment in Bitcoin. Now, newer technologies are helping to uncover Bitcoin users. It is no longer the anonymous network that people espoused.

In the coming days, you do not want to get into a precarious situation where a chain of lawsuits relating to tax avoidance starts knocking. However, you can enjoy all the benefits of Augur network without breaking tax related laws. Here are some expert tips to guide you.

- Ensure that the revenue from Augur activities such as trading and holding is considered taxable income.

- Ensure to report the profits or losses incurred during trading Augur trading when filing annual returns.

- Develop a habit of capturing important details that can help you confirm a situation if you are called to. For example, noting the value of REP’s value in your fiat currency at the point of trade can help you avoid over taxation.

- If you accept payment in REP, ensure to craft a good way of capturing it in the balance sheet. You could also work with a tax expert to help you craft the best way to do the books.

Does Augur Have a Consumer Protection?

Augur does not have consumer protection. As a decentralized and open source platform, it is owned by users with a stake in the network and spread in the network across the globe. This implies that you do not have a point to take complains to if offended. Even if you lose REP, it is not possible to even complain in a court of law because cryptocurrencies are not regulated. To operate securely in the network, here are some tips to follow.

- Do not share the private keys with third parties.

- Always countercheck the public keys before sending funds.

- Carefully follow specific markets to understand them when making predictions.

- Make sure that Augur client and the main computer are always up-to-date.

- Select the cryptocurrency exchanges to trade in with a lot of care.

- Avoid visiting risky sites.

- Move the REP to a cold storage when not trading them to lower the danger of getting attacked.

Illegal Activities with Augur

Though many criminals have demonstrated a preference for cryptocurrencies, no illegal activity had been reported with Augur by the close of the first quarter of 2018. Because Augur employs smart contracts, it has become very difficult for criminals to perpetuate their activities in the network.

Is Augur Secure?

When selecting a cryptocurrency network to join, the first thing to check is security. The Augur development team has been very active in securing the network to guarantee users of utmost security of their details and assets. Here are the three primary things that make Augur a secure platform.

- The system is operated as a smart contract on the Ethereum network. You will need to have an Ethereum node or use the Augur hosted node to operate in the Augur network.

- To prevent parasitic markets, trading on the platform is made as cheap as possible.

- The Augur development team is very aggressive and open to regular security audits. This means that gaps are easily identified and addressed promptly.

Is Augur Anonymous?

Yes, Augur is an anonymous network. As a smart contract built on the Ethereum platform, one of the primary requirements is that all transactions are made private. This main method employed by Augur to guarantee users of their privacy is advanced encryption and smart contracts. This means that you can participate in predicting the markets without worrying about getting unmasked. You can also send REP without worrying about being discovered by third parties.

Has Augur Ever Been Hacked?

Augur has never been hacked. Cryptocurrency networks have become the primary targets for hackers because of the rising popularity. However, hacking the primary networks such as Augur and Ethereum is never easy because their development teams use some of the most advanced security systems. Instead, the focus of most hackers has shifted to trading platforms that are easier to break and siphon users’ assets.

How Can I Restore Augur?

If you have lost REP, it might be possible to restore it based on the nature of loss and preparedness. If you lose REP through forgetting the private keys, you can only restore them by regenerating the keys with the seed. The seed is a special recovery code provided by your wallet the first time you used the wallet.

For Augur users who lose their REPs through damage to their wallets, restoration is only possible through the installation of a backup. You can also install another ERC20 compatible wallet and reconcile it with the seed phrase.

If you lose Augur through hacking or sending to the wrong address, such a loss is permanent. This means that the native assets have changed hands and now belong to another person. The loss cannot be undone.

NOTE: The secret to the successful recovery of REP is being appropriately prepared well before the loss takes place. This means backing up everything and taking special care of the private keys and the seed.

Why Do People Trust Augur?

The rising number of cryptocurrencies has made the battle in the crypto networks shift to competition for trust. The community has become more critical and wants to know how effective and profitable the networks are. Here are some of the reasons why people have a lot of trust for Augur.

- At Augur, the trust mainly comes from the design of the system. Unlike the standard prediction markets, the Augur employs smart contracts that automate the entire prediction market operation. This makes it easy, direct, and free from manipulation.

- The prediction market is a less explored niche. With most cryptocurrencies primarily focusing on sending funds, Augur’s venture into the market takes it to a less explored market that raises the possibility of steady growth over time.

- Augur is led by a tech-savvy team. Users are relying on the development team led by Jack Peterson and Joey Krug for progressive improvements and security over time.

- A lot of corporations have started expressing interest in Augur. This is an indication of the team's consistency in development and possibility of REP value increasing over time.

- Augur is one of the networks operated with a lot of commitment to openness. The development team even hired a security audit team in the last quarter of 2017 to evaluate the state of the network and give recommendations for improvements.

History of Augur

The idea of Augur was conceived in 2014 when the co-founders Jack and Joey decided to look for a better method of facilitating growth in the prediction markets. They wanted to create a platform that could remove the risks, uncertainties that were associated with centralized prediction markets. In April 2015, the founders released the first contact to the Ethereum network.

- In September 2015, the Augur team held crowdsale to help fund their developments. The ICO was very successful by raising a total of $5.2 million.

- The beta version of Augur network was released and deployed to the Ethereum testnet in March 2016.

- In May 2017, Augur entered into a partnership with IDEO CoLab that focuses on the human-centered approach to innovation. The Augur team started working with IDEO CoLab in areas of healthcare, energy, and fintech.

- In November 2017, The Forecast Foundation hired Zippelin to conduct a security audit. The audit was concluded and the full report published in March 2017. This audit is seen as a crucial indicator of the network's administration commitment to openness.

- In 11th January 2018, the value of Augur hit the highest point in its history, $100. However, the price further took a downward trend hitting $29 in mid-2018.

Who Created Augur?

Augur was created by Jack Peterson and Joey Krug. Jack works as a lead developer at Augur and believes that prediction markets are very important for all sectors. From business to politics, people can only move forward when they know what to anticipate. He pointed that by using prediction markets, users are able to make unbiased decisions for their enterprises. Jack is a software developer and has in the past worked as a mathematics instructor at Oregon State University, computer technician at Enterprise Information Technology Services, and Laboratory Technician at the University of Georgia.

Joey Krug is the current Co-Chief Investment Officer at Augur and a lead developer. He also serves as a director at Ether Capital Corporation. Previously he worked as a Game Developer at Dark Paradise Studios. He also founded MariPOS that target to help ease Bitcoin transactions.

At inception, Augur also featured other top personalities who came in as advisors to the new network. These included Ron Bernstein, Ethereum founder Vitalik Buterin and Robin Hanson.

Augur Videos and Tutorials

Augur Explained in 2 Minutes

Augur Fundamental Analysis

Augur & Polyswarm ICO Review - Predictive Intelligence Market Places

See Also

- Bitcoin | Ethereum | Ripple | Bitcoin Cash | Litecoin

- Cardano | NEO | Stellar | EOS | NEM | VeChain Thor

- Monero | Dash | IOTA | TRON | Tether | OmiseGO

- Bitcoin Gold | Ethereum Classic | Nano | Lisk | ICON

- Qtum | Zcash | Populous | Steem | Ontology | Waves

- DigixDAO | Bytecoin | Bitcoin Diamond | Binance Coin

- Bytom | Verge | Crypto Humor

- Cryptocurrency Dictionary | List of Cryptocurrencies | CEX.io

- Binance | Coinbase | Changelly | Coinmama | Bitpanda

- LocalBitcoins | Kraken | Paxful | Ledger Nano S | TREZOR