RChain

RChain cryptocurrency guide advises where to buy and how to buy RChain. This guide also contains the markets, value, trading, investing, buying, selling, transactions, blockchain, mining, technology, advantages, risks, history, legislation, regulation, security, payment, networks and many other interesting facts about RChain as well its status in the world of cryptocurrencies.

RChain, Thursday, 2025-06-12

Contents

What Is RChain?

RChain is a new blockchain platform in the market designed to help address the problems of scalability, speed, and security that have been a big setback for most cryptocurrencies. When Bitcoin was created, it helped to demonstrate the viability of decentralized and peer2peer digital currencies. Then, Ethereum introduced the application of smart contracts that are now becoming the denominator of most cryptographic projects. Despite these advances, scalability has remained a serious challenge to blockchain networks.

RChain, the brainchild of a mathematician and former Microsoft staff, Greg Meredith, is the Rho Virtual Machine (RhoVM) Execution Environment that operates multiple executive environments with each running smart contracts. The smart contracts execute concurrently and employ multiple threads making it possible to run very many transactions concurrently.

Early tests of the RChain platform demonstrated that it is capable of supporting over 40,000 transactions per second. This puts it at par with other top payment companies including Visa and Credit card companies. However, unlike the credit card accompanies that centralize the user data, RChain runs as a fully decentralized model with all details fully encrypted to avoid access or discovery by third parties.

To make the ambitious project a reality, Greg and his development team employed the Mobile Process Calculi and applied it together with game theory. The project has been described by the cryptocurrency community to have the potential to become the ultimate ladder to the next generation cryptocurrencies. Here is the complete analysis of RChain.

Beginner's Guide to RChain

RChain is one of the youngest cryptocurrencies in the markets today. By targeting to address the problems of scalability, security, and speed, the RChain system is being marketed as the better option out there. With the network being led by one of the tech minds you can expect in the industry, things can only get better. It looks like the ultimate cryptocurrency for you to join. However, you need to carry your own comprehensive review of the network. This is why this guide was created.

The guide is a comprehensive review of RChain to establish how it operates and core features. Whether you have some doubts or questions about the entire network or a section of it, rest assured the info is captured in this guide. Welcome to the guide to learn what RChain is, its value, where to buy and more.

Where and How to Buy RChain?

One notable thing about cryptocurrencies is that people never get tired of looking for better networks. The current trend is that newer cryptocurrencies are introducing advanced features that guarantee better security, speed, and anonymity. RChain is one cryptocurrency that has excited the cryptocurrency community such that no one wants to be left behind. Here are some of the top methods of buying RChain.

- Purchase from the cryptocurrency exchanges: Cryptocurrency exchanges are the points of sale that bring together sellers and buyers. They operate like the standard forex markets but trade digital assets as opposed to fiat currencies.

- To buy from cryptocurrency exchanges, the first step is selecting the platform that lists RChain. Then, open a trading account and verify it to gain access to the purchase portal. At this point, you can go ahead and buy the preferred RChain coins. Note that the price is driven purely by demand and supply. Great examples of these platforms include Radar Relay, KuCoin and Abucoins.

- Buy from those who already have them: The rising popularity of cryptocurrencies has made people to start creating small groups that help them discuss, share, and forge the way forward about cryptocurrencies. These groups are becoming so popular that some people rarely make decisions to invest in a new token or asset without seeking an opinion of the clubs. Now, the clubs are becoming important points to buy some crypto assets such as RHOC. Some examples of these clubs include Cryptocurrency Collector Club and London Cryptocurrency Club.

- To buy RChain from the clubs, all you need is the right cryptocurrency wallet to hold the coins. Note that unlike the exchanges, clubs do not have restrictions. This means that the coins you want can be paid using anything including hard assets. However, you need to appreciate that getting a person willing to sell the exact number of RHOC you want it never easy. Besides, you will also need to have good negotiation skills to make more from the deal.

RChain Wallet

As you venture into the cryptocurrency world, one must have thing is a cryptocurrency wallet. The accepted definition of a cryptocurrency wallet is a digital location for holding your crypto coins. However, this definition is in reality a misconception! In reality, crypto coins such as RHOC only reside in their native networks. Because they cannot exist outside their native networks and are not printed/ minted, how exactly are they stored in a wallet?

A cryptocurrency wallet does not in reality store crypto coins. What it stores is a set of codes that link with your coins and help make transactions. Note that even when such transactions are done, the coins still remain in the network. The first code generated and stored in the wallet is the private keys. This is a special code that helps to call your crypto coins to live when making transactions. Like the name indicates, the code is private and should never be shared with third parties.

The second code generated and stored by the wallet is the public keys. This code is used to point at your wallet. It works like your postal address. You provide the code to users who want to pay you in RHOC. Therefore, do not be shy sharing the keys in public with your payers.

The last code generated by the RChain wallet is the seed phrase. This is a special code used to regenerate the private keys in the case of a loss. Like the private keys, the seed phrase should never be shared with third parties. It is very important to keep the private keys and the seed phrase away from the main computer. To buy, store, and transact with RChain, you can use the following wallets.

- Ledger Nano S.

- Trezor.

- MyEtherWallet.

- Metamask.

- Ethereum Mist DApp.

Where to Buy RChain with Credit Card?

Credit cards have become one of the most preferred methods of payment in the society today. They are preferred by most people because of ease of use and acceptance in almost all marketplaces. Now, you can also buy RChain with credit cards. First, you need to buy Ether from another exchange such as CEX.io and then go ahead and buy RChain from the preferred market such as KuCoin and EtherDelta.

Where to Buy RChain with PayPal?

By the second quarter of 2018, there was no method that could be used to buy RChain directly with PayPal. PayPal has for many years looked at crypto networks as competitors. Therefore, it declined all payments targeted at the network. To buy RChain with PayPal, you have to follow the longer route of withdrawing cash to the credit card or bank account.

How to Buy RChain with Wire Transfer?

Some of the most trusted entities in the market today are banks. Many people trust them for financial advice, processing salaries and even access to credit. Now, bank wire transfers have also become a good way for buying cryptocurrencies. The first step in the entire process is acquiring an appropriate RChain wallet. Note that because the exchanges that list RChain do not accept payment in fiat currencies, buying RHOC with wire transfer will involve two stages. First, you need to select an alternative platform that lists other tokens such as Ethereum. Great examples include Changelly and Coinbase. Once you have bought Ether, direct them to your wallet. Then, move to the next stage.

- Select the preferred exchange and open an account. You will also be required to verify the account with personal details such as phone number and proof of location.

- Visit the preferred exchange that lists RChain tokens such as Kucoin and navigate to the section for buying crypto assets. Select the preferred quantity of RHOC and select pay with Ether.

- Once you click confirm, the transaction will credit your account with RHOC coins equivalent of the Ethers you selected.

- The last step is directing the coins to your RChain wallet. Your wallet is considered more secure than the exchange accounts.

Where to Sell and Trade RChain?

RChain is one of the top blockchain projects in the market. To enjoy high ROI (return on investment), many people are buying RHOC and holding them because the price is expected to keep growing. However, you can make more from RChain through selling and trading the native coins in the markets. These are platforms that bring together sellers and buyers of different crypto assets the same way the forex markets operate.

Selecting a good platform to sells and trade RHOC is never easy. It is important to appreciate that the trading platforms are the most vulnerable points when dealing with cryptocurrencies. In many cases, every report of a major cryptocurrency loss probably took place in a trading platform. The latest two cases included the hacking at Coincheck in Japan and attack at Youbit that saw the exchange file for bankruptcy. To be sure of trading safely in the exchanges, you can use the following tips.

- Look for the exchange that lists very many digital assets to always have a profitable option to pair with RChain.

- Go for the platforms that put a lot of focus on user' assets security. Here you should look for the platforms that employ 2-factor authentication, and moves the assets to a cold storage.

- Because of the threats that face users’ assets, it is important to go for the exchange that allows users to move their assets to their wallets immediately after trading is over.

- The ultimate platform should have a low transaction fee. This will help you to retain the bulk of the trading profits.

- Only use the exchange that has been on the market for some time and won positive reports from the community. You can visit communities such as Bitcoin Talk or Reddit to check for unbiased views about the best exchanges.

Note that unlike the native crypto networks, the trading platforms operate under local laws. This implies that just like forex markets, you are not allowed to operate anonymously. All sellers and traders have to open trading accounts and verify them with personal details such as phone number and dates of birth. Some great examples include KuCoin, OooBTC, and ForkDelta.

How Much Are the Transaction Fees of RChain?

While RChain does not specify the cost of transactions, the range is generally lower compared to other networks because of better scalability. The transaction fees at the RChain network are broken down into four main resource classes; network, compute, memory and storage. The network, memory, and compute resources used are calculated when a contract is implemented and the gas consumed will be paid to the specific owner based on token ratio. This implies that the authors of specific contracts can define and pay for authorized transactions.

RChain Markets

The cryptocurrency markets have been growing rapidly to maintain pace with the increasing numbers of cryptocurrencies and similar demands. Like the standard forex markets, the platforms are also driven by the forces of market. Note that because RChain is new, the number of markets that have accepted to list it is still low. Here is a closer look at some of them.

1) EtherDelta

EtherDelta is a decentralized ERC20 tokens exchange platform founded by Zack Coburn. The platform operates as a decentralized exchange which means that you do not need to open trading accounts. It has opened the door for people to extend the anonymity they enjoy in their native networks. To make trading ERC20 token possible, the ERC20 utilizes smart contracts as the principle pillar for managing deposits, trading, and withdrawals.

One of the biggest selling points is its low transaction fee. You only need to pay 0.003% of the transaction volume when using the EtherDelta. Because users are not required to open trading accounts, it means that joining and starting to trade at EtherDelta is prompt and direct.

The platform lists very many ERC20 tokens. This means that you will never miss a profitable asset to pair with RHOC if the present one becomes less desirable. The platform is also preferred by traders because it is perceived as comprehensive and secure as the Ethereum platform.

The biggest shortcoming of EtherDelta is that you can only trade ERC20 tokens. If you targeted trading RHOC for another crypto such as BCH, it will not be possible. Besides, the transactions at the exchange are generally slower compared to others. This is because the transactions must start by counterchecking whether the requirements have been met before executing on the Ethereum.

The exchange has also been a major challenge for people who want to use fiat currencies. As a crypto-to-crypto only platform, it implies that users with cash in fiat have to start their transactions on other platforms such as CEX.io and then move the tokens to EtherDelta.

2) KuCoin

Kucoin is a crypto-to-crypto exchange that entered into the industry in 2017. The primary target of the team that developed the exchange was to create a platform that allows users to make their transactions and exchanges in a safe and secure way. To enhance its use, value and perform well against competitors, KuCoin decided to follow in the footsteps of Binance (another exchange) by releasing its own token referred to as KCS.

One of the main selling points of KuCoin is its low transaction fee. By charging the traders only 0.1%, it means that it is one of the cheapest platforms. An additional fee will also be charged when withdrawing RHOC from the platform.

The exchange is preferred by users because it lists very many digital assets. You can trade both ERC20 tokens and others such as Litecoins and Bitcoins. One notable thing about the exchange is its commitment to pick emerging opportunities especially after tokens are released. Though this can be risky because some ICOs could be scams, it presents investors with early opportunities to invest and enjoy fast growth in the subsequent months or years.

To make it easier for traders to use the network, KuCoin processes transactions very fast. For example, standard withdrawals complete in less than a minute while withdrawing amounts takes approximately two minutes.

The biggest challenge of using KuCoin is that it is a crypto-to-crypto only platform. If you have credit cards or fiat currency, you cannot trade directly on the exchange. In such a situation, you will need to start from another platform that accepts direct deposits or withdrawals such as Changelly.

3) Token Store

This is a decentralized cryptocurrency exchange that targets dealing with ERC20 tokens. The exchange utilizes smart contracts and runs almost the same way EtherDelta operates. As a decentralized exchange, it implies that the platform does not in any way rely on third parties to facilitate trading, holding, or exchange of assets between users in the network. Notably, unlike the centralized exchanges such as Bittrex and Binance, the Token Store does not store users’ assets because traders run from their integrated wallets. This makes the platform very secure.

The exchange provides users with many digital tokens that make it possible to profitably trade most of the times. Besides, they also allow margin trading to allow users trade more even when their funds ran out.

The transaction fee at the exchange is 0.3%. Though the exchange team indicates that this is within range, traders have been calling for the same rate to be brought down to lower than 0.1% so that it can compete more effectively with others such as Binance, EtherDelta and KuCoin.

The biggest challenge for using the network is that it is a crypto-to-crypto only platform. For those who have cash in their banks or credit cards, trading at Token Store will need to start elsewhere. Another issue is that Token Store does not provide a simplified trading chart. This means that users especially the new ones cannot easily make meaning of the data provided in the order books. Besides, its customer support is very poor. Most inquiries take long to be replied to.

4) CoinSwitch

CoinSwitch is an Indian cryptocurrency exchange started in 2017. It operates as a cryptocurrency exchange aggregator that helps users to trade their RHOC with more than 250 cryptocurrencies. There are more than 6000 trading pairs you can check to trade profitably at the exchange.

To make trading easy and more profitable, CoinSwitch integrates many exchanges so that users can get the latest information and make the right decisions promptly. It has become the number one preference for many traders because it does not have transfer limits. Whether you are new and want to trade only a few RHOC or an experienced trader with thousands of RHOC, CoinSwitch does not impose any limitation.

The transaction cost at Coinswitch is given at between 0 and 0.75%. This has been the main undoing for the exchange. Many people feel that the cost of too high and the development team should work extra hard to pull it down.

Note that the cryptocurrency is a crypto-to-crypto trading platform. This makes it impossible to make deposits/ withdrawals using cash, bank transfers, or credit cards. If you have funds in these three states, the only method of joining and trading at CoinSwitch is starting from a different exchange such as LocalBitcoins.com.

Value of RChain

Though RChain was one of the youngest cryptocurrencies in the market by the first quarter of 2018, its value has continued to grow rapidly. In mid-November of 2017, the value of RChain was only $24.5 million in market capitalization at a price of $0.13. This value grew steadily to reach $500 million in market capitalization at a price of around $1.4 on early June 2018. This growth has thrust the cryptocurrency to the top 50 cryptocurrencies based on market capitalization. It also puts RChain well ahead of other cryptocurrencies including Dogecoin, Stratis and DigiByte.

Is It Profitable to Invest in RChain?

Yes, RChain has demonstrated its great affinity to grow steadily and deliver high ROI to the native coin holders. For example, those who bought RChain the first few months of the tokens release are now counting huge profits. By early June of 2018, the price of the native asset had grown with more than 1000% compared to the price on the RHOC early days. If this trend is maintained, users are sure of reaping even more from the network.

It is also important to appreciate that though the value of RHOC has grown steadily between launch and June 2018, the future profitability will depend on many factors including competition, ability to avoid attacks and regulations. Therefore, it is important to invest wisely and if possible, spread the investment to other assets.

Where to Spend or Use RChain?

Because RChain is one of the newest cryptocurrencies to enter the market, its acceptance by the mainstream market is still very low. By the close of the first quarter of 2018, no trader had come out to indicate he accepts payments in RHOC. Therefore, those with RHOC will need to convert the coins to the accepted crypto coin before making a purchase.

Can RChain Grow to Become a Major Payment Network?

Every cryptocurrency out there is in a race to become a major payment network. This is one of the reasons that make tokens release the first step when a cryptocurrency such as RChain are created. RChain can become a major payment network because of the unique architecture that makes it possible to run very many transactions every second. This speed is likely to attract traders who are interested in higher efficiency.

Though everything points to the potential that RChain has to become the next major payment network, the lead team has its work cut out. It has to work extra hard to compete with other faster and more established crypto networks such as Bitcoin and Ripple. The ability to moult into a major payment network will also depend on the looming regulations.

How Does RChain Work?

The RChain targets addressing the current blockchain issues

When the project RChain was unveiled, it instantly became sensational. A project that carefully captures the blockchain technology progresses and promises to elevate them to the next level was no doubt welcome. However, how does the RChain system address the issues that had chocked the previous networks? Here is a closer look at how the Rchain system works. The RChain system takes advantage of other network’s advances and adds major improvements to guarantee users a more effective system.

- Speed: The design of the RChain system is optimized to handle more transactions than most networks. It has a capacity of handling over 40,000 transactions per second. This will eventually be improved to handle more than 100,000 tx/s.

- The RChain cooperative: The RChain Co-op is a public group comprising of the developers, investors, and users in the network. The purpose of the Co-op is giving all members an opportunity to influence decisions and the future of the network.

- The tools of operations: RChain targets to provide developers with tools that will be used for applications and smart contracts creation. The tools are aimed at making it easier for developers to integrate their apps and optimize their portfolios in the network.

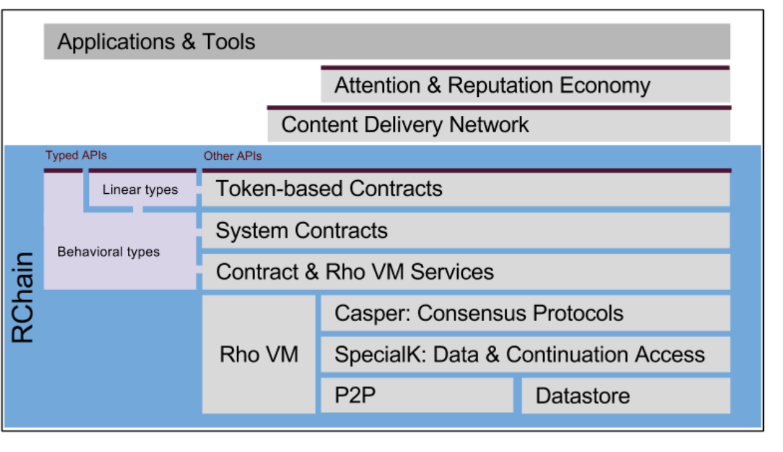

To deliver the outlined three targets, the RChain utilizes two primary components; the smart contracts and RHO Virtual Machine environment. The RChain namespaces will also be added in this category.

The Rho Virtual Machine Environment

The primary technology used at RChain is the Rho Virtual Machine Execution Environment that facilitates attainment of faster transactions and scalability. The RChain is the Rho Virtual Machine Execution is capable of operating simultaneously on different Rho Virtual Machines (RhoVM). In some instances, it even generates new versions of RhoVM to cater for unexpected new load.

The RChain network is architected as a multi-chain platform to make its blockchain run and operate in a coordinated and parallel way. Every virtual machine in the system is capable of executing independent smart contracts and separate blockchains when necessary.

The RChain nodes are created to be lightweight and multi-threaded so that they can easily handle multiple and decentralized applications. This is what has made it possible for the network to achieve revolutionary results.

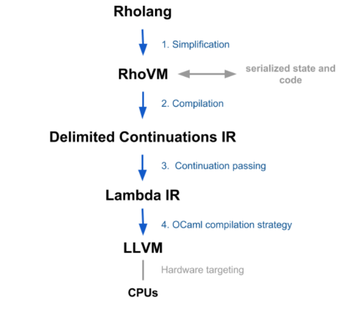

The smart contracts

The smart contracts have become the primary platforms driving individuals and enterprises to join blockchain technologies. The RChain smart contracts are programmed in Rholang (reflective high-order language). This language helps to support speed and efficiency of smart contracts.

Note that the smart contracts at RChain follow the standard verification process to help raise scalability. Once all the requirements of the smart contracts are met, the RhoVM compiles and executes them.

Namespaces

RChain goes against the common trend in most blockchains where public keys are used for distinguishing virtual address spaces. Instead, the virtual addresses sections are divided into namespaces. To put it in a simpler way, namespaces is like a set of channels for communicating the location of a specific network resource. They help to make the smart contracts issued in one blockchain to be visible to the entire RChain network. They can also be used to help improve RChain protocols and encryption.

Does RChain Use Blockchain Technology?

Yes, the RChain system uses blockchain technology. Like the Ethereum blockchain, the blockchain used in the case of RChain will store the transaction information and smart contracts in their serialized states. The blockchain is designed to be tamper-proof so that all the details captured in the blockchain helps to create a history. The purpose of the blockchain is to help with efficient storage of data for easy timestamping and sequencing.

The RChain blockchain employs the RChain Cooperative to help with the blockchain development and effective governance. The members of the community control and develop the platform. This cooperative is currently based in Washington and helps to bridge the gap between the community and the actual network. This is one component that most networks have been lacking. For example, most of them such as Ethereum form foundations that comprise of developers only. Once you join the cooperative, you will enjoy the following;

- Ability to elect board members to the cooperative.

- Participating in governance committees.

- Voting in project approvals and allocation.

- Accessing all RChain discord channels.

Note that every member of the cooperative only gets one vote irrespective of the tokens he holds. Besides, a one-time fee of $20 is also required to join the cooperative.

Mining RChain

Mining is the process of verifying transactions in a cryptocurrency network. At RChain, the consensus model in use is the proof of stake algorithm computing. To help with confirming transactions, the RChain system requires validators hold a specific stake in the network. Besides, the node must also be a member of the RChain Cooperative. Once you meet all the requirements, it will be a matter of waiting until your turn to validate a transaction comes. Therefore, a lot of patience is required.

What Are the Advantages of RChain?

RChain was unveiled at a time when more people were starting to get extra critical of cryptocurrencies applications. RChain builds on the existing blockchain technologies to emerge as the better option. Here are other advantages that come with using RChain.

- RChain is one of the most advanced projects in the crypto market today. It employs advanced technologies including Rholang (a unique smart contract programming language) and Rho Calculus (a special mathematical model that has formal models and verifications). This puts it at the apex of the blockchain niche.

- The RChain is the most scalable blockchain project out there. The system is capable of supporting over 40,000 transactions and a maximum of 100,000 transactions per second which is way far ahead of what other cryptocurrencies can offer. For example, Steem can support a maximum of 10,000 transactions/ second while NEM peaks at only 4000 tx/s.

- RChain operates as a platform that allows users to enjoy more than simply sending value. You can offer financial solutions, marketplaces, and even own token pegged on smart contracts. No matter your business or targeted operations, RChain will have something for you.

- It is a great network that allows users the opportunity to use and invest without worrying about third-party seizures. If all your cash is stored in a bank account, it can easily be frozen through a court order if a lawsuit comes knocking. This is because your details at the bank are known to a lot of parties including cashiers, bank management, financial authorities, and political administration. However, networks such as RChain are anonymous and only the user knows about the details.

- Unlike the Bitcoin system that employs Proof of Work consensus that is energy and time intensive, RChain uses Proof of Stake consensus that allows everyone with a stake in the network to participate in building consensus.

- The RChain network, though very young, has attracted and won the affection of the greatest blockchain leaders and projects. For example, the Reflective Venture Partners, Pyrofex, and Pithia Inc.

What Are the Risks of RChain?

The same way that RChain comes with great benefits, it is important to also appreciate that it also comes with its own share of risks. You need to appreciate these risks before making a decision to join and invest in the network.

- The RChain project is very ambitious. While all the espoused functionalities and features are no doubt great, concerns have been raised on their applications. There is a risk that the applications might become too heavy for RChain network in the coming years.

- The looming regulations are threatening to limit the growth, adoption, and success of cryptocurrencies such as RChain. If harsh regulations are installed, more people might stay away from cryptocurrencies and cause them to shrink.

- The threat of getting attacked and losing the native coins. Like other cryptocurrencies, no network is 100% hack free. You could get attacked at the network level, wallet level, or even in the exchanges.

- The RChain network is very young and the stability of its features cannot be ascertained immediately. For the cryptocurrency to be considered fully secure, it will require a couple of years. This implies that those investing and joining RChain should know that the efficiency could differ in the coming days from what is presented in the book.

What Happens if RChain Gets Lost?

When reports of hacking in the cryptocurrency networks are reported in the news, the entire industry gets into a shock. Many people feel inadequate and see like they will be the next victims. To avoid losing your RChain coins, it is important to understand what happens when such losses take place.

- If you lose RHOC through sending to the wrong address, it implies that they are still in the network but in a dormant state. However, the coins now belong to another person.

- If you lose the coins because of damage to the wallet or losing the private keys, it means that they are still lying dormant in the network. If you can regenerate the right private keys or the get the correct wallet, the lost coins will be restored.

- If you lose the RHOC through hacking, they have shifted hands. The process is similar to sending to the wrong address because the transaction is already completed and cannot be reversed.

RChain Regulation

When cryptocurrencies entered the market, governments saw them as immediate competitors that were out to change how things worked. Because they are peer2peer and decentralized networks, they bypass most centralized entities such as banks and financial services companies such as Visa. To put it in a different way, decentralized network that does not pay taxes are on the race to edge out law-abiding and tax-paying institutions.

The first jurisdiction to notice the threats that come from cryptocurrencies was the United States. The federal administration was warned by FBI that the cryptocurrencies could easily be used to fund terror and result to tax avoidance because they are anonymous platforms. Now, other threats including the risk of use in Ponzi schemes, high volatility, and even danger of total loss have emerged. But it is the danger of the crypto networks moulting into new Swiss accounts that have jolted states to act with speed in search for clear legal frameworks.

Even as the threats become more evident with the entry of more cryptocurrencies, it is important to appreciate that no country had passed a legal framework by the start of the second quarter of 2018. Even those that have banned blockchain networks in their jurisdictions resort to using direct executive orders as opposed to clear legal frameworks. It has now emerged that crafting a legal framework is not as easy as many would anticipate. Here are some of the key reasons why no country has a legal framework.

- The blockchain application technologies are very advanced and most countries are still studying them. Indeed, this could take even longer because newer technologies are progressively joining the fray.

- The cryptographic solutions have demonstrated the capacity to address some problems that have dogged most administrations for many years. A good example is the issue of Big Data.

- Blockchain technology is considered the apex of the fintech industry. Most administrations such as Hong Kong, the UK, the United States, Russia, and Brazil have been banking on them to take their economies to the next levels. Now, they are at hesitant to block technologies they have nurtured for years. They could take even longer before getting the right approach to address the demerits of blockchain networks without preventing their growth.

- The cryptocurrency networks do not belong to a single entity. This implies that unlike the banks that have specific ownership that can be compelled to implement the legal frameworks, there is no central entity to target with crypto laws.

NOTE: Though it has taken so long to come-up with legal frameworks, the truth is that they will finally dawn. Therefore, those joining the network should be ready for the aftershocks that might come with such laws. Therefore, be on the lookout and carefully follow draft bills when they are released to get the personal expectations right.

Is RChain Legal?

Yes, RChain is legal. Because most countries do not have clear legal frameworks for regulating cryptocurrencies, it means that you are free to own, make transactions and invest without worrying about breaking the law. However, there are countries that have outlawed the use of cryptocurrencies. Though they are only a handful, the approach taken by the jurisdictions is the use of direct orders as opposed to installing legal frameworks. Here is a closer look at some of the jurisdictions.

1) The European Union

The EU is one of the many jurisdictions that do not appear to have a clear stand on the direction to follow when it comes to cryptocurrency regulations. The EU Central Bank and EU Parliament appear to be pulling in different directions. While the central bank has all along been calling for caution because of the risks that come with the use of cryptocurrencies, the EU Parliament has indicated there is no need for a rush. The parliament indicates that there are a lot of good things associated to cryptocurrencies such as RChain. Therefore, the parliament called for a comprehensive study of the crypto market to determine the best legal framework that EU should take.

At the leadership of the union, the EU Commission has indicated that the risks that come with cryptocurrencies are too dire to be left without a clear regulatory framework. The EU Commission Vice President, Valdis Domnrovski, pointed that cryptocurrencies had proven to be highly volatile, put investors to risks of total loss, have numerous vulnerability gaps, and can easily become the next tax havens. This stand has been supported by the leadership of France, Germany, Italy, Austria, and even the UK.

2) Singapore

Singapore is another country that has recently changed its focus on cryptocurrencies to demonstrate total support for their growth. Up to the third quarter of 2017, the country’s central bank of Singapore was at the forefront warning people to tread cautiously when dealing with cryptocurrencies. However, the stand changed in 2018 with both the leadership of the country and fintech niche indicating that cryptocurrencies were indeed very safe.

In a communiqué released to the press by Singapore's Prime Minister, Tharman Shanmugaratnam, there is no distinction between the payment made using fiat and those done via cryptocurrencies such as RChain. The MAS fintech leader, Sopnendu Mohanty, supported the prime minister’s position that cryptocurrencies did not pose a risk such as Lehman Brothers’ type of financial slowdown.

Despite this, the two leaders pointed that there is a need for comprehensive legal frameworks to help protect consumers. The leadership reaffirmed its commitment to pass clear laws to protect cryptocurrency users. This came fast on the heels of Coincheck exchange attack where the primary target was the NEM based crypto network and its native assets.

3) The United States

United States, like other nations, has been lax in crafting a legal framework for regulating and controlling cryptocurrencies. Though the US administration was the first to note the threats associated to cryptocurrencies, it has opted for a global approach as opposed to a local one. The country is working with China, South Korea, Japan, China, and the G20 to try a forge a common front in addressing cryptocurrency regulations.

In January 2018, Sigal Mandelker, the Deputy Treasury Director, took a global tour indicating that it was time that a common stand was taken to prevent the cryptocurrencies becoming another Swiss account. Speaking at a conference in Tokyo, Japan, Sigal reminded the attendants of the threats that are likely to come with cryptocurrencies. Back at home, the Secretary of Treasury, Steven Mnuchin, told the World Economic Forum that cryptocurrencies were already becoming the primary channel for tax avoidance.

With the federal administration taking too long to provide guidance at the national level, individual states have decided to soldier on. For example, the state of Arizona passed Bill 1091 that allows users to pay their taxes in cryptocurrencies. The law requires the authorities to change the cryptocurrency into US dollars immediately and the cash credited to the payer’s account. This legislation has provided a new view of cryptocurrencies as more states and even countries abroad indicate they are in the process of crafting similar legal frameworks.

4) Russia

RChain is legal in Russia. While other countries appear to drag their feet in coming up with clear legal frameworks for cryptocurrencies, Russia is already moving ahead. The Finance Ministry has released the draft Digital Financial Assets bill that aims at sealing the loopholes of cryptocurrencies in the country. The draft bill which must first go to the parliament before it can become law is being considered the most comprehensive crypto regulation in the industry. It looks at all areas of cryptocurrencies and requires the installation of KYC (Know Your Customer) regulations especially at the exchanges.

To make it clearer about cryptocurrencies, the draft law starts by defining the digital financial assets as cryptocurrencies and tokens. It also classifies them as properties. This implies that the digital properties cannot be used for payment.

Mining is considered a procedure for generating properties. Think of it as a processing unit for releasing products to the market. Therefore, all miners that intend to be involved with mining are required to be registered. Those that want to release cryptocurrencies through ICOs must also have their projects registered and the value of such assets assessed by experts.

If the current legal framework becomes law, it will become almost impossible to operate on any crypto network anonymously. Though the crypto community has indicated its reservation with the draft law, the Russian administration has indicated it is hypocritical. The finance ministry indicated that when people lose millions of in hacking and other theft, no one in the crypto community moves to remedy the situation. In fact, even the crypto networks are anonymous. It will be interesting to see how things play out after the bill becomes law.

5) Switzerland

Switzerland is one special jurisdiction that appears least perturbed by cryptocurrencies' growth. While other countries are hasty in calling for stiffer laws, Switzerland administration is welcoming cryptocurrencies. Though the country has a history of forging its own path even when it means going against the route taken by neighbors, Switzerland is gearing to score yet another point with digital assets.

The Swiss Economics Minister, Johann Schneider-Ammann, indicated that they will spare no effort in making the country a crypto nation. While talking to the financial times, Johann indicated that cryptocurrencies were the apex of the financial sector and cannot be wished away. He further indicated that they were starting with the ICOs to see how they can be used to help raise funds even for the local projects. A report from the ICO working group is expected to be released by the close of 2018.

RChain and Taxes

While the topic of cryptocurrency regulations might look confusing, that of taxes is even more complex. One of the primary goals of cryptocurrencies such as RChain is providing users with a platform to operate anonymously. Because this allows users to operate without worrying of third-party seizures, the perception is that they can hide completely even from third-party seizures. This is where the problem comes in.

While it is true that cryptocurrencies such as RChain are anonymous, they were not designed to help people operate without paying taxes. Some tax professionals are referring to the focus to live without paying taxes as abuse of the blockchain technology. They further caution people in cryptocurrencies that anonymity will not last forever.

As newer and more advanced technologies get discovered, the chances are that the current anonymity might become very easy to unravel. To demonstrate this, take the case of Bitcoin. When Bitcoin was discovered in 2009, the network was considered completely anonymous. However, it has now emerged that pulling out details of the nodes in the Bitcoin network is not as difficult. It is no longer the completely anonymous network that people knew. You should anticipate the same scenario after joining the RChain network.

Tax and financial experts are also quick to point that saying people should pay taxes is not a blockade to enjoying the benefits that come with such networks. Indeed, you can enjoy every benefit associated with RChain without breaking the law. Here are some useful tips to follow.

- Make sure to report both profit and losses incurred during trading.

- Consider income from RChain operations as taxable revenue.

- For traders accepting payment in RChain, relook at the books of accounts to ensure that the balance sheet is done appropriately.

- If you feel inadequate about cryptocurrencies and being tax compliant, do not hesitate to work with experts. They will advise you to file returns and even capture all the details without compromising personal anonymity.

Does RChain Have a Consumer Protection?

RChain does not have consumer protection. The cryptocurrency network operates as a completely decentralized network. This implies that the network does not belong to the founders or the developers. Rather, the network belongs to the nodes spread in the network across the globe. This indicates that you are on your own after joining the RChain network. If something happens to your tokens, there is nowhere to complain. To operate safely on the network, here are some useful tips to follow.

- Make sure to triple check the public address when sending RHOC.

- Only use a single computer when transacting on the RChain network.

- Make sure to take store your RHOC in a cold storage when not trading them in the exchanges.

- Select the trading exchanges that put a lot of focus on users’ security.

- Avoid visiting risky sites that can give hackers an easy access and attack to your system.

Illegal Activities with RChain

Since 2009 when cryptocurrencies were introduced, criminals saw them as the ultimate platforms to target and pounce at the targets without worrying of being identified by authorities. Though many cryptocurrencies have in the past been associated with criminals, none of the cases had been reported with RChain. The possible reasons for this include the RChain’s focus on using smart contracts that have pre-drawn requirements and that the network is still very young.

Is RChain Secure?

When cryptocurrency enthusiasts aim at joining specific networks such as RChain, the primary thing they want to understand is their security. In addition to directing the bulk of the efforts to addressing scalability, the RChain team was also concerned about the security of its users. Here are the measures they installed to guarantee users of utmost security.

- The RChain is operated as a smart contract that defines all the terms and conditions for participants. This has made attackers to find it extra hard to gain access.

- The system employs Proof of Stake consensus model that requires nodes to hold some stake in the network to participate in voting. This means that it is very difficult to conspire to harm the network because they also own it.

- By employing PoS model, the distribution of the native coins is even. This implies that the risk of suffering from 51% attack is very small.

- Because the RChain system is built on top of the Ethereum system, it serves as an additional layer of security. The development team has also been very keen on identifying gaps and sealing them.

Is RChain Anonymous?

Yes, RChain is an anonymous network. The primary method used to enhance anonymity at the network is elliptic curve cryptography (ECC). The founders and the development team ensured that all users and transaction details are encrypted and unavailable to third parties. Even when sending value, the miners spread in the system can only follow back the public address to confirm that you have ample RHOC to send but not personal details.

Has RChain Ever Been Hacked?

The RChain network has never been hacked. The cryptocurrency has been tagged as one of the most secure blockchain networks in the industry. However, this should not be mistaken to mean that the network is not targeted by criminals. The development team gets hacking attempts regularly and thwarts them.

How Can I Restore RChain?

If you lose RChain, the ability to restore the native coins depends on how prepared you are and the method of loss. Even before a loss takes place, you need to be prepared and understand the restoration procedure.

- Loss through damage to the wallet: Make sure to install the backup wallet or acquire a compatible wallet and reconcile it with the seed phrase.

- For RChain users who lose their coins by forgetting the private keys, restoration can only happen by regenerating the keys.

- If you lost RHOC through hacking or sending to the wrong address, there is no method that can be used to restore them. They are gone forever.

Why Do People Trust RChain?

The fast-growing number of the cryptocurrencies has made competition to intensify. Now, people are not simply interested in getting a functional network, but a trusted system. The Rchain network has been unveiled at a time when cryptocurrency networks are out to demonstrate the diverse applications in different social, economic and even political realms. Here are the main reasons why people trust RChain.

- The cryptocurrency is led by a tech team that has demonstrated the zeal to keep advancing the cryptographic solutions. For example, the founder, Greg Meredith was one of the top advisors of the Ethereum Foundation.

- Rchain performance in the market has been very impressive. Though it was less than a year old by close of the first quarter of 2018, its value had grown steadily and demonstrated the zeal to grow even further.

- The cryptocurrency is marketed as a better option compared to other top networks including Bitcoin and Ethereum. This has made people remain optimistic about its future growth.

- RChain uses some of the latest technology in the computing niche. This places it well ahead of other cryptocurrencies and, therefore, many people find it irresistible.

- The cryptocurrency is pegged to a highly successful blockchain; Ethereum. This implies that it enjoys better security and stability.

History of RChain

The history of RChain can be traced back to 2016 when the founder, Greg Meredith, noted that blockchain networks were suffocating in their own technologies because of issues such as scalability, safety, and speed.

- On August 29th 2017, the RChain ICO went live. It hit $25 million in less than two weeks. Note that the token did not have a maximum limit though it had a minimum purchase of $50,000 worth of RHOC.

- By October 10th 2017, the price of RHOC hit to $0.29 before shifting down to a low of $0.14 in the subsequent month.

- Starting from November 2017, the price took a steady growth peaking to $2.9 in early January 2018. Since then, it has staggered up and down reaching around $1.4 by early June 2018, the community is optimistic that the value will keep growing in the coming days.

- In the second quarter of 2018, the RChain system plans the next release of the Alpha phase. This will allow all the developers to be able to set up many nodes for large content delivery and demonstration of Casper.

- In the 4th quarter of 2018, the RChain team targets to release the Mercury software.

Who Created RChain?

RChain was founded by Greg Meredith, a visionary mathematician & computer expert, and Ed Eykholt. Greg serves as the RChain president and a Member of the Co-op's board of directors. Before starting to work on RChain, Greg was working at Microsoft where he served as the principal architect of the highly successful Microsoft’s Biz Talk Process Orchestration. He was also the founder of the Microsoft Highwire offering and other programs including MCC’s Rosette technology, and ATM Network Management solution.

In his part, Ed is a member of the RChain Cooperative and also services as the CEO of the Holding Campaign, rchain.io. Before coming to RChain, Ed had worked in other companies including Alstom Grid and Microsoft. He holds a B.S. in Electrical Engineering from Purdue University.

RChain Videos and Tutorials

RChain Review - The Future of Blockchain

RChain Interview - New Language, New Blockchain, Big Potential

Introducing Rholang

See Also

- Bitcoin | Ethereum | Ripple | Bitcoin Cash | Litecoin

- Cardano | NEO | Stellar | EOS | NEM | VeChain Thor

- Monero | Dash | IOTA | TRON | Tether | OmiseGO

- Bitcoin Gold | Ethereum Classic | Nano | Lisk | ICON

- Qtum | Zcash | Populous | Steem | Ontology | Waves

- DigixDAO | Bytecoin | Bitcoin Diamond | Binance Coin

- Bytom | Verge | Crypto Humor

- Cryptocurrency Dictionary | List of Cryptocurrencies | CEX.io

- Binance | Coinbase | Changelly | Coinmama | Bitpanda

- LocalBitcoins | Kraken | Paxful | Ledger Nano S | TREZOR