Maker

Maker cryptocurrency guide advises where to buy and how to buy Maker. This guide also contains the markets, value, trading, investing, buying, selling, transactions, blockchain, mining, technology, advantages, risks, history, legislation, regulation, security, payment, networks and many other interesting facts about Maker as well its status in the world of cryptocurrencies.

Maker, Thursday, 2025-06-12

Contents

What Is Maker?

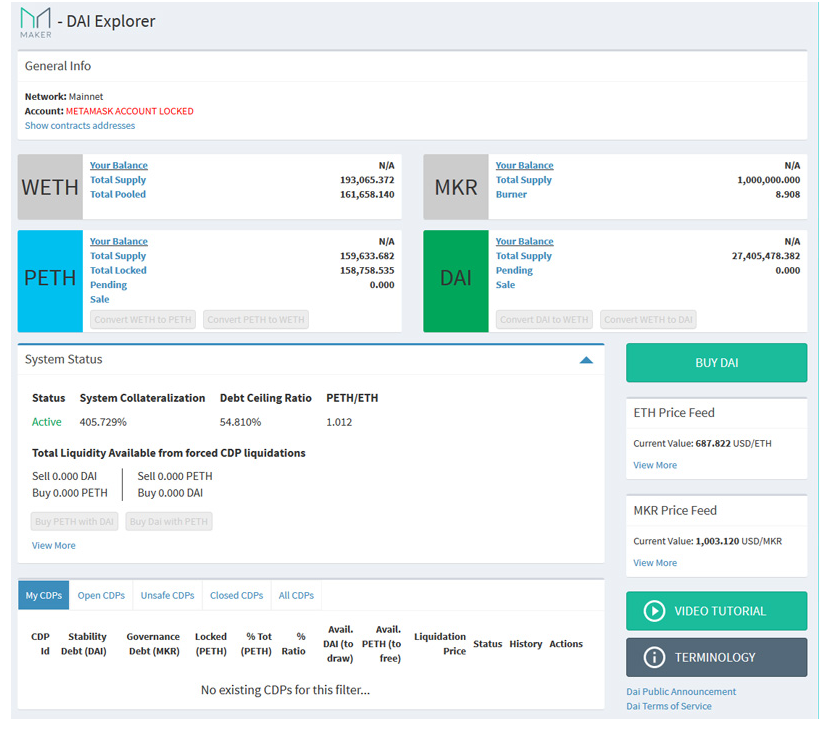

Maker is a Decentralized Autonomous Organization (DAO) on the Ethereum network designed to help lower the threat of cryptocurrency volatility of its own stable token called Dai. Maker was founded by Rune Christensen and uses interest rate to stabilize the MKR price. It uses a Collateralized debt position (CDP) to create Dai that can be recovered to MKR at will.

The unique structure of the Maker utilizes target rate feedback mechanism (TRFM) to help adjust the price of Dai to the targeted price. This model has made the popularity of Maker to grow very fast as more corporate organizations and even other cryptocurrency networks develop interest.

A closer look at the top cryptocurrency in the market today, Bitcoin, indicates that its value can fluctuate with as much as 25% in a single day and at times hitting 300% in a month. Others are equally volatile. This volatility is what makes the realization of optimal blockchain potential difficult. The model adopted by Maker of working with Dai coin that is pegged to the US dollar, meaning that 1 Dai = 1 USD, has won the crypto community’s affection making the demand for the native coins to even go against the grain in early 2018 when most digital assets's price was tumbling.

When Maker was released, the price of MKR was about $20. However, this price grew steadily to hit more than $900 by mid-May 2018; a whopping growth of more than 4400%. Here is a comprehensive look at Maker that is being touted to have the potential to turn around the cryptocurrency industry.

Beginner's Guide to Maker

A closer look at the cryptocurrency industry reveals one characteristic of most cryptocurrencies; they are highly volatile. The price of cryptocurrencies can swing with a huge margin within days. Now, Maker has introduced a solution to address the problem of volatility.

By pegging Maker to Dai (a stable Bond/coin), a user can now invest in the cryptocurrency or use it without worrying about losing value through volatility. This looks like the ideal cryptocurrency that you should join to enjoys sustained profitability. However, the Maker architecture is complex and need you to comprehensively understand it. This is why this guide was created.

This Maker guide is a comprehensive review of the Maker system that is aimed at demonstrating how the system works to assist you to make the right decision. The guide looks at all areas of the project so that the questions and doubts you have can be cleared. From the advantages of using the cryptocurrency network to its history, everything is outlined in this guide. Welcome to learn more about the project and make the right decision about using it.

Where and How to Buy Maker?

When people hear of Maker and its recent meteoritic value growth, the first thing that crosses their minds is how to own a part of it. You need to join the network to enjoy this growth. The best way to acquire MKR is purchasing from the markets. The cryptocurrency markets are designed to work the same way forex markets work. However, the crypto markets list crypto assets as opposed to fiats.

The first step to buying Maker is selecting the right cryptocurrency wallet. While you can leave the coins to stay in the exchange of choice, they are at a very high risk of getting siphoned away by attackers. There are two primary places where you can purchase Maker from.

- Buy from cryptocurrency exchanges: These are the primary markets designed for trading digital assets such as tokens. To buy MKR from the exchanges, you need to identify an exchange that lists MKR and open a trading account. You will also have to verify the trading account before purchasing the quantities of MKR you want. Some of the exchanges to go for include Bitfinex and Bibox and Paradex.

- Buy from those who already have them: Because of the complexity involved in purchasing cryptocurrencies from the exchanges, some people now prefer to buy directly from those who have the coins. As cryptocurrencies continue growing in popularity, special clubs targeted at helping members to understand the industry are springing up. These clubs provide members with an opportunity to meet other cryptocurrency enthusiasts and even support direct purchases. The good thing about them is that the seller and buyer are free to agree on their own terms and conditions of sales.

Maker Wallet

Are you planning to join the Maker network? The first thing should be acquiring an appropriate wallet. A cryptocurrency wallet is a digital location designed to hold your digital assets such as MKR. However, this definition is indeed a misnomer. In reality, crypto assets do not leave their native networks. Therefore, how exactly do crypto wallets work?

Crypto wallets are designed to help you take control of the tokens stored in the native networks via special codes. The wallets generate three sets of codes that link and help you control the tokens in the network. The first code is the private keys. This is a special code that helps a user on the Maker network to call their tokens to live during transactions. Like the name suggests, the private keys should be kept as private possible and away from third parties.

The second code generated by the wallet is the public keys. This key acts as the main address that points to your wallet. This means that those who want to pay you with MKR have to send it to your public keys/address. It is also used by miners to confirm transactions when sending value.

The last code generated by the Maker wallet is the seed. The seed is a special code used to regenerate the private keys in the case of MKR loss. It is very important that the seed and private keys are kept safely and away from the main computer.

Cryptocurrency wallets are categorized into five main groups; hardware wallets, mobile wallets, desktop wallets, web-based wallets, and paper wallets. The following are the top Maker wallets you should consider when joining the network.

- Ledger Nano S (hardware wallet).

- Trezor (hardware wallet).

- MyEtherWallet (Desktop wallet).

- MetaMask (web-based wallet).

Where to Buy Maker with Credit Card?

Credit cards have become the primary methods of payment in the market today. Their acceptance in both online and conventional stores has made them a must-have item for most people. Now, you can also buy cryptocurrencies such as Maker from exchanges such as Bitfinex and Okex. If you want to buy from exchanges such as Bibox that are crypto-to-crypto only, the process has to begin from other platforms that accept credit cards such as CEX.io.

Where to Buy Maker with PayPal?

There is no direct method for buying Maker with PayPal. PayPal has for many years considered crypto networks as direct competitors. Therefore, it discourages users from making direct payments to networks such as Maker. If your cash is in PayPal, you can only make a purchase by withdrawing to a bank account or credit card.

How to Buy Maker with Wire Transfer?

Banks are perhaps some of the most trusted institutions in the globe today. They are trusted by people because of their professionalism especially in working with financial experts. Because of this, many people rely on banks to process salaries and even access credit. Now, you can also use wire transfer to buy MKR among other tokens. Here is the procedure to follow.

- Start by picking the right cryptocurrency wallet. This is very important because you will need to move the tokens to the wallet for extra safety after the purchase process is over.

- Select a cryptocurrency exchange that lists MKR and that accepts wire transfer. A great example at this point is Bitfinex or Okex. If you select a crypto-to-crypto platform, you will need to start from another platform that accepts fiat or credit cards.

- Open a trading account at the exchange and verify it. The verification requires users to provide additional information such as phone number, date of birth, and proof of location. The verification details could differ depending on individual exchange's policy and local regulations.

- Visit the trading dashboard to select the quantities of MKR tokens to buy and check pay with a wire transfer. Once you add the bank details and confirm they are okay, the transaction will go into a pending mode until the cash hits the trading platforms account. This could take two to four days depending on the location and specific platform.

- Once the transaction is completed, the MKR you have bought will go to the exchange account. Now, you will need to move them to your wallet for extra safety.

Where to Sell and Trade Maker?

Do you have some MKR and have been wondering about the best way to optimize profitability? The most recommended method is trading the crypto asset in the markets. Cryptocurrencies are traded in the markets the same way that fiats trade in the forex markets.

To trade in the crypto markets, it is important to appreciate that they have become the primary targets for hackers. In January of 2018, a Japanese based cryptocurrency exchange referred Coincheck was attacked and millions worth of crypto coins siphoned away. About one month earlier, YouBit, South Korean exchange was hacked and millions worth of crypto coins stolen. The exchange was forced to file for bankruptcy. Indeed, every huge loss associated to cryptocurrencies can be traced to the trading exchanges. Therefore, how do you pick a safe and reliable platform? Here are some useful tips to consider.

- Only select the exchange that puts a lot of focus on traders’ security. Here, you can check for important features such as 2-factor authentication, insurance of traders’ assets, and cold storage.

- The ideal platform should have a large list of tradable assets. This will always provide multiple profitable options when the current ones become less desirable.

- A great exchange should have low transaction fees. If the exchange charged very high transaction fees, most of the profit will be eaten away.

- The exchange should have an intuitive interface to make trading and operations easy. An easy to use platform makes it easy to follow the markets optimize profitability.

- Go for the platform that has been in the market and earned great reputation. Consider checking what trusted communities such as Reddit have to say about the selected exchange.

- An ideal platform should allow traders to move their MKR and other assets to their wallets immediately after closing trade. Moving the tokens to your wallet helps to secure them from the high-risk platform so that you can have absolute control.

Some of the top cryptocurrency exchanges for trading and selling MKR include Bibox, OKEx, Paradex, Gate.io, and OasisDEX.

How Much Are the Transaction Fees of Maker?

When you join the Maker system, the main transaction charge is stability fee. Though the development team does not outline the cost of sending MKR to other users, the cost is relatively high compared to most cryptocurrencies because of the current high price of MKR.

Maker Markets

As the popularity of cryptocurrencies keeps growing, the number of markets has equally been going up to keep pace. Because of its unique structure and operational model that is promising huge returns, a lot of markets have listed for you to buy. Here are some of these markets.

1) Bitfinex

Bitfinex is a Hong Kong-based cryptocurrency trading platform that allows users to make their deposits using fiat currencies. Though it was initially designed to help Bitcoin traders, the list has grown over time to include other high potential tokens including MKR.

The biggest selling point of Bitfinex is its low transaction fees of 0.2%. The management indicates that users can enjoy lower transaction fee by trading higher volumes. Besides, many users prefer the exchange because it allows margin trading. This places it on the same level with other top exchanges such as Poloniex.

The platform also allows users to make deposits using multiple methods including fiat currencies. Even as other crypto exchanges such as Bibox opt for the crypto-to-crypto type of trading, Bitfinex makes it easy to use many types of payments. This makes it a great option even for new traders who only have cash in their banks or credit cards.

If you plan to move a large volume of MKR or other cryptocurrencies in the exchange, the platform offers a special feature called Over The Counter service. This gives preference and lower transaction costs to those transacting large volumes.

Other features that make Bitfinex a great trading platform include its mobile app that provides instant notifications about the market. For example, if you want to trade MKR after it hits a specific point, you simply set the mobile app to notify you. You also get advanced trading metrics to help you understand the market and start trading like an expert in no time.

The biggest problem with Bitfinex is that it has a hacking history. This makes most traders run away the moment they hear about the hacking history.

2) Bibox

This is a relatively new Chinese based cryptocurrency exchange that has been gaining a lot of popularity. Like Binance, (another Chinese based exchange), Bibox targets to make cryptocurrency trading easy, cheap, and direct. It also has a native based Bibox Token called BIX. The exchange encourages traders to pair their tokens with BIX or use it to pay fees on the platform.

To guarantee users of greater security at a time when most cryptocurrencies have become the primary targets for hackers, the exchange utilizes 2-factor authentication. This means that even if an attacker manages to break into your email address, it will be impossible to steal without getting other factors such as phone number. The development team of Bibox comprises of members who have been involved in the crypto industry with other projects especially Binance and OkCoin.

The cryptocurrency exchange charges a very small fee of 0.15%. This makes it one of the cheapest options out there. You can also enjoy special discounts of up to 50% by paying the transaction fee with BIX. You can, therefore, expect to keep the bulk of the profit from trading MKR.

The biggest issue with Bibox is that it is a crypto-to-crypto trading platform. This implies that those with cash have to start from a different platform that accepts fiats. Besides, the exchange is based in China, a jurisdiction that has outlined its direct dislike for cryptocurrency exchanges. This could threaten Bibox existence in the coming months.

3) Gate.io

Gate.io is a cryptocurrency exchange based in Florida, United States. The exchange was started by Gate Technology that targeted helping make trading in cryptocurrencies easy and secure. The main selling point for Gate.io is its long list of supported cryptocurrencies. This implies that you will never miss a profitable crypto token to pair with MKR.

The transaction fee at Gate.io is 0.2%. An additional charge is levied for making withdrawals from the exchange. Though this is considered to be within range, the Maker community has been calling for it to be pushed below 0.1% to make it more competitive compared to other platforms such as Binance.

To keep users' cryptocurrencies safe, Gate.io uses both hot storage and cold storage. Then, users are required to use two-factor authentication to access their coins for trading. The login password is used to allow users log into their Gate.io accounts while the funds password is used to allow users trade their assets and make withdrawals.

4) OKEx

This is a Hong Kong-based cryptocurrency market owned and operated by OkCoin. Recently, Okex has experienced low transaction volumes as more people become worried about exchanges based in China because of the ongoing onslaught by the government. One unique thing about Okex is its special focus on security. The exchange requires users to open their trading accounts and verify them with government-issued ID and proof-of-residence.

The transaction fee at Okex is 0.2% for the takers and 0.15% for makers. Note that this fee goes down when your transaction volume goes up. For example, if you are trading more 12,000 BTC worth of Maker, the transaction fee is 0.02% for the maker and 0.05% for the taker.

One unique thing about Okex is that traders are allowed to use fiat currencies. They can also use wire transfers. This makes Okex a great option for starters who only have fiat currencies or traders who target making regular withdrawals. By accepting deposits in fiat, Okex has become a major entry point for users with cash and target trading in other crypto-to-crypto trading platforms.

Value of Maker

Maker is one cryptocurrency that has performed very well in the markets especially between mid-2017 and early 2018. Its value grew progressively to thrust the crypto into the top 50 cryptocurrencies. In early June 2018, the market capitalization of Maker was around $500 million at a price of around $800. This put well ahead of other coins including Stratis and Golem. The demand and fast growing community of Maker is likely to keep pushing its value further up. The highest peak of Maker value happened in January 2018, when the market cap hit $1 billion at a price of almost $1700.

Is It Profitable to Invest in Maker?

For many people, the interest in cryptocurrency is driven by the expected returns on investment. This is why you will hear people asking whether the price of the targeted cryptocurrency can grow and reach the level hit by Bitcoin. For Maker, the indicators are that it will be a highly profitable network. To demonstrate this, here is a closer look at the value shift in the Maker network.

In January 2017, the price of MKR was around $22. This price grew steadily to reach more than $1000 early in May 2018. This is more than 4400% growth. If you invested about $1000 in early 2017, the investment would have grown to around $45,000 in slightly more than one year.

The Maker community is optimistic that the value of the cryptocurrency will keep rising to deliver higher ROI to MKR holders. Another thing that is likely to keep pushing the value of Maker up is its architecture. Though its design of addressing volatility is complex, many people are coming to appreciate it and joining the network.

Note that like other cryptocurrencies, Maker’s profitability is dependent on the occurrences in the market. For example, if looming regulations are harsh and suppress the growth of cryptocurrencies, Maker's profitability could take a dive. This implies that you should only invest what you can afford to lose.

Where to Spend or Use Maker?

Though Maker has demonstrated its unique design that helps to reduce the volatility of its Dai coin, no store has come out to accept it for direct payment. This means that the development team has its work cut out. If you have some MKR and want to spend them in a store that only accepts other top crypto coins such as Bitcoin, you simply need to convert them.

Can Maker Grow to Become a Major Payment Network?

Yes, Maker can become a major payment network. Like other networks, Maker is in the race to becoming a major payment network. Many traders prefer Maker because of its low volatility. This means that the risk of loss is very low even if users hold the tokens for sometime before using them. However, other networks such as Bitcoin appear to be racing faster on the road to becoming a major payment network. For example, Ripple is working with other payment networks such as banks to increase its chances of becoming major payment networks.

How Does Maker Work?

Maker cryptocurrency is presented as a smart contract platform aimed at stabilizing the value of a bond referred to as Dai. The Dai bond is pegged to the USD (1 Dai = 1 USD). Besides, Maker utilizes interest rate to help stabilize the price of MKR. Here is a closer look at how it happens.

The collateralized debt position (CDP)

In order to interact with the Maker platform, you are first required to form a Collateralized Debt Position (CDP). What exactly is CDP?

To create Dai, on the Marker platform, the user has to leverage his Ethereum in special smart contracts called CDP. Though the CDP generate the Dai to use in the platform, users also enjoy an interest referred as a stability fee. The collateral accepted in the maker platform is PETH (a Pooled Ether). Therefore, to obtain Dai from a CDP; you will have to start by converting Ether to PETH. The interaction with CDP can be seen in four main stages.

- Making the Collateralized Dept Position: At this point, the user is required to create CDP and send PETH to collateralize it.

- Generate Dai: In the second stage, the user sends the transaction indicating the quantity of Dai he wants from the CDP. When you receive Dai, an equivalent amount in PETH is locked in the smart contract. This locked collateral cannot be accessed until the Dai debt is cleared.

- Debt reconciliation: In order to receive one’s collateral back, the user has to clear the CDP debt and a stability fee. The fee is paid in MKR while the debt is only paid in Dai.

- Withdrawing the collateral: Once you have paid the debt and the stability fee, you can now retrieve the collateral by sending the transaction to Maker platform.

The Maker price stability system

The Maker Stablecoin System utilizes external market factors as well as the economic incentives for pegging Dai to USD. First, the Maker system uses the Target Price to help calculate collateral debt ratio of the CDP. The Target Price is also used to establish the value of collateral assets when making settlements across the globe.

The stability system also employs the Target Rate Feedback Mechanism (TRFM). This is employed in the case of severe instability to help adjust the target rate for stabilizing the Dai Market price closer to the anticipated price.

When the market falls below the target price, TRFM raises the Target Rate. Increase in the Target Rate makes generating Dai very expensive. However, when the market climbs above the targeted price, TRFM decreases the target rate. A decrease in Target Rate helps to reduce the supply of Dai while simultaneously raising the demand for Dai. However, the reverse is true when there is a decrease in the target rate (the market law of demand and supply).

Another stability mechanism used by the Maker system is the Global Settlement that guarantees Dai holders get targeted price in the case of an awful emergency. The global settlement shuts down the Maker system and ensures that all users get the net value they are entitled to. Note that before a global settlement takes place, the MKR holders have to vote on the ensuing situation.

Does Maker Use Blockchain Technology?

Yes, Maker uses blockchain technology. The Maker system operates as a smart contract in the Ethereum system. There are a total of one million MKR with 530,000 MKR tokens already in circulation (by Nov 2017) for paying the fees on the Maker system.

The Maker system operates as a decentralized and open-source platform with users spread all over the globe. The MKR holders in the network are responsible for voting in the platform. This means that they have to vote on major decisions such as Global Settlement which serves as a global stability model. Other areas where MKR holders vote in include;

- Adding new CDP types.

- Modifying existing CDP types.

- Modifying sensitivity parameter.

- Modifying target rate.

- Adjusting price feed sensitivity.

- Selecting the trusted oracles.

Mining Maker

There is no mining in Maker system. Unlike other networks such as Bitcoin that relies on miners to confirm transactions and release new coins, things are completely different at the Maker network. If you want to earn on the Maker network, the only method to use is holding Dai to earn interest.

What Are the Advantages of Maker?

Which is the best cryptocurrency to join? While the primary aim of joining cryptocurrencies is enjoying a lower cost of sending transactions, the focus is now shifting to other functionalities. Here are the main benefits that you will get from using Maker.

- Maker is designed to help users address the serious problem of volatility. The problem of volatility has been the biggest stabling block of blockchain networks adoption and growth. Now, Maker has provided a reliable solution which could greatly help to enhance adoption and success of cryptocurrencies.

- The stability brought by Maker through Dai has set it in own category that is fast growing the community and value. Between launch and close of the first quarter of 2018, the price of MKR had shot close to $1000. The price is expected to climb even further and rival even other top cryptocurrencies such as Bitcoin.

- Like other cryptocurrencies, Maker is a great platform that allows users to operate without worrying of third-party seizures. If you save cash in a bank, it is important to appreciate that the funds can be frozen with a strike of a pen in case a court battle hauls itself into your doorsteps.

- A great way to use and own the network. When people use banks or other payment services such as PayPal, they feel passive. Once a transaction is complete, one feels detached and only comes back during the next transaction. However, Maker is different. When you join the network, you become part of its decision-making system. This means that you will be called to help with building consensus in things such as adding new CDP types and modifying target rate.

- By operating as a smart contract in the Ethereum network, Maker enjoys an added layer of security that makes it safer compared to others. Its development team has also been very active in keeping the network secure and updated all the time.

What Are the Risks of Maker?

While Maker has numerous benefits that make people want to join it right away, it is important to also appreciate the associated disadvantages. Here are some of these demerits.

- The danger of the looming regulations. Since 2009 when cryptocurrencies debuted, many governments have expressed their concerns that digital assets could make tax collection and governing hard. If the administrations go ahead and pass harsh regulations, there is a risk of Maker and other cryptocurrencies regressing or fading away with time.

- The threat of getting attacked by hackers: Crypto assets have become a unique attraction to hackers because of the expected progressive growth. Hackers can attack you at the Maker network level, wallet, or even when trading at the exchanges.

- The danger of more advanced cryptocurrencies entering the market: Just like Maker has joined the market and introduced a new method of addressing volatility, there is a risk of newer cryptocurrencies entering the market and introducing better features. This could dwindle the attractiveness of Maker and even slow down the anticipated growth.

- The Maker relies on the Ethereum network. This means that Maker is likely to get affected negatively if an unexpected problem affects the Ethereum system. The problem is also likely to be experienced when Maker grows over time necessitating it to go for own blockchain.

- The threat of irrational markets over a long period could make users to easily lose confidence in the stability of the system. This could easily trigger a mass shift to other cryptocurrencies and pull down the value of the cryptocurrency.

- The operation of the Maker is very complex. Unlike other cryptocurrency networks such as Bitcoin whose coins are direct and easy to use, many people joining the maker network find its operation very complex. The idea of price stability mechanism that includes market incentives is very complex especially to people outside the money market realms.

What Happens if Maker Gets Lost?

It is not uncommon to hear somebody shout in that his Maker was lost. Such losses can be devastating especially if you had taken a lot of time to accumulate the coins. However, many people have been asking what really constitutes a cryptocurrency loss? What happens when such losses take place?

If you have standard fiat currency, the loss could means complete damage to the notes. Such damages could take them completely away from circulation. However, native coins do not leave their networks. Even when losses take place, the coins are still in the network. Here is a demonstration of what happens.

- Loss through sending Maker to the wrong address: In this type of loss, Maker coins have simply changed hands and belong to another person. However, they are still active in the native network. The transaction cannot be reversed.

- The loss caused by damage to the wallet: In this case, the coins are still in the network under your name but in a dormant state. You will need to get the right wallet again to restore Maker.

- Loss through hacking: If your wallet, the Maker network, or exchange is hacked and MKR lost, the loss is permanent. The MKR tokens are still in the network but under a different owner.

Maker Regulation

Between 2009 when Satoshi Nakamoto released Bitcoin and 2018, the cryptocurrency industry has operated without a legal framework. Many countries feel threatened by the fast growth of cryptocurrencies in their jurisdictions. In the United States, the Federal Bureau of Investigation was the first to note the threats that that come with cryptocurrencies. The bureau noted that cryptocurrencies posed a huge risk to the stability of the government by creating anonymous lines that can be used to fund terror and tax evasion.

It is not just the United States that is seeing issues with cryptocurrencies. Rather, all countries have voiced similar concerns and vowed to craft laws that will control the crypto space. Here are some of these concerns.

- Because crypto networks provide platforms for peer2peer operations, they could ultimately eliminate centralized organizations such as banks. This could come with a massive loss of employment and slowdown local and global economies.

- Cryptocurrencies allow users to operate anonymously. This is seen by most administrations as a new conduit for illegal activities.

- Cryptocurrencies are providing a new line of investment that administrations do not control. Because the crypto assets are considered to have higher ROI, many people are now opting for them as opposed to the conventional real estates or bonds.

- As anonymous networks that utilize advanced encryption, some people believe they can operate without paying taxes. This could ultimately deny the administrations the cash they need for development.

While these concerns are indeed monumental, it is interesting to realize that no country has passed a clear regulatory framework to control of guide cryptocurrencies. Even the countries that have come out to voice their disapproval of the new blockchain solutions are only using direct orders. For example, China banned ICOs in the country and started freezing bank accounts of exchanges that supported such trade. Now, it is emerging that most countries are finding it very difficult to pass cryptocurrency laws. Here are some of the things making crafting crypto related laws difficult.

- The cryptocurrency topic has become a highly politicized issue. Any administration or party that appears to go against the crypto grain is seen to be against the will of the majority.

- The cryptocurrencies have proven to be a reliable solution for problems that have bedeviled governments for many years. A great example is the issue of Big Data.

- Blockchain networks are not owned by any single party. Rather, they belong to user spread in respective networks across the globe. This implies that there is no specific party to target with the laws the way a government licenses entities such as banks.

- Cryptocurrency technology is evolving rather fast. Most administrations are now forced to play catch-up when it comes to crypto networks.

While so many handles lay on the way, the truth is that these regulations will finally dawn. In most of the cases, it will only take one country to craft a legal framework and others will start using it as a case study. For example, Russia has already released the draft cryptocurrency framework that could become law if passed the parliament. Therefore, you should focus on what will happen when the laws finally take effect. To know the status of Maker in specific jurisdictions, take a look at the next section.

Is Maker Legal?

Maker is legal in most of the countries across the globe. Though no country had passed a clear legal framework to guide Maker and cryptocurrencies by early 2018, they are at different stages of crafting the laws. Some have opted to use the existing legal frameworks and reinforcing them with executive orders.

1) The United States

Though the United States was the first to note the threats that come with cryptocurrencies, it was yet to pass a legal framework by close of the first quarter of 2018. The administration has opted for a global as opposed to a localized approach on cryptocurrency regulations. Initially, the country provided a clarification through the Commodity Futures Trading Commission (CFTC) that indicated all cryptocurrencies are commodities. The clarification was largely meant to help guide the crypto community pay taxes to Internal Revenue Service (IRS).

The threats that come with cryptocurrencies have, however, started altering the investment landscape forcing the country to take a newer direction. In January, the Treasury Deputy Director, Mandelker Sigal, went on a global tour to try and work on a common position with other countries such as Japan, China, and South Korea that have a very huge crypto population.

Back at home, the Secretary of Treasury, Mr. Mnuchin indicated that they will not relax and see cryptocurrencies turning into an evolved form of Swiss accounts. While speaking at the Economic Club in Washington, Mnuchin emphasized that cryptocurrencies could easily undo the efforts they have used to prevent fraud. He was particularly concerned about the risk of cryptocurrencies opening the channels for money laundering.

As the federal administration appears to take longer, individual states have moved ahead to create some sort of arrangements to fit individual situations. Early in March 2018, Arizona passed Bill SB1091 that now allows residents to pay their taxes in cryptocurrencies. The law was informed by the fact that a lot of people were already into cryptos but they feared using the cryptocurrencies directly. The new Arizona law has created a new way of looking at things with more states such as Georgia and Wyoming are lining up to pass similar crypto frameworks.

2) Russia

While the United States is looking at a global approach to crypto regulations, Russia has taken a more localized approach. Up to September 2017, the Russian stand was the government would not regulate cryptocurrencies. The Russian Federation Central Bank chief, Nabiulina Elvira, indicated that regulating the cryptocurrencies was tantamount to accepting them like legal tenders.

The hands-off approach suddenly changed by the close of the year when the Finance Ministry indicated that it was impossible to tell whether traders who accepted payment in cryptocurrencies were committing crimes. The legal vacuum, according to the ministry, needed an urgent address in the form a legal framework. This is what prompted the ministry to urgently work on a draft legal framework referred as the Digital financial assets draft bill. It was considered the most comprehensive and tight legal framework in the globe by the close of the first quarter of 2018.

Under the draft law, cryptocurrencies such as MKR are considered commodities and not legal tenders. This implies that they cannot be used for payment of goods and services. The draft law defines digital assets and only allows authorized cryptocurrencies that are licensed by the government to trade them. Besides, it strictly demands KYC (know your customer) procedures to ensure that all those trading the assets are known and do not commit fraud.

The law further defines ICOs as the process of releasing tokens by registered companies to raise funds for development. This means that only companies that are registered and whose administrations are well known by the licensing authority can issue an ICO in Russia. The draft law does not stop there.

Mining under the proposed bill will now be only allowed for the entities that are registered. Like ICOs, mining is seen as a process of releasing a new commodity, crypto asset, into the market. Therefore, only licensed entities can do it. If you mine or release an ICO without appropriate authority, you are committing an offense.

3) Venezuela

Venezuela, unlike the US and Russia, has opted to take a unique approach to address cryptocurrencies. Because of the espoused anonymity in cryptocurrencies, Venezuela saw that as an opportunity to circumvent international sanctions. The country came up with a national cryptocurrency (petrol cryptocurrency) and outlawed all other blockchain networks in the country.

Since very few countries were willing to buy oil from Venezuela for fear of similar sanctions, the trade can now be completed without getting discovered. A petroleum buyer simply needs to make payment in the petro cryptocurrency to get petroleum delivered.

Though the local currency is worth very little and, indeed not of huge significance globally, many countries are now turning to Venezuela to look at the best ways of optimizing blockchain technology. For example, Russia is working closely with Venezuela to see how it can implement a better blockchain system.

4) Switzerland

As other countries outline the threats that come with cryptocurrencies such as MKR, one country that does not look perturbed is Switzerland. Instead, the Swiss administration is welcoming cryptocurrency networks that are being rejected elsewhere. The Economics Minister was reported by the Financial Times indicating that the administration was looking forward to making the jurisdiction a crypto nation.

He indicated that an ICO working group had already been formed to work on modalities of crafting a crypto-neutral laws that would encourage the growth of ICOs and other crypto systems without compromising the integrity of the local financial system. This is an indication that Switzerland will be an oasis that crypto networks, developers, and associated parties can run to any time.

Maker and Taxes

While the subject of cryptocurrency regulation might look complex, wait until you check the tax section. One of the primary reasons drawing people to cryptocurrencies is anonymity. However, the anonymity has been taken by many people to mean that they can operate without paying taxes. This assumption is among the primary forces driving administrations to threaten cryptocurrencies with harsh regulations.

In the United States, Credit Karma Tax indicates that very few people pay cryptocurrency related taxes. The same thing is replicated in other countries including the UK, South Korea, and China. Now, the question that many have been asking is; is the anonymity provided by cryptocurrencies ample to cover you from paying taxes?

Tax experts are categorical that cryptocurrencies were not meant to assist people paying taxes. Rather, they are meant to assist people optimize profitability when working on blockchain networks and paying all the necessary tax requirements. To demonstrate this, here is an example that is given in the tax circles.

When Bitcoin was unveiled, many people rushed to it because of espoused anonymity. Even criminal and outlawed groups such as Wikileaks opted for Bitcoin to receive payments and carry transactions without being discovered by authorities. But it did not take long before new technology was discovered and unmasking faced in Bitcoin became very easy.

When newer technologies are finally discovered, your identity in Maker blockchain could be revealed. This could open the door to many tax avoidance related cases. However, things do not have to get to this point because you can enjoy the benefits of being in the Maker network without breaking tax related laws. Here are the tips to follow.

- Consider income from Maker as taxable revenue.

- Make sure to file returns about the cryptocurrency trading whether positive or negative.

- Always capture and record the most important components that might be needed at some point for confirmation. These include the trading pair, value in fiat, and traded volume.

- For traders who accept payment in Maker, it is important to ensure that the balance sheet is done appropriately to match the standards of bookkeeping. Do not hesitate to work with a tax or accounting expert if you find it difficult to harmonize the system.

Does Maker Have a Consumer Protection?

Maker does not have consumer protection. The maker network belongs to the users spread in its system. As a decentralized network, it means that Maker is not under control of any one party. Rather, users in the system are involved in making the decisions about things that happen in Maker. This implies that when you join Maker, you are on your own. Therefore, how can you operate safely in the Maker network? Here are some great tips to help you operate safely in the network.

- Always triple-check the public address when sending value on the Maker protection.

- Ensure to keep the Maker and your computer updated all the time.

- Select the cryptocurrency exchanges with great care to ensure that only those with a special focus on traders' assets are picked.

- Try to keep your MKR in cold storage all the time when not trading them. You should especially focus on moving the coins away from the high-risk exchanges to your wallet.

- Do not share personal private keys with third parties.

Illegal Activities with Maker

Because Maker and other cryptocurrencies are anonymous, they are considered perfect platforms for illegal activities. Criminals such as fraudsters and Ponzi scheme perpetrators prefer using them because they can operate under the cover of anonymity. However, no illegal activity had been reported with Maker by early 2018.

Is Maker Secure?

While the primary focus of Maker was to help address the problem of liquidity, the development team was equally committed to keeping the system and coins secure. This is one of the reasons why Maker has never been hacked. Here are the methods employed in the Maker system to help secure Maker.

- Maker utilizes smart contracts that define the terms and conditions of operations.

- Maker operates on the highly secure Ethereum platform.

- The development team is always working on updates to help fix bugs and loops that can compromise security.

- Because Maker does not use mining, there is no risk of 51% attack.

Is Maker Anonymous?

Yes, Maker is an anonymous network. The development team of Maker holds the view that a cryptocurrency can only be effective if it is secure and anonymous. Indeed, this is one of the requirements for operating in the Ethereum system. The main method used to enhance anonymity in the Maker system is encryption. Whether you are sending value or using the collateralized debt position, your details are encrypted so that no third party can easily know about your details.

Has Maker Ever Been Hacked?

No, Maker has never been hacked. While hackings have become the order of the day, it appears that the primary targets are the exchanges. However, even the crypto networks are also targeted. For example, Bitcoin Gold was hacked when it was only a few days old. However, Maker does not have a hacking history. Note that though Maker has never been hacked does not mean there are no attempted attacks. The development team indicates that they thwart hacking attempt every other day. The teams agility in improving the system has been the primary reason for the robust security of the Maker.

How Can I Restore Maker?

If you have lost Maker, there is a possibility of restoring the coins depending on the method of loss and preparedness. If you lost Maker through forgetting the private keys, the native coins can be restored through regenerating the keys. You can do this using the seed that was generated the first time you used the Maker wallet. If Maker was lost through damage to the Maker wallet, restoration can be done using the backup. You can also do this by using another allowed ERC20 compatible wallet and reconciling Maker using the seed. If the Maker was lost through hacking or sending to the wrong address, there is no method that can be used to effectively restore them. They are lost permanently.

Why Do People Trust Maker?

Since 2009 when Satoshi Nakamoto released the first blockchain network, over 1500 crypto networks have entered the market. This has made the competition on cryptocurrencies to become stiff and shift to trust. The community now understands more about cryptocurrencies and carry due diligence before joining, investing, and even trading them. Here are the main reasons that make people trust Maker.

- The Maker network has employed and demonstrated a new and workable method of addressing volatility in cryptocurrencies.

- Because it is based on the Ethereum network, Maker enjoys another layer of security compared to other networks that operate on their own.

- The development team of Maker comprises some of the top minds in the cryptocurrency niche.

- The growth of Maker has been remarkable between its release and early 2018. Many people, including experts, are now expecting the growth to even surpass that of Bitcoin.

- The Maker crypto community has been growing steadily as people anticipate even further value improvement. This growth has been part of the reasons for the progressive upward shift in value.

- The Maker project its design has won the affection of many corporate including other crypto networks such as OmiseGO.

History of Maker

The history of Maker can be traced back to 2015 when Rune Christensen started working on MakerDAO. Rune gathered a team of crypto experts and held the first meeting on January 2016. This meeting targeted creating the initial modalities of the coin. Other major events in the network included;

- In May 2016, Rune and his team announced the formation of Genesis DAO developed as a smart contract on the Ethereum blockchain. The project lead, Rune Christensen targeted to form a decentralized bank for the Ethereum network that would operate as an asset tagged to the USD. The asset was later named Dai.

- In November 2017, the total MRK in circulation reached 530,000.

- In December of 2017, Maker announced it sold 12 million MKR to a group of investors from Polychain Capital.

- In January of 2018, Maker price hit the highest mark of $1600. This was the highest point in the Maker history.

- On April of 2018, Maker teamed with OmiseGO to forge in advancing a more centralized future. The target is creating a disintermediated finance that will help to advance the focus on stabilizing even more coins.

- On May 20, 2018, AirSwap announced its partnership with MakerDAO which means that Dai stablecoin is now available on AirSwap. This creates a stable medium of exchange for decentralized marketplaces.

Who Created Maker?

Maker was created by Rune Christensen who also serves as the CEO and project lead. Rune previously worked as the Marketing director at Audience Science and Playdom before starting to work on MakerDAO in 2015. The Maker founder could not have achieved their objective without their tech advisors that including the following;

- De L4 Ventures.

- Polychain Capital.

- 1Confirmation.

The early investors also played an important part in the system development. They included Scanate, FBG Capital, Andreessen Horowitz, and Wyre Capital.

Maker Videos and Tutorials

MakerDAO and the Dai Stablecoin by Rune Christensen

What Are Stablecoins?

MakerDAO and Digix Partnership

See Also

- Bitcoin | Ethereum | Ripple | Bitcoin Cash | Litecoin

- Cardano | NEO | Stellar | EOS | NEM | VeChain Thor

- Monero | Dash | IOTA | TRON | Tether | OmiseGO

- Bitcoin Gold | Ethereum Classic | Nano | Lisk | ICON

- Qtum | Zcash | Populous | Steem | Ontology | Waves

- DigixDAO | Bytecoin | Bitcoin Diamond | Binance Coin

- Bytom | Verge | Crypto Humor

- Cryptocurrency Dictionary | List of Cryptocurrencies | CEX.io

- Binance | Coinbase | Changelly | Coinmama | Bitpanda

- LocalBitcoins | Kraken | Paxful | Ledger Nano S | TREZOR