Wanchain

Wanchain cryptocurrency guide advises where to buy and how to buy Wanchain. This guide also contains the markets, value, trading, investing, buying, selling, transactions, blockchain, mining, technology, advantages, risks, history, legislation, regulation, security, payment, networks and many other interesting facts about Wanchain as well its status in the world of cryptocurrencies.

Wanchain, Thursday, 2025-06-12

Contents

What Is Wanchain?

Ever thought of creating your own bank? It is now easy and direct in the Wanchain blockchain. Here is a closer look at Wanchain.

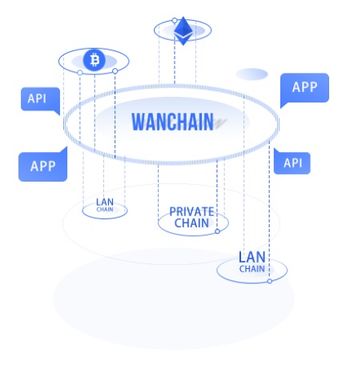

The blockchain technology is fast moving from being a simple platform for sending value to a complex ecosystem. Wanchain is a blockchain technology that targets building a super financial market for the fast growing digital economy. It targets building a distributed infrastructure (call it ecosystem) for the digital asset economy.

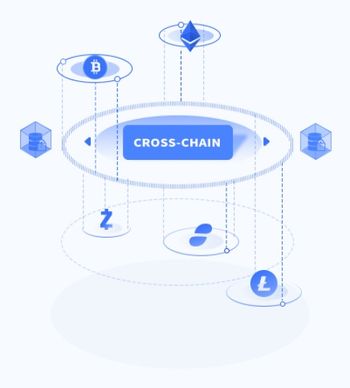

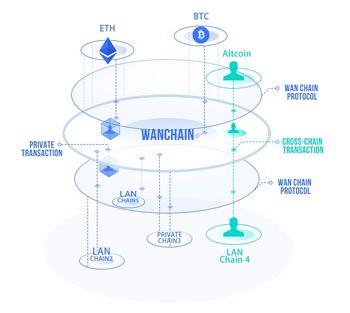

The Wanchain ecosystem, once fully operationalized, will connect and facilitate exchange of value between different blockchain networks in a distributed manner. Building on cross-chain protocol and distributed ledger solutions that capture all cross-chain and intra-chain transactions, the Wanchain project is one of the most ambitious in the fast growing blockchain industry.

Wanchain blockchain was forked from the Ethereum core code by Jack Lu (Factom founder) and modified to run as a completely separate chain. Indeed, the native Wanchain token, Wancoin, is not an ERC20 Token. Once fully operational, the Wanchain blockchain will solve the need for people to hop from one chain to another to transfer value or take advantage of available opportunities.

With the main target being the financial markets, it means that any person or groups will be able to setup virtual teller windows (equivalents of standard banks). This implies that you can setup a “bank” on the blockchain using smart contracts to issue loans, credit payments, and run other transactions. These transactions will be made possible using smart contracts that focus on the following three modules.

- Registration module.

- Cross-chain transaction data transmission module.

- Transaction status query module.

The value of Wanchain has grown since its launch to reach $1 billion in market capitalization at a price around $8 USD. This places it at position 33 in the market based on market capitalization (as of May 2018) well above other cryptos including Dogecoin, Stratis, and Waves.

The project is already winning a lot of support as more people purpose to move to the next level of blockchain technology; cross-chain operations. Though there are fears that its idea is very open and could easily be replicated to give other cryptos a comparative advantage, it will be very interesting to see how this cryptocurrency steers in the fast evolving industry.

Beginner's Guide to Wanchain

Which is the best cryptocurrency to join? This is one question that new cryptocurrency enthusiasts always ask when they decide to join the crypto industry. While there are very many cryptocurrencies that you can join, one outstanding project that has captivated the minds of many investors is Wanchain. It is a third generation cryptocurrency that targets facilitating cross-chain operations. This means that you will not need to open multiple accounts with every cryptocurrency to send funds across different networks. For example, if you have an account at Bitcoin network and want to send funds to a person in the Ethereum network, you will only need to get the public keys.

The cryptocurrency community appears in agreement that this is the cryptocurrency that could easily become the next Bitcoin. Well, do not simply buy the argument without carrying a comprehensive analysis of the cryptocurrency. To help you understand Wanchain network, you need a comprehensive guide. This is why this guide was prepared.

The Wanchain guide is a comprehensive evaluation of the Wanchain system to establish its structures and how it operates. It provides expert viewpoints so that all the questions and doubts that you might have are easily cleared. From how Wanchain operates to regulations and comprehensive history, everything is articulately captured in the guide. Welcome to learn more about this interesting crypto and make an informed decision on whether to join it or not.

Where and How to Buy Wanchain?

When cryptocurrency enthusiasts hear of the unique architecture of the Wanchain and its operational model, one of the things that cross the mind is how to invest there. Though you sell services to get paid with Wancoins, a simpler and direct method is purchasing them from the market. Here is an account of where to buy Wancoins.

- Purchase from the cryptocurrency exchanges such as Binance and KuCoin. Note that the exchanges that list Wancoins do not accept fiat, wire transfer, or credit cards. Therefore, you might need to start from another exchange that accepts fiat/ credit card such as Changelly, Coinbase, or CEX.io. To buy from the exchanges, you are required to open a trading account and verify using personal information such as phone number.

- Buy from those who already have Wancoins. Today, the cryptocurrency communities are forming special groups/ clubs that help to bring members together for crypto related discussions. In these clubs, you can easily find people who want to sell their cryptocurrencies and buy directly from them. One examples of these clubs is the London Cryptocurrency Club.

- Buy from cryptocurrency brokerages. These are crypto trading platforms that closely mimic the operations of the exchanges. Though the prices of listed crypto assets closely follow those in the exchanges, they are adjusted upwards to cater for the profits of the brokerages. Great examples of cryptocurrency brokerage platforms are Coinmama and Bitpanda. Note that you might be required to buy another top crypto asset such as Bitcoin and trade it for Wanchain at a local exchange.

- Purchase from cryptocurrency ATMs. These are new establishments in the cryptocurrency world. They run like the standard ATMs though they deal with cryptocurrencies and not fiat currencies. Like the brokerages, most ATMs available today only allow people to buy top cryptocurrencies especially Bitcoin. Therefore, you will be required to buy Bitcoins and exchange it for WAN in an appropriate exchange.

Note that in all the cases, you MUST have a cryptocurrency wallet to store the Wancoins after a successful buyout.

Wanchain Wallet

Wanchain wallet is a digital wallet designed for holding private and public keys. The private keys are special codes that point at your WAN tokens in the Wanchain network and activate them when making transactions. The private keys should never be shared. If someone knows your private keys, he can easily access your tokens.

The public keys, unlike the private keys, can be shared in the blockchain network. You give the codes to those who want to make transactions to you in Wancoins or confirm transactions in a mining process.

Wanchain system has one main wallet called Wan Wallet that is designed to operate in its network. However, the development team has indicated it is working to get more wallets to support it. The wallet allows users to deploy smart contracts just like in the Ethereum system.

Wan Wallet is designed to help users manage multiple assets that include WAN. Using the wallet, you can transfer assets either in stealth transactions or public transactions. To use the wallet, you have to download it and install on your computer.

Where to Buy Wanchain with Credit Card?

If you have funds in a credit card, you are now able to buy Wancoins from platforms that accept direct deposits. Note that top Wanchain trading platforms such as Binance and KuCoin exchanges that handle the highest volumes of WAN do not accept credit cards. Therefore, you have to start by purchasing other cryptocurrencies and exchanging them for WAN. Top three platforms that accept credit cards include CEX.io, Coinmama, and Changelly.

Where to Buy Wanchain with PayPal?

It is not possible to buy Wancoins with PayPal. For people with cash in their PayPal accounts, the best method is offloading to their credit cards and purchasing an alternative crypto asset such as Bitcoin from exchanges such as Coinbase and LocalBitcoins.com.

How to Buy Wanchain with Wire Transfer?

Banks are some of the most trusted institutions in the globe today. Their operational design, focus on operating within the law, and ability to provide workable financial advice makes them irresistible. Now, you can also use banks to buy crypto assets such as Wancoins. Here is the procedure.

Note that there is no direct way to buy Wancoins with a wire transfer from the exchanges such as Binance that trade most of WAN. Therefore, you need to start by purchasing a different crypto asset such as Bitcoins and exchanging them for Wancoins at an appropriate exchange such as KuCoin and Binance.

- Make sure to start by acquiring the right cryptocurrency wallet (Wan Wallet).

- Ensure that you have a bank account with ample funds to buy the crypto coins of choice. Also, factor the charges involved in the transactions.

- Select an appropriate exchange that accepts payment with a wire transfer. These are top platforms such as CEX.io and Changelly.

- Open a trading account and select a top asset such as Bitcoin or Ethereum. Then, choose pay with Wire Transfer.

- Once the transaction is through, the cryptocurrency assets purchased will be deposited in your trading account. This could take between 1-3 days depending on the location of the bank and the exchange.

- Now that you have some crypto assets, go ahead and exchange them for WAN from another exchange such as Binance.

Where to Sell and Trade Wanchain?

After staying on the Wanchain network for some time, the best way to optimize profitability is trading them on the markets. These are trading platforms that bring together sellers and buyers the same way forex markets operate. Whether you want to buy, sell, or learn about the Wanchain markets, the trading platforms are the best points.

One thing that every trader should appreciate when joining the exchanges is that they are the weakest points in any cryptocurrency cycle. In most of the cases when you hear that some cryptocurrency assets have been lost, the chances are that they were hacked and siphoned from an exchange. Recently, Coincheck exchange was hacked in Japan and over $530 worth of crypto assets lost. In December of 2017, Youbit, a leading cryptocurrency exchange in South Korea was hacked and forced to file for bankruptcy. To be sure of identifying the right cryptocurrency trading and selling platform, here are some useful tips to follow.

- Only use the exchange that has a clear structure for securing users’ information and assets.

- Go for the platforms that charge low transaction fees so that all the profit will not go into the exchange.

- Select the exchange that has been on the market for some time and the crypto community has a positive feedback about it.

- The ideal exchange should have a system of moving the users’ crypto assets to cold storage for extra safety.

- Select the exchange that operates in your jurisdiction.

Some of the main cryptocurrency selling and trading platforms include Binance, EtherDelta, and KuCoin. Remember that no matter the cryptocurrency exchange of choice, you must have an appropriate digital wallet.

How Much Are the Transaction Fees of Wanchain?

One of the promises given by cryptocurrencies, call it the core target of blockchain designs, is helping users to be able to send value in a decentralized manner. This means bypassing centralized profit oriented-institutions such as banks to make transactions direct and cheap. At Wanchain, the average transaction charges is 0.0042 WAN. This makes it one of the cheapest networks out there when compared to other cryptocurrencies such as Bitcoin and Ethereum.

Wanchain Markets

The cryptocurrency markets have been growing steadily over time to keep pace with the rising numbers of cryptocurrency assets. Note that most markets are created to operate in line with the local laws. This means that you have to adhere to strict rules including verification of personal trading accounts with info such as phone number and proof of address. Here is a closer look at the top Wanchain markets.

- Binance is one of the top cryptocurrency exchanges in the market today. It was founded by Changpeng Zhao in 2017 with the main goal being to make trading crypto assets easy, fast, and secure. To make trading easier and increase the number of available crypto assets in the exchange, Zhao also launched a native token called BNB (Binance Coin).

- The cost of transactions in the Binance exchange is 0.1% of the traded volume. However, you can enjoy lower charges for trading WAN on Binance by paying for transaction costs in BNB. If you pay the transaction costs in BNB, it is reduced by 50%. This means you will only be charged 0.05%, one of the lowest rates in the market.

- Note that trading at Binance is only crypto-to-crypto. This means that if you have fiat currency or cash in a credit card, the trading process must start at a different exchange that accepts them such as CEX.io or Coinbase.

- KuCoin.

- Like Binance, KuCoin is a fast growing exchange in the industry. It is based in Hong Kong and targets providing traders with the best opportunities to grow and succeed. When a new crypto asset is released, KuCoin is one place where you are sure of getting it. For example, it was among the first to list Bitcoin Diamond even when other exchanges such as Bittrex declined listing it.

- As a Wanchain holder, joining KuCoin provides massive trading opportunities by listing many trading assets. This implies that you will never miss a profitable pair to shift to if the current pair proves less desirable. The exchange also provides users with advanced trading metrics so that they can easily understand the market and start they can trade like experts.

- The transaction fee for using KuCoin is 0.1%. This makes it one of the cheapest options out there. They also provide special offers to traders who handle large volumes and refer others.

- EtherDelta.

- EtherDelta was designed to help cryptocurrency enthusiasts especially those who hold ERC20 tokens trade in its platform. Though Wancoins are not ERC20 tokens, they indeed share a lot of similarities from the fact that Wanchain was forked from the Ethereum network.

- EtherDelta utilizes the Smart Contracts to make trading easy, direct, and inviolable. Because the traders already have their details captured in their respective token networks, they are not required to create extra trading accounts. This makes the exchange a great option for those who want to trade without going through the complex verification procedures. One thing you have to get right when dealing with EtherDelta is that tokens cannot be traded directly from the native networks. You must move them to the preferred wallet and integrate the wallet with the exchange.

- To trade Wanchain in the EtherDelta, a transaction fee of 0.003% of the transaction volume is required. The fee is used to pay for the transaction and part of motivation fee for miners. If you want the transactions completed faster, you can always opt to pay more.

Value of Wanchain

The value of Wanchain has continued to grow progressively and reached position 33 with a total market capitalization of $1 billion at a price of around $8 USD (Coinmarket report in May 2018). This marks significant growth compared to the close of March. For example, on April 10th of 2018, the market capitalization was only $394 million. This means that it has more than doubled in few weeks.

Is It Profitable to Invest in Wanchain?

Most people coming to cryptocurrencies are looking for top investment opportunities. They want to know whether their assets will grow at the same rate manifested by Bitcoin. Well, it is hard to tell whether that rate will be met by Wanchain any time soon, but the cryptocurrency has demonstrated it is highly profitable at the moment.

If you bought Wanchain tokens when they went up for sale in October 2017, the average was about $0.4. When this is compared to the highest peak of $9.82 on early May 2018, it points at a growth of more than 2000%. This increasable! The value of the cryptocurrency is even promising to continue growing in the coming months.

The rising Wanchain community and experts are in agreement that this is no doubt a leading cryptocurrency to watch. Because of its elaborate design, Wanchain is attracting people not to simply send funds on a peer2peer basis, but to also facilitate cross-chain operations and even setting cryptocurrency "banks".

NOTE that cryptocurrencies' price and value are highly volatile. You need to appreciate that the profitability can be affected by things such as the looming regulations, a shift in demand, and entry of newer cryptos. Therefore, even though all pointers are blinking green, it is important to make the decisions wisely. Only invest what you can afford to lose and make sure to spread the investment.

Where to Spend or Use Wanchain?

Wanchain entry into the market and part of its charm are based on making transactions easy and direct. The aim at this point is ensuring that the cryptocurrency is accepted in most stores. Despite this effort, there are no stores that have come-out to accept direct payments with WAN. This implies that you need to convert WAN to other accepted coins such as Bitcoins or Ethereum when making purchases.

Can Wanchain Grow to Become a Major Payment Network?

Yes, Wanchain can grow into a major payment network. To put it differently, Wanchain was designed to be a major payment network. By virtue of its design that allows cross-chain transactions, it means that the network will be used by both people in the native Wanchain network as well as those in other networks. Some pointers that indicate Wanchain can become a major payment network include;

- The cost of sending funds is very low compared to other top networks such as Bitcoin and Bitcoin Cash.

- The community around the Wanchain network is growing rapidly.

- It employs smart contracts that allow users to design and make even complex transactions easy and inviolable.

How Does Wanchain Work?

To provide the decentralized exchanges and financial services that the development team targets, the Wanchain network is using five core components in its system.

1) The cross-chain communication protocol

This the primary method employed by the Wanchain system to transfer data between its blockchain and other chains. The cross-chain system operates in three main modules.

- The registration module that helps to register where the transactions are originating. It also captured the asset that is being transferred.

- Cross-chain transaction info transmission module. This module helps to initiate cross-chain transaction requests to the Wanchain network. The module is also used in helping to acknowledge if the validator node returned a successful/failure report.

- The transaction status query module. This helps to monitor the status of every transaction when it is initiated.

2) The verification node consensus algorithm

In its effort to create a complete ecosystem for cryptocurrencies, Wanchain closely follows Ethereum in its shift to new Proof-of-Stake algorithm. Like the Ethereum network, Wanchain aims to implement solutions such as Raiden Networks and Plasma. The PoS algorithm used at Wanchain will have three types of verification nodes.

- Vouchers: These are the nodes that receive security deposits from user’s transaction fee. The vouchers will in return provide proof of transactions between the Wanchain locked account and the original account. If the proof turns out to be false, the deposit will be taken away from the holding account and the node will not verify the transaction.

- Validators: These nodes will help with the recording of data on the Wanchain blockchain. They will be rewarded with a section of the transaction fees.

- The storemen: These are the nodes that must stay online to maintain their individual shares in order to receive part of the transaction fees.

To verify transactions in the Wanchain network, you need to hold ample stake that will qualify you as a verification node/validator. However, those who do not have ample WAN to become verifier nodes can still participate by operating as general nodes. As a general node, you can also participate by entrusting your stake to a verifying node. Once the transaction fee is paid to the verifying node, part of it will be directed to you because you contributed to the stake.

3) The Wanchain locked account generation scheme

Wanchain employs the Locked account generation scheme to help secure funds and private keys if there are many parties involved in transactions. The scheme is premised on the Shamir’s secret sharing scheme that breaks the main key into shares and distributes them to all participants. The storemen are the nodes responsible for managing the appropriate key shares of the locked accounts for different transactions.

Wanchain opted for the share distribution method because it generates locked accounts via multi-party computation. This helps to raise the level of decentralization. Besides, it enhances the system’s stability since users do not need to require every key share to create a signature for all locked accounts. This means that even if some validators are not available/ offline, the transactions will still continue with the available shares.

Note that the transactions with the locked accounts are achieved through the original chain. This implies that chains in the ecosystem can easily integrate and interact without requiring new validators or transaction types.

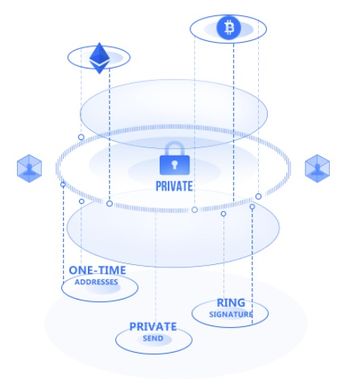

4) The smart contract token transaction anonymity

Wanchain is among the blockchain projects that have included anonymity within smart contracts. By employing one-time address generation and ring signatures, users are assured of utmost anonymity in their transactions whether operating in the Wanchain platform or cross-chain transactions.

The ring signatures use the transaction initiator signature and mix it with others that make it very difficult to trace the actual value sender. Then, a new address is generated for every transaction that makes it impossible to detect the transaction patterns.

5) The Wanchain native token (Wancoin/WAN)

WAN is the native token in the Wanchain platform. This means that is the primary method of payment when you use the system. Every transaction consumes a specific amount of the WAN and you will also need to pay the security deposit in WAN for cross-chain verification nodes.

A total of 107.1 million tokens were sold during the Wanchain ICO. The tokens comprise 51% of the total supply of the total WAN. The funds raised during the ICO will be used for research and development, community development, daily operations, and infrastructural development.

Does Wanchain Use Blockchain Technology?

Yes, Wanchain employs blockchain technology. The Wanchain core code was forked from the Ethereum blockchain but adjusted to run as a completely independent blockchain. The primary goal of every blockchain network including Wanchain is helping users to make transactions without going through centralized third-party organization such as banks.

When a Wanchain user initiates a transition, it is taken over by nodes that swing back to confirm whether the respective public address has ample WAN to complete transactions. The nodes will also confirm whether the targeted public keys are correct. Once the transactions are confirmed, the details are added to the latest blocks and the blocks included in the Wanchain public ledger.

Note that the transactions do not simply mean sending funds. It can also mean execution of smart contract actions such as lending and borrowing funds.

Mining Wanchain

Mining is the process of confirming transactions in blockchain networks for a reward. The Wanchain network uses Proof-of-Stake algorithm which implies that you only confirm transactions based held in the network.

By employing PoS consensus model, even people in the Wanchain network can mine the network with standard GPUs. This means that you do not need to acquire expensive ASICs equipment to start mining the network. Simply acquire as much stake as you can in the network and wait for your turn to confirm transactions. Even if you do not have ample stake to act as a validator node, it is still possible to lend the stake to others and enjoy part of the transaction fee paid for confirming transactions.

What Are the Advantages of Wanchain?

Many people look at cryptocurrencies with a lot of expectations. Unlike in the past, most people are now seeing blockchain technology as the ultimate solutions to issues that have ailed the society and institutions for many years. Here are some of the main benefits of using Wanchain.

- The Wanchain cryptocurrency allows users to make transactions that are completely anonymous.

- By providing users with a platform to implement smart contracts, they can simplify even complex transactions to make them direct and inviolable.

- Wanchain’s enhances anonymity using ring signatures and stealth transactions that make it easy to operate without worrying about third-party seizures.

- Wanchain presents the cryptocurrency community with an opportunity to access and make transactions in multiple blockchain networks without necessarily joining all of them.

- It is a great opportunity for users in the Wanchain network to extend their opportunities to net higher ROI (Return on Investment).

- The price of WAN has been growing rapidly and users are sure of reaping huge returns on investment in the coming years.

- The cryptocurrency is led by a very advanced tech team that has demonstrated the capability to steer the crypto to the top.

What Are the Risks of Wanchain?

Even as investors position themselves well to take advantage of the Wanchain blockchain, it is important to appreciate that the risks are equally many. Here are some of these risks.

- The anonymous nature of Wanchain makes it one of the many options for illegal activities because criminals can hide from authorities.

- While the Wanchain project has a lot of potential, it is very ambitious. Many people are skeptical of how all the features will be implemented.

- The looming regulations pose a huge risk to Wanchain’s success and existence.

- As more technologies get discovered, there is a risk of newer and more appealing cryptocurrencies emerging in the industry.

- The volatility of Wanchain, like other cryptocurrencies, is very high.

- The cryptocurrency does not have consumer protection.

- The implementation timeline for the Wanchain is very long. This opens the cryptocurrency to myriads of dangers including getting copied by others.

What Happens if Wanchain Gets Lost?

When people invest in Wanchain, the main target is seeing their investment grow over time. They want to become part of a system that will see them get rewarded for confirming transactions and grow together with the most promising cryptocurrency. However, this journey can easily be cut short through loss of Wancoins.

In the recent past, reports of people losing their cryptocurrencies have become way too common. In most of the cases, the loss happens on the cryptocurrency exchanges. However, you can still lose the coins at the cryptocurrency and even wallet levels. Here is what happens when you lose Wancoins.

- If you lose Wancoins through hacking or sending to the wrong address, the loss is permanent. The coins have simply changed hands and now belong to a new owner. However, they are still in the network.

- If you lose the coins through damage to the wallet or forgetting the private keys, the coins are still in the network but in a dormant state. This means that you still own the coins and can recover them by regenerating the private keys or reinstalling the wallet from the backup.

Wanchain Regulation

Cryptocurrency regulation is one of the top options for most governments. Since 2009 when Satoshi Nakamoto pioneered the blockchain technology, most governments have reported direct threats especially the compromised ability to collect taxes because of cryptocurrency’s anonymity.

The United States was the first to note the threats that come with the use of the cryptocurrencies. The Federal Bureau of Investigation pointed that the high level of anonymity brought about by the cryptocurrencies risked becoming the primary channel for Ponzi schemes. The FBI also noted that the cryptocurrencies also risked becoming the avenues sourcing funds by terror groups. Despite these concerns, the United States had not passed a cryptocurrency related regulation by the first quarter of 2018. The same scenario is replicated in other countries. From the EU to Japan, none of the countries has a clear cryptocurrency framework.

In some countries, the governments have opted for direct orders to help limit cryptocurrency growth. China has opted to ban cryptocurrency related activities while Venezuela has come up with a state-run blockchain. In Venezuela, all other cryptocurrencies except the state run crypto network are outlawed. These efforts leave the cryptocurrency community with one major question; why are countries not passing crypto regulations? What is standing between them and passing good legal frameworks?

- Crafting cryptocurrency regulations is very complex because the blockchain technology and cryptographic solution are evolving very fast.

- Most countries are forced to play catch-up when it comes to cryptocurrencies because they lack the expertise.

- Most cryptocurrencies such as Wanchain have demonstrated the capacity to address serious problems such as big data that have dogged administrations for many years.

- The topic of cryptocurrency is slowly molting into a complex political one. Most administrations that are against the cryptocurrencies are increasingly being seen to be against the people because crypto networks are cheap and reliable.

- The cryptocurrency networks such as Wanchain are not owned by any single individual. Rather, they belong to users spread in the entire network. This makes it very difficult to target specific networks.

While every country appears to lag behind when it comes to passing cryptocurrency related regulations, there is no doubt that the legal frameworks will finally dawn. Some countries such as China and Austria have already created draft laws that are awaiting going to respective parliaments for discussion before adoption. To know the actual status of Wanchain in various jurisdictions, have a closer look at the next section.

Is Wanchain Legal?

In the recently concluded G-20 meeting in March of 2018, the Financial Stability Board (FSB), the international watchdog that is charged with financial regulations for the G-20 economies, used a cautious tone in its call for individual countries to crack down digital currencies. “The FSB initial assessment was that cryptocurrencies do not pose risk to financial stability,” explained Mark Carney, the Board Chairman.

Mr. Carney, who is also the governor of the Bank of England, further explained that because of the relatively small size of the asset class when compared with other financial systems, the risks posed by crypto assets is still very low. While this is true from a macro-economic viewpoint, most countries appear to have a different viewpoint. They see cryptocurrencies as serious threats.

- Japan

- Wanchain is legal in Japan. Japan is one of the leading cryptocurrency markets in the globe. The government has indicated that there is nothing wrong with digital assets such as Bitcoin and Wancoin but does not recognize them as legal tenders. The only policy that Japan has on cryptocurrencies is that the cryptocurrency exchanges must be registered with the Japanese Financial Services Agency (FSA) and strictly adhere to rules of operations. For example, Binance was issued with a warning for operating in Japan without a license from FSA.

- Following the hacking and loss of the digital currencies from the Coincheck exchange where over $530 worth of digital coins were stolen in March 2018, Japan is reported to have issued punishment notices to multiple exchanges. The country is also working with South Korea and the United States to craft a cryptocurrency legal framework.

- The United States

- Wanchain is legal in the United States. Though the United States is seen as a top beneficiary of the fast-growing cryptocurrency niche, there is a serious push to have crypto regulations in place. SEC launched a probe by the end of February 2018 which is aimed at taking a closer look at Initial Coin Offering (ICOs). The jurisdiction is also working with other countries such as China and South Korea to take a common ground in drawing legal framework for cryptocurrencies.

- Though the country clarified that cryptocurrencies such as Wanchain are legal and should be considered as commodities, the move was interpreted to be aimed at ensuring all crypto traders pay related taxes. By failing to craft a clear legal framework, it means that individual states are left to craft local laws. One state that has moved on to craft a sort of crypto operational framework is Arizona.

- On February 10th 2018, Arizona passed a bill that seeks to allow residents pay for their services with cryptocurrencies such as Bitcoin and Wanchain. Though the bill will first be viewed by the house of representative, it could become a landmark in the United States. What is yet to become clear is whether Arizona will run its own blockchain or utilize cryptocurrency ecosystems such as Wanchain.

- South Korea

- South Korea appears undecided about the approach to take when it comes to regulating cryptocurrencies. Initially, the government had indicated that it was not intending to regulate cryptocurrencies. However, recent hacking in its cryptocurrencies has made it change the focus. The government has now joined the United States in seeking a common global position that will help to protect investors, facilitate payment of taxes, and prevent the use of crypto networks for fraud.

- Canada

- Wanchain is legal in Canada. The Canadian government does not consider cryptocurrencies as legal tenders. Though the government had approved the Bill C31 back in January of 2014, the law did little to address the fast burgeoning cryptocurrencies. The Central Bank of Canada pointed that cryptocurrencies are more Crypto than currencies and, therefore, will consider them as securities. The country has joined the North American Administrators Association (NASAA) in taking a precautionary approach when it comes to cryptocurrencies such as Wanchain.

- Venezuela

- Though Venezuela is not a leading global economy, its approach to cryptocurrencies has become a major point of interest. The nation's stance under the leadership of Nicolas Maduro is skirting economic sanctions through the announcement of its own blockchain. They call it the Petro Blockchain.

- Starting in 2017, the country started cracking down on cryptocurrencies to cushion the already unstable economy. By crafting its own cryptocurrency and blockchain, it means that residents in Venezuela can only take advantage of the blockchain advancements by joining what the government provides. Interestingly, other countries working on how to counter the faster proliferation of cryptocurrencies such as Russia have turned to Venezuela to establish how it runs the national blockchain.

- Switzerland

- While other countries see the threat coming from cryptocurrencies, Switzerland administration believes that blockchain technologies are the way to go. "The government is working on crafting a legal framework that will help it to become a crypto nation," reported Jorg Garser of the Financial Times. By the close of January 2018, the Swiss government set up an ICO working group that will help to raise the legal certainty and help facilitate tech-neutral regulations. The ICO working group reports directly to the Swiss Federal Council.

Wanchain and Taxes

The cryptocurrencies impact on taxes has become the primary force behind most administrations quest for harsh legal frameworks. Because most cryptocurrency networks such as Wanchain allow users to operate in total anonymity, most people have taken that to be an advantage point to operate without paying taxes. From the profits made when trading Wancoin in the exchanges to value growth for holding the coins over time, very few people want to make appropriate tax deductions.

The anonymity espoused in cryptocurrencies has reached pitch high with some business communities coming out to express their anger. The argument is that though trading in cryptocurrencies is very lucrative, it is the small enterprises that are left with the burden of meeting all the tax requirements.

In the United States, only a handful of the people pay taxes despite the large population in the cryptocurrencies. In one of the studies done by Credit Karma Tax, fewer than 100 people of 250,000 who have had filed their tax returns by early 2018 in the US had indicated their cryptocurrency related gains or losses. In addition to being used as avenues for fraud and funding terror, cryptocurrencies have now become the primary avenue for tax avoidance.

Tax experts have, however, cautioned people that they are staring at dozens of lawsuits in the coming months if not years for not paying tax from crypto related activities. As technologies advance, tax experts are warning that the cover you have could easily be wiped off and expose everything. It is better to be on the safer side. Here are some useful tips to help you stay on the safer side of the law while still enjoying full benefits of being in Wanchain network.

- Make sure to report both profit and loss that you make trading Wancoin.

- Ensure to treat revenue from trading Wancoins as taxable income.

- Always note crucial details about your Wancoin trading especially trading volume and value of the corresponding fiat.

- For businesses accepting payment in Wancoins, it is important to ensure you work with a tax expert to ensure that the books of accounts are done appropriately.

Does Wanchain Have a Consumer Protection?

When cryptocurrencies entered the globe, one of the main characteristics was community ownership. This is one trait that is also manifested in the Wanchain system. After forking the Ethereum core code, the Wanchain development team ceased to be owners. Rather, the network is owned by the users spread in the network across the globe.

Because Wanchain does not have consumer protection, it is important to appreciate that you are on your own. For example, if the network is hacked and some or all your coins stolen, there is nowhere to complain to. You cannot even go to a court of law because cryptocurrencies are not regulated.

To be sure of operating safely in the Wanchain system, it is important to understand the crypto well and how it operates. Here are other useful tips for operating safely in the network.

- Never share the private keys with anyone.

- Make sure to store the private keys and wallet safely and away from the main computer.

- Ensure to keep your Wanchain client and the main computer updated all the time.

- Select the trading exchanges with a lot of care. Make sure to put the focus on the exchanges that have a better focus on keeping clients coins as secure as possible.

- Only invest what you can afford to lose.

- Try as much as possible to keep the native coins in cold storage.

- After trading Wancoins, make sure to move them to your wallet for extra safety.

Illegal Activities with Wanchain

Many criminals see anonymous cryptocurrencies as perfect hiding places to evade scrutiny and even authorities. By taking a comprehensive model that includes vouchers, validators, and storemen, it has become very difficult for a criminal to run illegal activities in the Wanchain network. No illegal activity has ever been reported with Wanchain.

Is Wanchain Secure?

Yes, Wanchain is a secure network. The architecture of Wanchain is carefully thought about to ensure that users are able to trade without worrying of losing their assets. Here are the main components that help the crypto network to operate as a secure system.

- Smart contracts.

- Advanced encryption.

- Progressive update of the core code.

- A highly aggressive development team.

- It employs Proof-of-Stake that has decentralized mining and reduced chances of one party holding over 51% of the coins and conspiring to harm the network.

Is Wanchain Anonymous?

Yes, Wanchain is anonymous. Like other cryptocurrencies, one of the main targets of Wanchain is ensuring it is completely. This is one of the main attractions that are drawing people to cryptocurrencies. Wanchain and its homogenous chains support privacy protection on the basis of smart contracts. This is achieved using three important things;

- One-time addresses.

- Ring signatures.

- Advanced encryption.

Has Wanchain Ever Been Hacked?

Wanchain has never been hacked. In the cryptocurrency world, hacking of cryptocurrencies is seen as an indication of weakness in the core code or poor commitment by the development team. Though Wanchain is a very broad cryptocurrency project, no report of successful hacking has even been reported.

NOTE that this does not imply that the network is not targeted by hackers. The development team reports that hacking attempts are made regularly but they are noted and thwarted at the earliest possible point.

How Can I Restore Wanchain?

When reports of the people who have lost cryptocurrencies hit the news, the shockwaves are felt throughout the crypto community. Many people have a feeling that if other crypto coin holders can lose their assets, the risks facing them are equally high. Though there are cases when the losses are permanent, there are instances when you can restore the coins. Here is a closer look at the cases of when you can restore the coins.

- Loss through hacking: There is no method that can be used to restore Wancoins.

- Loss through sending to wrong address: This loss is permanent and cannot be reversed.

- Damage to the wallet: The Wancoins can be restored through wallet reinstallation from the backup. You can also get another similar wallet and reconcile using the private keys.

- Forgetting the private keys: You will need to regenerate the private keys using the private seed generated the first time you used a Wanchain wallet.

NOTE: The secret to a successful recovery of your Wancoins is preparing appropriately before the loss occurs.

Why Do People Trust Wanchain?

Starting from 2014, the rate of cryptocurrencies entry into the market has been very high. The main focus has shifted from simply crafting a system for value transfer to a functional ecosystem that can leverage businesses, institutions, and personal investment targets. Wanchain is gaining a lot of trust from the crypto community because of the following reasons.

- The cryptocurrency has a very advanced model that targets to enhance cross-chain transactions.

- The community and value of Wancoins have been growing rapidly.

- The cryptocurrency has unique features that include smart contracts and enhanced privacy settings.

- Wanchain is led by some of the top brains in the market that.

- With more experts agreeing that Wanchain is a high potential cryptocurrency, investors moving away from cryptos perceived to have hit a climax such as Bitcoin see it as a perfect investment opportunity.

- The cryptocurrency employs PoS algorithm which means that only those who have some stake can confirm transactions and participate in consensus.

History of Wanchain

Wanchain development started in 2016. At this early stage of the cryptocurrency development, the primary thing was research about cross-chain transaction. This early evaluations and studies also involved privacy protection. Here are other important components in the Wanchain timelines. Note that the timeline captures even the expected happenings in the years to come.

- In 2016, the Wanchain idea was born and research commenced on the application architecture. The process also involved pretesting of some components especially on privacy considerations.

- In December of 2016, the Wanchain development team was working on the Proof-of-concept that would be used to craft the white paper.

- In June of 2017, the Wanchain development team released the white paper. The paper defined and outlined how all the structures would operate to enhance effective operation of the ecosystem.

- In October of 2017, the Wanchain tokens (WAN) went on sale in its ICO which raised $36 million.

- In January 2018, the Wanchain 1.0 went live with its privacy protection, wallet, blockchain explorer, and WAN being released to the public.

- The WAN tokens hit the exchanges at the end of March where the price has been on an upward trend and hit an all-time high of almost $10 on early May, 2018.

- In June of 2018, the Wanchain 2.0 is expected to be released. This will integrate the Wanchain with Ethereum network.

- In December of 2018, Wanchain 3.0 will be released. This will integrate the blockchain with Bitcoin.

- By December of 2019, the Wanchain 4.0 will be released allowing the network to integrate with other chains. It will also update the multi-coin wallet.

Who Created Wanchain?

Wanchain was founded by Jack Lu. Lu is also the founder of Factom and the current CEO of Wanglu Tech. At Factom, Lu was very successful and managed to steer it through an ICO that netted $9 million while the cryptocurrency grew to enter top 30 cryptos in the market based on market capitalization. Lu is a graduate of American and Chinese universities and has worked at companies such as HP and Xerox.

To make Wanchain successful, Lu worked with experts from Wanglu Tech, China, and United States from an early stage of the project’s design. These personalities included Dustin Byington, Zane Liang, Ying Zhang, Tony Zhang, and Diamond Bai.

Wanchain Videos and Tutorials

Will Wanchain Replace The Banking System?

6 New Wanchain ICOS +WANLAB

See Also

- Bitcoin | Ethereum | Ripple | Bitcoin Cash | Litecoin

- Cardano | NEO | Stellar | EOS | NEM | VeChain Thor

- Monero | Dash | IOTA | TRON | Tether | OmiseGO

- Bitcoin Gold | Ethereum Classic | Nano | Lisk | ICON

- Qtum | Zcash | Populous | Steem | Ontology | Waves

- DigixDAO | Bytecoin | Bitcoin Diamond | Binance Coin

- Bytom | Verge | Crypto Humor

- Cryptocurrency Dictionary | List of Cryptocurrencies | CEX.io

- Binance | Coinbase | Changelly | Coinmama | Bitpanda

- LocalBitcoins | Kraken | Paxful | Ledger Nano S | TREZOR